Can Mercedes-Benz Maintain the 2 Million Sales Threshold?

![]() 12/31 2024

12/31 2024

![]() 627

627

Original by New Energy View (ID: xinnengyuanqianzhan)

Full text: 2,923 words, reading time: 8 minutes

The prestigious luxury car brand Mercedes-Benz finds itself in a precarious position.

The iconic three-pointed star emblem has illuminated the careers and futures of millions of car owners, but it has yet to shine brightly for the company that produces it. Recently, Gehardi Plastic Technology announced its bankruptcy; it is the manufacturer of Mercedes-Benz's iconic three-pointed star emblem.

This bankruptcy is intricately linked to the sharp decline in Mercedes-Benz production. According to the latest data released by Mercedes-Benz, in the first three quarters of this year, the company sold 1.463 million vehicles globally, a year-on-year decrease of approximately 4%, nearly a million fewer than its peak annual sales in 2019.

Upon segmenting the national markets, it becomes evident that the Chinese market, once a growth engine, has now become a drag on Mercedes-Benz. In the first three quarters of this year, Mercedes-Benz sold a cumulative total of 512,200 vehicles in the Chinese market, a year-on-year decrease of 10.2%.

Faced with this "red light" warning, Mercedes-Benz Works Council Chairman Elgen Lümali clearly stated in an interview with the German newspaper Frankfurter Allgemeine Zeitung that the company has a clear bottom line for annual sales—at least 2 million vehicles, a necessary condition to ensure the efficient operation of its German factories.

However, amidst the backdrop of the irreversible global energy transition, can Mercedes-Benz, which is lagging behind in electrification, hold onto the 2 million sales threshold?

1. Are Consumers Reluctant to Buy?

Mercedes-Benz is undoubtedly a household name in the automotive industry.

Founded in 1926 through the merger of Karl Benz and Gottlieb Daimler, it has surged ahead in the global market for nearly a century, leveraging its first-mover advantage in the field of fuel vehicles, high-end brand image, and meticulous craftsmanship in materials, power systems, and intelligent assisted driving technology.

However, the story of the "automotive industry's big brother" has not been entirely smooth. In 2020, Mercedes-Benz began to experience setbacks, with global sales of 2.164 million vehicles, a year-on-year decrease of 7.4%.

In the following four years, Mercedes-Benz's situation did not improve, and it continued to decline.

This year, based on its current average monthly sales growth rate, it is feared that it will barely reach an annual sales volume of 2 million vehicles.

Especially in the Chinese market, Mercedes-Benz is facing an even more severe sales dilemma. Data shows that in the first three quarters of this year, Mercedes-Benz's cumulative sales in China decreased by more than 10 percentage points year-on-year, completely offsetting its 9% year-on-year increase in the North American market.

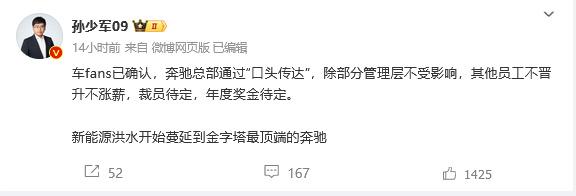

At the beginning of December, Sun Shaojun, the founder of Chefans, posted on social media that "Chefans has confirmed that the headquarters of Mercedes-Benz has 'verbally communicated' that except for some management personnel, other employees will not be promoted or receive salary increases, layoffs are pending, and annual bonuses are pending."

Image/Sun Shaojun's post

Source/Internet screenshot from New Energy View

However, what we waited for immediately afterwards was not an explanation from Mercedes-Benz China regarding this "verbal communication," but a major overhaul of the senior management at Mercedes-Benz Greater China.

It is reported that Tang Shikai, who is responsible for Mercedes-Benz's business in Greater China, Claesson from the Human Resources Department, and White, who is responsible for ethical business practices, will retire upon the expiration of their contracts; Tong Oufu, Geisen, and Shi Kun will replace them, respectively, becoming members of the new board of directors.

How did it come to this, having once won the global luxury brand sales champion in 2019?

From market data, the gradual rise of new energy vehicles is one reason, but not the only one.

Many consumers have openly stated their reasons for not giving priority to Mercedes-Benz when buying a car now. "I used to drive a Mercedes-Benz C260 L. For me, who uses the car every day, the most headache-inducing thing is maintenance. Repairs like wheel hubs take about ten days or more."

Image/Mercedes-Benz C260 L

Source/Internet screenshot from New Energy View

"The car is cheaper, but it's also been downgraded in a disguised way. For example, the dashboard camera for some GLC models has changed from standard to optional, with an optional price of 1,800 yuan."

"It's called heritage in a good way, or lack of innovation in a bad way. The models have been replaced, but there hasn't been much change in appearance."

From this, we can see that Mercedes-Benz's overall sales in the fuel vehicle sector have not changed much in recent years. However, due to the insufficient thoroughness of updates to the appearance and configuration of its former "profit" models, consumers' original sense of novelty has gradually decreased, making these models gradually lose competitiveness among peers.

2. Pressure from Chinese Brands

It should be emphasized that in the face of the growing new energy vehicle market, Mercedes-Benz has not been passive.

In November 2019, Mercedes-Benz launched its first pure electric vehicle, the EQC, in the Chinese market. It is reported that this vehicle is based on the oil-to-electricity conversion of the mid-size SUV GLC model and comes from the Mercedes-Benz MEA platform. In 2021, Mercedes-Benz introduced multiple electric vehicle models such as the EQA, EQB, and EQE into China.

Image/Mercedes-Benz EQC

Source/Internet screenshot from New Energy View

In addition to product planning and layout, Mercedes-Benz has also been active in electric vehicle research and development.

Financial report data shows that in the first three quarters of this year, Mercedes-Benz invested over 30 billion yuan in research and development, approximately twice the combined total R&D expenditures of domestic leading new force brands Li Auto and NIO in the first three quarters.

According to multimedia platforms, since 2023, Mercedes-Benz's R&D center has received a special allocation of funds to independently dismantle popular new energy vehicle models in China. This year, Mercedes-Benz's first disassembly target was born, the Zeekr 001.

It can be expected that Mercedes-Benz's heavy investment will not be in vain. In November of this year, Mercedes-Benz released a video on social media, publicly showcasing its first L2++ level mapless intelligent driving model for the first time. According to its plans, we will see Mercedes-Benz's "end-to-end + pure vision solution" mass-produced in 2025.

Image/Mercedes-Benz releases mapless L2++ intelligent driving model

Source/Mercedes-Benz official Weibo screenshot from New Energy View

However, why is Mercedes-Benz, which has undergone a series of "troop deployments," still struggling in the trough of "unsellable" cars?

From the perspective of start-up speed, Mercedes-Benz's electric vehicle layout is forward-looking, but due to its less decisive attitude during implementation in recent years, it has gradually become a "latecomer." Some of its "oil-to-electricity" products, compared to the finely crafted products of domestic new force brands such as NIO, Li Auto, and AITO, which focus on consumer needs, naturally have weaker market competitiveness.

In addition, affected by the intensifying price war in the domestic automotive market, Mercedes-Benz, with its long-standing luxury brand image in the market, cannot conceal its relatively high pricing. Even after entering the price war, the starting prices of the Mercedes-Benz C-Class and E-Class are still above 200,000 and 300,000 yuan, respectively.

Li Wei (pseudonym), a former owner of a Mercedes-Benz E-Class, gave up on Mercedes-Benz when changing cars this year and chose to buy a Li Auto ET7 instead. "The design style of Mercedes-Benz models is too outdated, and the advantages are obviously weakened compared to the diverse new energy vehicle models currently on the market. Besides, Li Auto's battery swapping is really convenient, comparable to the speed of filling a fuel tank."

There are many consumers who share Li Wei's sentiment. The 2024 McKinsey China Automotive Consumer Insights Report shows that high-net-worth individuals in China tend to choose domestic new energy brands when purchasing cars.

Those consumers who love to follow trends believe that Mercedes-Benz electric vehicles are generally too expensive, and their technological experience lags far behind that of new force brands in the same class.

3. How to Maintain a High Market Share?

Currently, many automakers are standing at the forefront of the new energy market due to their rapid transformation, but to remain at the top of the pyramid, they must establish and solidify their own differentiated "labels".

Liu Yuan (pseudonym) from Jinan, Shandong, drives a Mercedes-Benz GLS 400. According to him, the reason for choosing Mercedes-Benz is simple—two words, "nostalgia".

Image/Mercedes-Benz GLS 400

Source/Internet screenshot from New Energy View

"I've been driving a Mercedes-Benz for many years. I'm reluctant to change to other brands of fuel vehicles mainly because of my preference for the unique charm of Mercedes-Benz. I'm also accustomed to the handling and solid chassis tuning of Mercedes-Benz. That kind of steadiness and precision makes me feel at ease."

Guo Xiaohan (pseudonym) from Beijing took advantage of the "huge discounts" offered by automakers at the end of the year and bought a Mercedes-Benz C 200L. "I'm also interested in new energy vehicles, but I'm used to driving fuel vehicles, and I can't give up the driving feel of their engines. Besides, Mercedes-Benz fuel vehicles accelerate more smoothly and linearly."

Image/Mercedes-Benz C 200L

Source/Internet screenshot from New Energy View

Many consumers who have recently purchased Mercedes-Benz fuel vehicles admit that in the face of the current hot new energy vehicle models, it would be false to say they have never hesitated. After all, who doesn't want to experience a highly technological car? However, due to their trust in the fine craftsmanship of the Mercedes-Benz brand and their persistent commitment to traditional automotive craftsmanship, they ultimately chose Mercedes-Benz fuel vehicles.

Among these consumers, there are also those who express their willingness to consider buying a Mercedes-Benz electric vehicle when they mature. "Actually, Mercedes-Benz's intelligent driving assistance system is quite good and is not inferior to new force brands. However, due to its low-key promotional efforts and the current market's preference for younger consumers, it is difficult for it to regain its previous market presence."

"Currently, Mercedes-Benz has too few electric vehicle models to choose from, and the model names are not as recognizable as those of AITO and Li Auto. I hope they can expand their electric vehicle product matrix as soon as possible."

Faced with the multiple pressures Mercedes-Benz is currently under in the market, industry insiders believe that Mercedes-Benz should focus on high-end niche markets and strengthen the development and deployment of autonomous driving technology to enhance brand competitiveness.

"While adopting a multi-dimensional strategy to maintain market share, Mercedes-Benz should also strengthen consumers' perception of the value of its luxury vehicles, which goes beyond just pricing."

Based on this, in the future, if Mercedes-Benz wants to regain its leading position in the electrification transformation, it should focus on aspects that consumers care about, such as product quality, technology roadmap, and intelligence.

It should be noted that multimedia platforms have reported that the cost per German employee dispatched to the Chinese market by Mercedes-Benz exceeds 2 million yuan per year, while the salary cap for Chinese employees working at Mercedes-Benz is approximately 300,000 yuan per year.

Therefore, if Mercedes-Benz wants to truly thrive in the Chinese market in the future, in addition to focusing on the consumer level and getting Chinese people to pay for its products, it should also put aside its arrogance and treat Chinese and foreign employees equally. After all, the attitude of employee service will be reflected in consumers' car-buying and after-sales experiences.

Facing the flag of the "2 million sales threshold," whether Mercedes-Benz can sail against the wind and successfully maintain its high market share remains to be seen.