Huang Guangyu's New Venture: GOME Mall Transforms into an Auto Showroom

![]() 01/02 2025

01/02 2025

![]() 545

545

Author | Shen Tianxiang

Editor | Li Guozheng

Produced by | Bangning Studio (gbngzs)

I wonder how many 4S dealerships will groan anew—the once-dominant electrical appliance retailer GOME has embarked on a venture into the automobile distribution industry, inevitably drawing customers away from 4S dealerships, adding insult to injury for those already struggling with operational difficulties.

On December 28, 2024, Huang Guangyu, the 55-year-old founder of GOME Group, who had been out of the public eye for a long time, stepped onto the podium at the GOME Auto Strategy Conference and Ecological Partner Conference with renewed ambitions and delivered a speech.

Previously, the GOME store at Xibahe on the auxiliary road of East Beisanhuan Road in Beijing underwent closure and renovation, transforming into the GOME Auto Smart Car Experience Hall and opening up for investment attraction.

This store, established in 2003, carries the glorious history of GOME and once achieved an annual sales volume of 530 million yuan, making it one of GOME's benchmark stores.

Now, as the first GOME Auto Smart Car Experience Hall, it will host over 30 new energy vehicle brands in the future, offering consumers a 'one-stop' car-buying experience, ranging from car selection and test drives to purchase and after-sales services, akin to a large new energy vehicle marketplace.

From a glorious 21-year-old electrical appliance mall to today's Smart Car Experience Hall, the inception of GOME Auto marks both the end of Huang Guangyu's previous legend and the beginning of a new adventure.

Life's Ups and Downs

'A single region should normally become profitable within 18 months. If not, it's either because the work is poorly done or the model is wrong.' Facing sharp questions from the media about GOME's profit expectations in entering the automotive retail sector, Huang Guangyu responded.

The last time he mentioned the 18-month timeframe was almost four years ago, in early 2021.

At that time, he had just regained control of GOME and declared at a senior management meeting of GOME Holding Group, 'I will go all in and strive to restore GOME's original market position within the next 18 months.'

In the 1980s, the underage Huang Guangyu and his brother Huang Junqin ventured north from Guangdong to start a business, renting a clothing store named 'GOME' in Beijing, half of which sold clothing and the other half sold electrical appliances. As electrical appliance sales gained popularity, they transformed into a specialty electrical appliance store, and GOME Electrical Appliances was born.

In 1991, Huang Guangyu placed an advertisement in the middle column of the Beijing Evening News, reading, 'Buy electrical appliances at GOME.' Since then, GOME Electrical Appliances expanded rapidly, moving from Beijing to the rest of the country.

In terms of operations, GOME pioneered a low-price strategy, breaking down the high price barriers of traditional home appliance sales and adhering to the business philosophy of 'small profits but quick turnover, service first,' making GOME Electrical Appliances the preferred destination for many consumers purchasing home appliances.

In 2004, GOME Retail went public in Hong Kong, and Huang Guangyu, at the age of 35, became China's richest man with a fortune of 10.5 billion yuan. At that time, GOME Electrical Appliances had opened more than 300 stores in over 60 cities across China and even overseas.

His life plummeted from its peak in 2008 when he was imprisoned for stock price manipulation and was not released on parole until 2020.

During this period, due to the rise of online shopping and internal factors, GOME declined from prosperity. Financial report data shows that although its performance fluctuated, it remained profitable in 2016. However, since 2017, it has been plagued by consecutive years of losses, and the losses have been increasing.

2021 was a new starting point full of hope and challenges for both GOME Group and Huang Guangyu. Huang Guangyu once again donned his armor and was ready to lead GOME Group out of its predicament.

He launched an e-commerce APP called 'Zhen Kuai Le,' claiming to adopt an entertaining approach and strive to become a social shopping platform. This APP boasts numerous functions, including group buying similar to Pinduoduo, as well as short videos, live broadcasts, and note-sharing features.

For this purpose, the GOME store at Xibahe underwent renovation and was upgraded to the 'Zhen Kuai Le APP Experience Center - GOME Store at Xibahe' in September 2022, with a trial operation commencing. Officials claimed it was a new model store featuring 'display and experience, home extension, home entertainment, and home services.'

However, things did not go as planned. Despite Huang Guangyu's immense efforts for 'Zhen Kuai Le,' it failed to make much of a splash and could not compete with mature e-commerce platforms such as JD.com, Taobao, and Pinduoduo. In 2022, GOME Retail suffered a loss of nearly 20 billion yuan, compared to JD.com's net profit of 28.2 billion yuan that year.

The cruel reality shattered Huang Guangyu's ambitious goal of 'restoring GOME's original market position within 18 months' like a bubble.

According to financial reports, GOME Retail lost 4.6 billion yuan in the first half of 2024, with total liabilities reaching 41.3 billion yuan. The number of offline GOME Mall stores has dwindled from a peak of over 4,000 to less than 1,000.

GOME Retail has reached a critical juncture and once again stands at a crossroads in its fate.

Now, can Huang Guangyu, a generation of titans, lead GOME Auto to profitability within 18 months?

Easy to Change, Hard to Make Money

Opinions differ on the future success of GOME Auto.

The general trend in the industry is that the automobile distribution sector is undergoing monumental changes. Over the past four years, more than 8,000 4S dealerships have disappeared nationwide; in the first half of 2024, 50.8% of dealers were in the red, struggling on the brink of survival. The China Automobile Dealers Association once predicted that the number of 4S dealerships exiting the market this year would exceed 4,000.

Currently, there are mainly three offline sales models in the automobile distribution sector: the 4S dealership model, the agency model, and the direct sales model.

Among them, the 4S dealership model is still the most mainstream, providing comprehensive services to consumers. However, its drawbacks include high operating costs and complex profit distribution between dealers and manufacturers. Traditional 4S dealerships are struggling to survive amidst factors such as a price war that has lasted for more than two years.

While the agency model does not bear inventory risk, it is still constrained by high operating costs such as labor, venue rental, utilities, insurance, and management, limiting its room for further development.

The direct sales model sounds appealing as it allows manufacturers to directly control sales channels, facilitating unified brand image management and precise market strategy execution. However, its high costs make it difficult to achieve widespread coverage in a short period.

Moreover, these models share common shortcomings: difficulty in achieving fully functional clustered management, inability to provide multi-brand 'one-stop' car-buying services, and limited improvement in the user car-buying experience.

Xiao Zhengsan, the president of the China Automobile Dealers Association, believes that the automotive industry and products are being redefined amidst the waves of new energy and intelligence, which will inevitably give rise to a new distribution model that matches and possesses new productive forces. 'In the future, through the reorganization of distribution supply chain elements, a more efficient and intensive model will emerge, resulting in a third sales model parallel to existing branded dealerships and manufacturer direct sales. This model will break down brand isolation and the boundaries between manufacturers and merchants, creating a shorter, lighter, and more efficient automobile distribution chain.'

GOME Auto belongs to this third model.

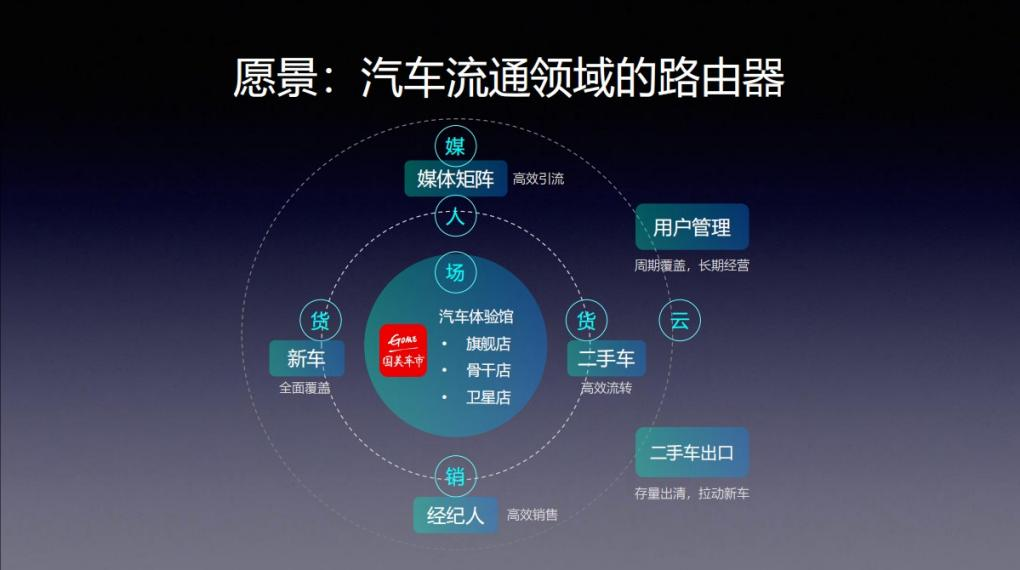

GOME Auto aims to form an intensive sales model integrating display, experience, sales, and delivery. Theoretically, this model can reduce costs, streamline processes, increase efficiency, and boost revenue. Simultaneously, it systematically creates an online and offline, new and used car, domestic and foreign, physical and financial 'four integrations' tangible market with high-tech content.

In terms of online and offline integration, GOME Auto plans to build a large-scale automotive self-media live sales center within the park and establish an online intelligent traffic diversion operation system centered on live sales, collaborating with GOME Auto's offline integrated stores.

At the same time, it also plans to construct an online used car auction information system and a large database for used car export transactions, including a used car export auction platform.

'It is hoped that the used car export transaction service platform of GOME Auto can seize the current market gap and occupy an important industrial role,' said Wang Xia, president of the Automotive Industry Branch of the China Council for the Promotion of International Trade.

To this end, GOME Auto has invited seasoned professionals from automotive platforms as consultants and hired experienced automotive media personnel to execute plans.

'On the whole, GOME Auto's concept and model are quite innovative, and the execution team is strong,' said an expert from the China Automobile Dealers Association to Bangning Studio. 'However, due to various reasons, it is easy to talk about change in the automobile distribution industry but difficult to make money at present.'

That 21-year-old Xibahe store has now embarked on a new adventure for Huang Guangyu, but whether this is the beginning of a new success or failure will be known in 18 months.