Geyue Auto's Sudden Collapse Reflects the Struggles of New-Force Automakers

![]() 12/31 2024

12/31 2024

![]() 508

508

Last year, Elon Musk predicted an impending wave of bankruptcies in the electric vehicle industry, and it now appears that his prediction was prescient.

In 2022, the Delaware Bankruptcy Court approved the bankruptcy reorganization plan of the emerging American electric vehicle manufacturer Fisker, allowing the company to repay its creditors with remaining funds after selling its vehicles. Once a market star, Fisker was an up-and-coming American electric vehicle company with a market value that rivaled that of Tesla.

Turning to the domestic market, Geyue Auto, a joint venture between Baidu and Geely Automobile, is also facing a severe crisis, including employee rights protection actions and investor withdrawals, which have sparked widespread online outrage and concern among new energy vehicle owners.

The Rise and Fall of Geyue Auto

Geyue Auto, formerly known as Jidu, was established as a high-end smart car brand on March 2, 2021, by Baidu and Geely Holding Group. Backed by these two giants, it garnered considerable attention.

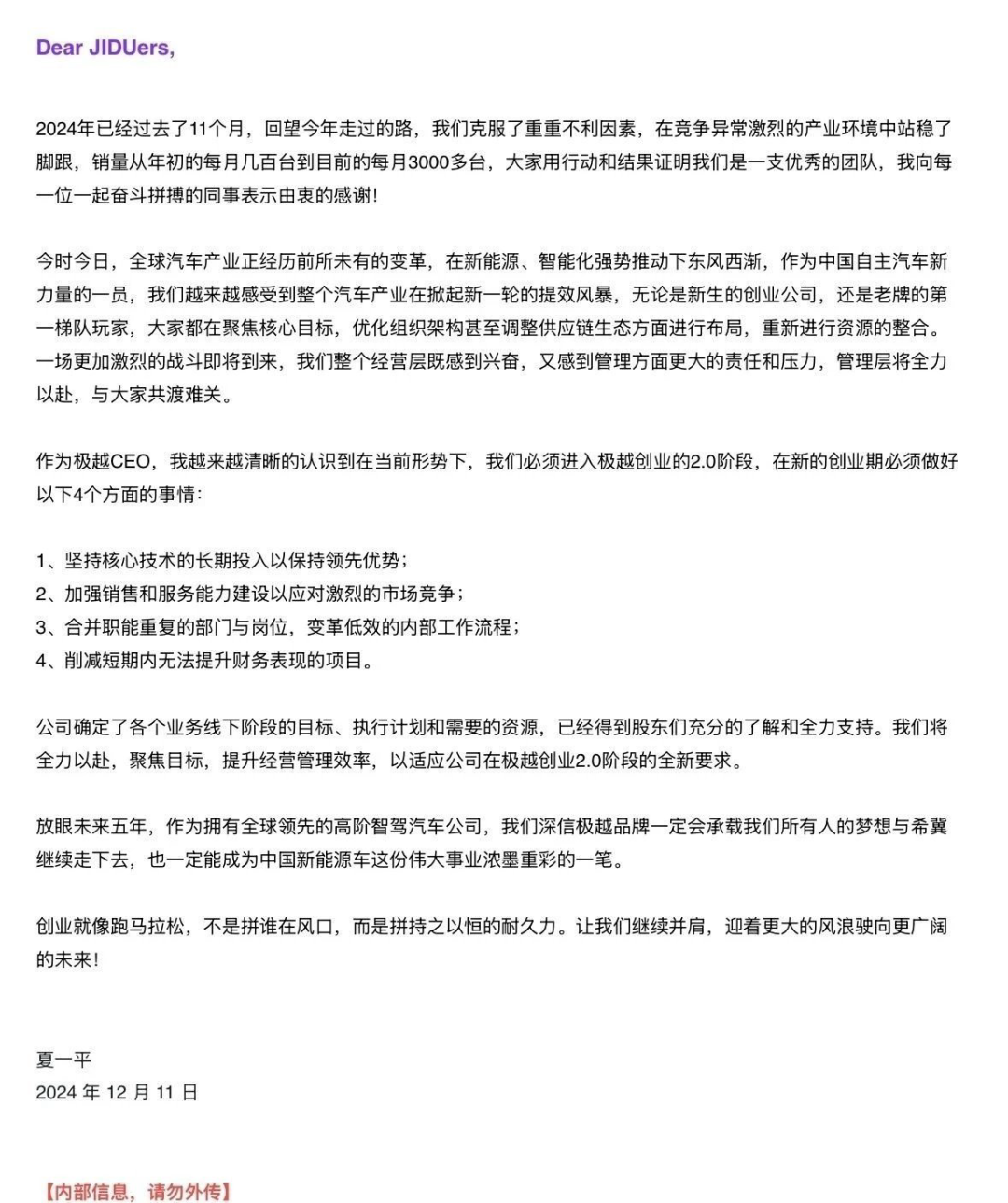

However, in early December, rumors began circulating online about Geyue Auto's potential collapse. At the time, various reports referred to the company anonymously as a "new-force automaker," sparking widespread speculation within the industry. On December 11, Xia Yiping, CEO of Geyue Auto, issued an internal letter announcing that the company would enter the "Entrepreneurship 2.0" phase, necessitating organizational optimization, supply chain ecosystem adjustments, and resource reintegration. On the same day, tech media outlet TechPlanet publicly demanded payment from Geyue on Weibo, claiming that Geyue owed it 360,000 yuan for promotion services.

Later that afternoon, Xia Yiping announced at an internal meeting that due to operational difficulties, employees faced two choices: voluntarily resign by December 16 and receive N+1 compensation, or take unpaid leave without social security and provident fund contributions during this period. The next day, December 12, Xia Yiping was confronted by employees demanding back payments for social security, wages, and severance pay.

From defaulting on supplier payments to announcing dissolution, Geyue Auto collapsed within just two days, sparking a furor in online public opinion.

Unsuspecting netizens have inquired about why Geyue, backed by Baidu and Geely, would face a cash flow crunch.

According to media reports, Geyue Auto had a financial shortfall of up to 7 billion yuan, directly leading to a break in the capital chain. After discovering this issue during due diligence, Baidu decided to withdraw its investment, becoming the final straw that caused Geyue's collapse.

There are even rumors of corruption among Geyue's senior management. According to Geyue employees and netizens, CEO Xia Yiping was accused of forcing suppliers and approving payments to specific suppliers at prices higher than the market rate.

In terms of market performance, Geyue Auto's sales figures objectively reflect the problem. Compared to mainstream new-force automakers, Geyue's performance lags significantly. As the first model under the Geyue brand, Geyue 01's sales have never exceeded four digits, and even after multiple price reductions, it has failed to receive positive market feedback.

In China's new energy vehicle market, competition among new-force automakers is increasingly fierce, making profitability a crucial indicator of a company's competitiveness. This has led Baidu, the main investor, to hold a pessimistic view of Geyue Auto's profitability prospects and choose to cut its losses promptly.

Objectively speaking, Geyue, which seemed to collapse overnight, had actually been struggling for a long time.

A Glimpse into the Plight of New-Force Automakers

Setting aside Geyue's internal management issues, what challenges are new-force automakers facing from an industry perspective?

In recent years, some new-force automakers have struggled with poor sales and significant operational pressures, leading to broken capital chains. WM Motor, once one of the "Four Little Dragons" of new-force automakers, fell into operational difficulties due to factors such as the pandemic's impact and an unfavorable capital market, leaving it with debts of up to several billion yuan. After launching three models, HiPhi Auto announced a six-month suspension of production, plunging its operations into stagnation. NIO faced declining sales and financial pressure, with sales of only 120,000 vehicles in 2023, a year-on-year decrease of 16%.

From HiPhi Auto's suspension of production to rumors of NIO's mismanagement and Geyue Auto's sudden "halt," the new energy vehicle market is gradually saturating and entering a brutal elimination phase.

Another Loser on the Horizon

With the rapid development of the new energy vehicle industry, new-force automakers have come a long way in their first decade and are now entering a critical market reshuffle phase.

Over the past decade, the market has swiftly transitioned from a blue ocean to a red ocean stage, with increasingly fierce competition. Currently, NIO, Li Auto, XPeng, and Xiaomi Automobile have demonstrated clear scale advantages. BYD has taken the lead in this competition, marking a new stage in industry rivalry.

Behind the new-force automakers in the industry are the strong support of large enterprises. NIO has the endorsement of 360's Zhou Hongyi, XPeng received support from Alibaba, Li Auto was invested in by Wang Xing of Meituan, and Geyue Auto is the result of collaboration between Baidu and the Geely Group. Among these new-force automakers, NIO, Li Auto, and XPeng have begun to demonstrate scale effects, while BYD has become an industry leader.

While large enterprises' cross-border ventures may seem effortless, some industries with heavy assets are not solely reliant on capital and courage for success. The success of new-force automakers depends not only on capital injection but also on a deep understanding of the automotive industry and continuous technological innovation.

Geyue's example highlights that the endorsement of large enterprises is merely a name. Only those enterprises that can adapt to market changes, continuously innovate, and optimize management can secure a place in the new decade of the new energy vehicle industry.

As industry reshuffling intensifies, it is believed that only a few automakers will survive this "car-making game" in the future.