Year-End Review: Rapid Acceleration of New Energy Vehicles

![]() 12/31 2024

12/31 2024

![]() 679

679

The automotive industry stands as a pivotal indicator of a nation's manufacturing prowess, and the meteoric rise of new energy vehicles (NEVs) offers a vital window into industry trends. In November 2024, China surpassed 10 million units in annual NEV production for the first time, marking a significant milestone in the country's transition from a major automotive producer to a global powerhouse. This achievement heralds a new era of high-quality development for China's NEV sector.

Reflecting on the journey, in 2012, annual production stood at a mere 13,000 units. By 2018, this figure soared to over a million, and by 2024, it is projected to reach 12 million. Globally, China accounted for over 60% of NEV production and sales in 2023, retaining the top spot for nine consecutive years.

These statistics underscore China's economic resilience, bridging the past with the future. Next, I'll delve into the 2024 data and trends in the NEV industry for investors' reference.

01. Accelerating Momentum in 2024

According to the China Association of Automobile Manufacturers, the year-on-year growth rate of NEV passenger vehicle sales in China has progressively increased each quarter this year. In Q1, Q2, and Q3, sales growth rates were 31%, 32%, and 34% respectively, demonstrating robust growth. This surge is primarily fueled by a significant rise in NEV penetration rates. Industry experts predict that sales growth will further accelerate to 46% in Q4.

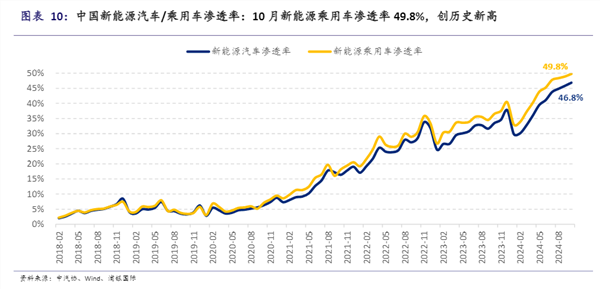

From a penetration perspective, the rate climbed steadily in the first three quarters, reaching 34.9%, 43.2%, and 48.4% respectively. In April, the rate nearly matched the December 2023 high of 40.4%, setting new highs for six consecutive months. By October, the penetration rate hit 49.8%, meaning nearly half of all passenger vehicles sold that month were NEVs. Experts anticipate this rate will exceed 50% in Q4, reaching 50.1%.

This year's NEV industry growth surpassed most forecasts. Post-Chinese New Year, price wars reignited with BYD's launch of its Honor Edition models, driving prices from 'parity between oil and electric' to 'electric cheaper than oil', significantly capturing fuel vehicle market share. Auto shows in Beijing, Chengdu, Guangzhou, and trade-in policy upgrades maintained strong growth momentum. As promotional efforts waned, competition moderated, leading to improved gross profit margins and profits in Q2 and Q3.

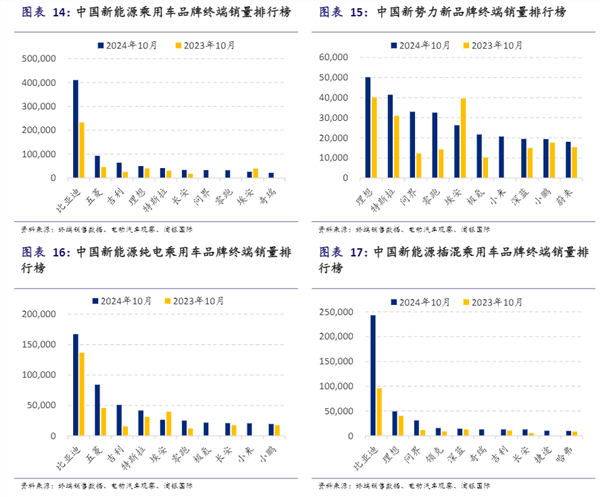

In October, NEV passenger vehicle sales reached 1.371 million units, up 11% month-on-month and 51% year-on-year, marking three straight months of growth. This reflects enhanced consumer confidence and demand, coupled with an increase in high-quality product supply. Experts expect this positive trend to continue in November and December.

02. Competitive Landscape: Tesla and BYD Maintain Dominance

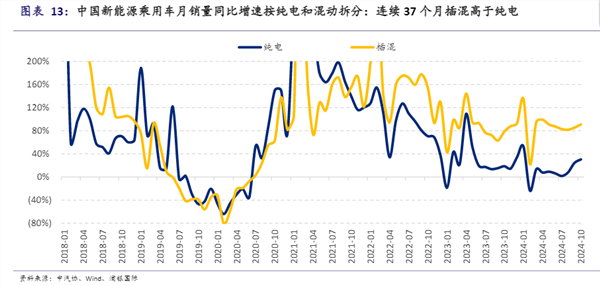

Reviewing 2024's NEV industry, plug-in hybrid (PHEV) models outpaced pure electric vehicles (BEVs) in growth. From January to October, BEV sales grew 12.7% year-on-year, a notable drop from 2023's 24%. Conversely, PHEV sales surged 86.3%, slightly higher than 2023's 83.4%. By October, PHEV sales growth had outpaced BEVs for 37 consecutive months.

PHEV's market share in China's NEV passenger vehicles surged from roughly 30% in 2023 to over 40% this year. In July, PHEV sales accounted for 45.8% of the market; for January to October, the share was 41.8%.

Overall, 2024 witnessed new competitive dynamics across vehicle types (BEVs, PHEVs, sedans, SUVs) and price ranges.

In the pure electric SUV segment, Tesla's Model Y leads with average monthly sales exceeding 50,000 units, dominating the >RMB 300,000 market. BYD's Yuan series sells around 20,000 units monthly, leading the RMB 100,000-200,000 segment. NIO's C11, C10, and C16 also featured in October's top ten sales.

In the RMB 200,000-300,000 SUV market, competition intensified. Last year, Xiaopeng's G6 sold over 8,000 units monthly in October; this year, sales dropped to just over 4,000. For 2025, industry insiders anticipate new high-quality models, including NIO's LeDao L60, Xiaomi's YU7, and Xiaopeng's P7+-based SUV, to enter the segment, intensifying competition and expanding market space.

Xiaomi's SU7, a 2024 hit in the BEV sedan market, sold over 20,000 units in October despite just seven months on the market. BYD's Dolphin sold around 18,000 units in the RMB 100,000-200,000 range. Xiaomi's SU7 dominates the RMB 200,000-300,000 segment, mirroring Tesla's Model Y's dominance above RMB 300,000. Demand for Xiaomi's SU7 still exceeds supply. Xiaopeng's MONA M03 and P7+ also performed well, with strong delivery expectations for 2025.

In the PHEV SUV market, the landscape remains stable. Above RMB 300,000, AITO (based on Huawei's HarmonyOS) and Lixiang's L series dominate, with no clear third competitor. Xiaomi and Xiaopeng are expected to launch extended-range models, particularly in the RMB 200,000-300,000 range.

In the RMB 100,000-200,000 PHEV SUV market, BYD excels. Its Song PLUS, Song L, and Song Pro each sold over 20,000 units in October, leading the market with sales significantly higher than fourth-placed models. In the PHEV sedan market, BYD also dominates with multiple models, including Qin L, Qin PLUS, HaiBao, HaiBao 06, Destroyer 05, and Han.

Finally, in the pure electric MPV market, Xiaopeng's X9 and Lixiang's MEGA performed well. Despite initial sales declines for Lixiang's MEGA, it recovered in Q2 and Q3, nearing 1,000 units monthly. Both models are expected to maintain current delivery levels in 2025.

03. The Silent Dawn of Intelligent Driving's Second Half

The proliferation of NEVs has fueled rapid intelligent driving technology development and commercialization. Intelligent driving has emerged as a key competitive focus for automakers.

Technological advancements and maturing user perceptions have propelled China's passenger vehicle intelligent driving sector into a new phase. Amid NEV market growth and price competition, intelligent driving features showcasing product competitiveness and technological edge have become automakers' investment and marketing priorities. Differentiating through intelligent technology is crucial for competitive advantage.

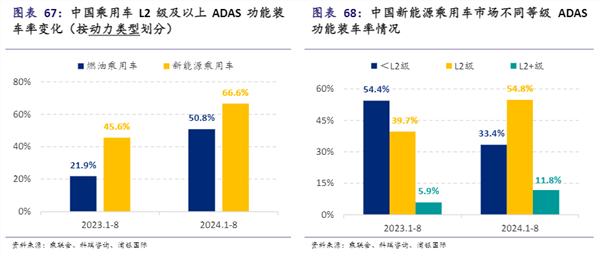

Industry-wide, the installation rate of L2+ intelligent assisted driving features has surged. Data from the China Passenger Car Association and CRI Consulting show that from January to August 2024, the L2+ ADAS feature installation rate in China's NEV passenger vehicles reached 66.6%, a 21.0 percentage point year-on-year increase. High-end models' installation rates significantly exceed those of lower-end models, aligning with industry perceptions of high-level assisted driving system hardware costs.

However, as technology advances, intelligent driving technology costs are decreasing and efficiency increasing. Factors like reduced hardware manufacturing costs due to scale are expected to further boost intelligent driving penetration. Some automakers' intelligent driving model sales proportions are also rising. Xiaomi's SU7 Max model accounted for 43.17% of sales. After launching an end-to-end large model, Lixiang's AD Max version sales proportion also increased, from 18%-19% to 25%-30% in the L6 model.

Emerging NEV makers are accelerating high-level intelligent driving penetration into mainstream price segments. For instance, Xiaopeng's November-released P7+ model brought intelligent driving features to the RMB 200,000 range through cost reduction, achieving 'parity between oil and intelligent driving'. More high-level intelligent driving models and intelligent hardware configuration penetration into lower price segments reflect China's NEV market's quality supply increase.

As intelligent driving costs decline, automakers like BYD's penetration rates are expected to rise, becoming a significant growth driver for the intelligent driving industry.

At the automaker level, the intelligent driving experience is increasingly a core consideration for vehicle purchases, prompting automakers to accelerate intelligent driving-related business layouts.

Specifically, Xiaopeng's XNGP urban intelligent driving achieved 100% map-free capability, doubling available mileage and fully realizing map-free driving nationwide in Q3. Huawei's AITO series added map-free urban intelligent driving pilot assistance to all models, achieving nationwide coverage. Lixiang made progress in its map-free NOA applicable to all roads, launching a public beta test involving thousands of users in May and pushing map-free NOA to all AD Max users via OTA in July.

Currently, automakers are moving towards map-free, full-scenario, low-cost solutions for advanced intelligent assisted driving. Compared to high-speed NOA, urban intelligent driving faces more complex road conditions and higher perception solution demands. Thus, many automakers are adopting map-free NOA solutions. In urban intelligent driving map-free NOA development, Xiaopeng and Huawei's HarmonyOS Intelligent Drive lead, with emerging players like NIO and Lixiang rapidly transitioning to end-to-end architectures, catching up with pioneers.

04. What Lies Ahead in 2025?

Looking ahead, the NEV market will face intensifying competition and profound changes in 2025. With pure electric vehicle market share expected to decline, plug-in hybrid models will remain in high demand, attracting consumers with their range anxiety solutions and excellent driving experiences. Additionally, the average battery capacity per NEV passenger vehicle will decrease, impacting battery installation volumes, necessitating a new balance between technological innovation and cost control.

The continued enhancement of charging infrastructure is pivotal for fostering the widespread adoption of new energy vehicles. Despite China's early achievement of its charging facility construction targets, the uneven distribution of these facilities remains an issue that must be addressed to guarantee convenient access to charging services for consumers across all regions. Furthermore, as the market share of first-tier joint venture brands stabilizes and that of second-tier brands declines, competition between luxury and domestic brands will intensify, particularly in the pursuit of the luxury high-end market. Here, technological innovation and brand building will be decisive factors for success.

Against this backdrop, new energy automakers must consistently bolster research and development innovation, as well as enhance product quality and service levels, to cater to the increasingly diverse needs of consumers. Additionally, strengthening international cooperation and exchanges to collaboratively address the challenges and opportunities presented by global automotive industry transformations will be essential for fostering the sustainable and healthy growth of the new energy vehicle industry.

- End -