Controlling the 'Vitamins' of New Energy: China's Advantage in the Automotive Industry

![]() 12/31 2024

12/31 2024

![]() 557

557

Introduction

Does China's dominance in the new energy vehicle (NEV) industry stem solely from its production scale?

"The Mustang Mach-E carries the iconic American car name, but beneath the surface, 51% of this Mustang's components are manufactured in China."

Figures from a US government report reveal an underlying anxiety: While China leads the NEV market in terms of scale, with impressive sales figures, the more challenging gap lies in the NEV supply chain, intricately linked to numerous other manufacturing sectors.

"China nearly has complete control over battery and magnet materials, creating potentially devastating supply chain vulnerabilities for key Western industries. As a result, automakers are scrambling to find alternatives."

Key electric vehicle technologies, from battery cathodes and anodes to magnets, heavily rely on production processes largely controlled by Chinese manufacturers. Whether it's Europe, the birthplace of automobiles; the largest automotive market outside China, the United States; or Japan and South Korea, which once dominated the Asian automotive industry, all face the risk of being 'choked' as they expand their NEV production scale.

The NEV and related materials industrial chain extends beyond automobiles, closely tied to industries such as fighter jet manufacturing, consumer electronics, medical equipment, and wind turbines.

"Governing a great state is like cooking a small fish," emphasizing not only caution and patience but also the importance of systematic, step-by-step growth in macro-industries to achieve leadership.

The 'Dark Cloud' Upstream of NEVs

"China could say, 'Western automakers, I don't want to sell you traction motors anymore; I want to sell your customers the entire car now.'"

This analogy was made by David Wilcox, Executive Chairman of Evolution Metals and Technologies. What does this company do? It integrates mineral resources and merges five currently independent companies into an alternative supply chain for magnets and battery materials, primarily through the recycling of EV batteries and other consumer electronic waste.

Evolution Metals and Technologies is far from a mere 'scrap collector' in the metal industry. According to David Wilcox, the challenge lies not only in the short-term supply shortage of rare earth materials or final products like magnets and battery materials but also in a long-term constraint.

The other half of the subtext that David Wilcox didn't mention was highlighted in a report by the US Government Accountability Office (GAO) this year.

The report revealed that "from 2019 to 2022, over 95% of the total rare earth consumption and related downstream products in the United States were imported, with the majority coming from China."

According to data from the "2024-2029 China Rare Earth Industry Market Development Prospects Research Report" consulted by Auto Society, China accounted for 40% of global rare earth reserves in 2023, followed by Vietnam, Brazil, Russia, and India with percentages of 20.00%, 19.09%, 9.09%, and 6.36%, respectively.

The total proven global rare earth reserves are approximately 100-120 million tons.

Beyond military applications, focusing solely on the automotive industry, the motors in NEVs are predominantly made of rare earth permanent magnet materials. According to Ghahreman, CEO of Cyclic Materials, a NEV typically uses about 2-5 kilograms of rare earths. Other data sources vary between 0.5-6 kilograms.

When China restricts the supply of rare earths, it inevitably impacts the development of NEVs in various countries.

Some may ask: Since the United States also produces rare earths, isn't it wise to import Chinese rare earth resources while keeping its own as a strategic reserve?

However, rare earths are divided into heavy and light rare earths, and China's reserves in the field of heavy rare earths are superior to those of the United States. Furthermore, China's advantage in rare earths extends beyond reserves to processing capabilities. During the trade war, when the United States restricted Chinese semiconductors, China reciprocated by restricting certain rare resources.

In July 2023, China's Ministry of Commerce and other departments imposed export control measures on gallium, germanium, antimony, superhard materials, graphite, and other related dual-use items, though not targeting specific countries or regions at that time.

As of December 3 this year, the Ministry of Commerce announced strengthened controls, strictly controlling the export of these items to the United States and implementing stricter end-user and end-use reviews.

According to US-related agency data, China accounts for about 68% of global gallium reserves, with its production share exceeding 90%. The global proven reserves of germanium are 8,600 tons, with the United States and China accounting for 45% and 41%, respectively. However, over the past decade, China's germanium supply has accounted for 68.5% of the global total. Additionally, China's graphite production accounts for about 77% of the global total. In 2023, China's antimony mine production accounted for about 48% of the global total, and antimony smelting accounted for about 71%.

Let's focus solely on the automotive field.

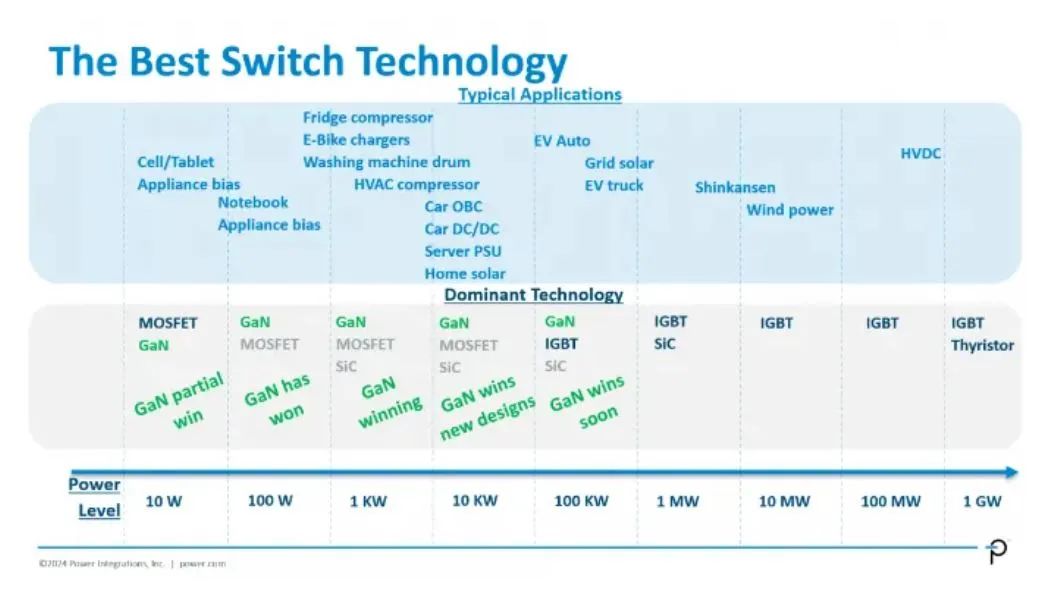

Taking gallium as an example, indium gallium arsenide is a crucial material for 1550nm lidar. Gallium nitride, an emerging material, is gradually being adopted in vehicles. On the one hand, gallium nitride is increasingly prevalent in on-board chargers and high-voltage DC converters. On the other hand, it is poised to be the next evolution in power semiconductors, critical for electrified vehicles, following IGBT and silicon carbide devices.

Doug Bailey, Vice President of Marketing at Power Integrations (PI), pointed out this year that while silicon carbide has been continuously tested in the field of EV traction, gallium nitride will ultimately achieve this goal.

Reserves are a gift, but processing is the gap

If you believe China's advantage in upstream NEV mining primarily relies on natural reserves, you are mistaken.

Merely holding natural reserves or preliminary mining capabilities does not constitute a deep moat; the deep processing system is the insurmountable chasm.

According to the US, nearly 70% of global rare earth supplies (such as neodymium used in high-performance magnets) are processed in China. The issue extends beyond rare earths to the expertise, knowledge, and capital investment in factories that process rare earths into oxides, metals, alloys, and flakes for magnet and battery production.

"China's chokepoint is in processing," said Michael Dunne of Dunne Insights, a consultancy tracking the Chinese EV industry.

The GAO report found that over the past four decades, the production of rare earth oxides, alloys, metals, and flakes for magnets and batteries has shifted to China, partially due to the US pursuit of high environmental standards, giving Chinese producers an advantage.

In a sense, this liberal rhetoric hides a deeper factor—the US has become too accustomed to making quick money through finance and is reluctant to engage in basic manufacturing that requires 'turning screws.'

General Motors' Magnaquench subsidiary was once the primary supply chain producer of neodymium magnets at US factories until 1995, when the business was sold to Beijing Zhongke Sanhuan Advanced Materials Co., Ltd., and China Nonferrous Metal Mining (Group) Co., Ltd. The company's last American factory in Indiana closed in 2006.

Why does China hold an absolute advantage in the extraction and processing of rare earths, gallium, and germanium? This cannot be viewed in isolation but must be observed in connection with the entire metallurgical and even manufacturing industries.

Those unfamiliar with metallurgy may not realize that "germanium is a by-product of zinc, and gallium is a by-product of aluminum." Gallium production stems from aluminum refining, and China happens to account for most of the world's aluminum production capacity. Electricity is a significant portion of aluminum costs, and only China, with its low electricity prices, can build a massive aluminum production capacity, which in turn drives gallium production capacity.

If the West wants to significantly expand gallium production, it must also significantly expand aluminum production, significantly increase electricity supply, and reduce electricity costs—a mission impossible.

William Russell, a GAO official, said in a recorded discussion of the agency's research, "It takes 10 years to build a mining and processing facility and complete all regulatory procedures... There aren't many quick fixes."

The European Union is also encouraging domestic processing of critical minerals. The EU's goals include processing 17 raw materials by 2030 to meet 40% of its annual demand.

Analysts and industry executives say that in the long run, government and corporate efforts to reduce greenhouse gas emissions will rely on a significant increase in advanced battery production and clean energy hardware containing rare earth materials.

According to consulting firm Wood Mackenzie, demand for high-performance neodymium magnets is expected to grow by 84% over the next eight years compared to current levels. However, Adamas Intelligence, a Toronto-based consulting firm, says that production of magnets and battery materials will grow at a slower rate than demand, "as market suppliers find it increasingly difficult to keep up with rapidly growing demand."

Difficult Alternatives

Automakers are investing in other companies to develop the production of battery materials and magnets in the United States and allied countries.

In 2021, General Motors reached a long-term agreement with US company MP Materials, which operates the Mountain Pass rare earth mine in eastern California, the only rare earth mine in North America. GM's first batch of MP magnets is expected to hit the market by the end of 2025.

However, experts say it takes more than a decade for a magnet startup to scale up to meet the demand of a Western automaker. Until then, all magnets used in electric vehicles by automakers will still come from China.

California-based battery recycling startup Redwood Materials, led by JB Straubel, co-founder of Tesla, has raised $2 billion from investors and received a $2 billion loan commitment from the US Department of Energy to establish its high-cost business, serving high-volume, low-margin operations.

Emerging Western battery material producers also face fluctuations in electric vehicle metal prices and regulatory obstacles, which may slow down the construction of processing facilities and overall battery production in the Western world.

Over the past year, as major Chinese battery manufacturers have increased production, global demand for electric vehicles has slowed down, falling short of automakers' and battery manufacturers' forecasts.

Uncertainty about whether the Trump administration will continue to provide federal subsidies for US consumers to purchase electric vehicles has raised doubts about recent electric vehicle demand. A Reuters report in December stated that one consequence of this is that global lithium prices have plummeted by 90% in the past two years.

Moreover, some struggling miners are closing mines or seeking mergers for shelter. This summer, mining giant Rio Tinto acquired Arcadium Lithium and is now seeking to purchase more battery mineral assets. In November, Albemarle, the world's largest lithium producer, reported a quarterly loss of over $1 billion due to declining lithium demand.

However, Joe Lowry, a lithium market expert at Global Lithium LLC, predicts that the rise in electric vehicle demand may reverse the battery material market by the end of the century in the long run.

"The current oversupply (including lithium in cathodes and battery inventories) will shift to a shortage faster than many people realize," Lowry said.

Although electric vehicle production may not have reached previously predicted levels, and China still controls the processing of key materials, the sheer number of smartphones, laptops, computers, servers, and energy storage solutions continues to drive overall demand for e-waste recycling.

Most of this e-waste contains sensitive health or national security data. The United States currently lacks the capability to safely recycle the world's largest inventory of e-waste—billions of tons generated by governments, industries, and consumers. According to the United Nations, only 20% to 25% of the global e-waste generated is currently collected for recycling. The US government estimates that only about 25% of the country's e-waste is collected for recycling. Most of the rest is landfilled or incinerated.

Spent batteries and scrap materials generated during battery manufacturing constitute another crucial source of minerals. While the capability to recycle lithium-ion batteries outside of China is expanding, it is not progressing as swiftly as the anticipated influx of scrap batteries. According to Fortune Business Insights, the global lithium battery recycling market is projected to grow at a rate of nearly 23% annually, reaching $23.2 billion by 2032.

Overall, Benchmark Mineral Intelligence predicts that by 2040, end-of-life scrap materials could account for 73% of all materials in the battery recycling industry in North America, up from the current 37%.

Further evidence of Sino-U.S. tensions may surface in the coming months. The incoming Trump administration could take a more active role in this conflict compared to its predecessor. Regardless, the risks confronting Western industries may now be greater than previously perceived.

The question arises: Is it too late for them to take action now?