2025: No More Niche Blue Oceans in China's Auto Market

![]() 01/02 2025

01/02 2025

![]() 559

559

Introduction

Every segment will face increasingly fierce and saturated competition.

If I had to choose a word to describe China's auto market in 2024, it would undoubtedly be "intensification".

Some might ask, wasn't 2023 the same?

My response is that the intensity of competition has surged exponentially. With automakers collapsing one after another, a brutal atmosphere has enveloped the entire market.

As a witness, I am filled with awe and emotion. Regardless of who you are, in this era of accelerated electric vehicle transformation, if you wish to stay in the game and continue sharing the pie amidst constant change, you must endure significant hardships.

This also necessitates that everyone have no apparent weaknesses in product development, marketing, research and development, finance, sales, and service.

Looking ahead to 2025, it is foreseeable that this intensification will continue to worsen across all aforementioned dimensions, leaving no room for the weak.

The most representative scenario will be that "niche blue oceans will vanish completely from China's auto market."

In other words, every segment will encounter increasingly fierce and saturated competition, and selling each new car will be akin to competing for scraps in a jungle. The fundamental reason behind this judgment lies in the undercurrents observed in the new energy SUV segment.

Who wouldn't envy something that sells well and turns a profit?

Looking back at 2024, the popularity of multiple mid-size, large, and extra-large new energy SUVs from Li Auto's L series and AITO's M series undoubtedly stirred envy among many competitors.

Especially when many brands were embroiled in price wars, these models thrived financially due to their precise product positioning.

Coincidentally, NIO, often labeled as a 'mini Li Auto,' achieved stable monthly deliveries exceeding 40,000 units with its three highly cost-effective C-series new energy SUVs. The speed of its ascent astonished the entire industry.

Precisely against this backdrop, based on currently available information, a wave of similar 'new products' will begin to aggressively follow suit.

From the Trumpchi S7 to the Aion HL, from the Qiyuan C798 to the Denza N9 to the ARCFOX S09, although their prices vary, they all aim for the same 'pie'.

Within Geely, from Geometry to Lynk & Co to Zeekr, targeted and effective actions will be taken consecutively based on domestic consumer preferences.

In contrast, among the other two companies in the 'NIO-XPeng-Li Auto' trio, XPeng's G9 facelift is imminent, and the family flagship SUV will most likely debut in 2025. NIO's second brand, AL Auto, has confirmed that it will continue to launch a large five-seater and a six-seater pure electric SUV after the L60.

Including players from the 'national team' such as IM Motors, Voyah, and AITA, they will also participate with great determination. Additionally, Xiaomi's YU7 is also keeping a close eye on the market...

In summary, the obvious trend is clear. Whether it's Li Auto, AITO, or NIO, the days of comfortably reaping profits in niche blue oceans are over. Based on the current situation, I believe no one dares to claim they have an absolute 'winning hand'.

Taking Li Auto as an example again, rumors suggest its 2025 sales target is 700,000 units.

Frankly speaking, this is not a substantial increase compared to 2024. Perhaps, due to the increasing pressure on the extended-range segment and the uncertain future of the pure electric segment, it is better to be modest than to be proven wrong later. Its relative conservatism already reflects how daunting the upcoming 'transition from blue to red' will be.

Looking deeper, the most direct consequence of the intensification in the mid-size, large, and extra-large new energy SUV segments, besides the bloodbath in this niche segment, is that the demise of traditional fuel vehicles will accelerate, and the strongholds of joint ventures will suffer even more severe impacts.

Regarding this, I want to remind all automakers involved: 'Never overestimate yourself and never underestimate others.'

To put it more bluntly, only by being fully prepared in terms of products, pricing, production capacity, and marketing can one have a chance of achieving good results. The right time, place, and people must all be in place.

Otherwise, you will only become so-called 'cannon fodder' and 'stepping stones'.

No niche blue oceans, only seas of red

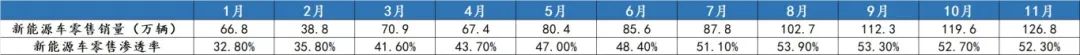

32.80%, 35.80%, 41.60%, 43.70%, 47.00%, 48.40%, 51.10%, 53.90%, 53.30%, 52.70%, 52.30%.

I believe most readers are puzzled by the series of numbers at the beginning of this paragraph and wonder what they represent. The answer is simple: 'The retail penetration rate of new energy vehicles from January to November 2024.'

In other words, this is currently the best indicator to observe the progress of the transition from fuel to electric vehicles in China's auto market, bar none.

In fact, as early as the beginning of last year, BYD Chairman Wang Chuanfu made his prediction: 'The monthly retail penetration rate of new energy vehicles will definitely exceed 50%.'

As soon as he said this, he faced a wave of criticism. However, the clear results have silenced the doubters.

Focusing further, since July 2024, this key data has stably surpassed the 50% mark, and new energy vehicles have truly become the 'mainstream choice' for end consumers compared to traditional fuel vehicles.

From 32.80% in January to 51.10% in July, the retail penetration rate surged by 20% in just six months, demonstrating a trend of 'overwhelming force'.

The reasons behind this are undoubtedly linked to changes in potential customers' perceptions, strong policy support, and automakers, especially domestic brands, rushing to launch and iterate new products. These factors layered, catalyzed, and boosted each other, jointly contributing to the prosperity of the entire market.

With the advent of 2025, how high this data will climb has become a topic of concern.

Little did we know that recently, Zhang Yongwei, Vice Chairman and Secretary-General of the China Electric Vehicle Hundred People Forum, made a prediction at a media briefing.

"China's auto market is generally stable with progress, with total sales of around 32 million vehicles, including around 26 million vehicles in the domestic market, representing a growth rate of 3%. Optimistically, sales of new energy vehicles will reach around 16.5 million in 2025 (including exports), with a growth rate of nearly 30% and a penetration rate exceeding 50%. Domestic demand is expected to reach 15 million vehicles, with a penetration rate exceeding 55%."

He then added: "Considering the overall macroeconomic situation and the development patterns of the automotive industry, China's automotive industry has entered a stage of stable growth. Among them, new energy vehicles are still in a critical period of accumulating economies of scale and consolidating advantages."

In other words, the 'battle between fuel and electric' has officially entered a stage of stalemate and checks and balances, and new energy vehicles will not immediately overwhelm traditional fuel vehicles in an overwhelming manner.

Regarding this judgment, I rationally and objectively agree.

However, precisely because the former is now facing the most important battle against the latter, as mentioned at the beginning of the article, the competition in China's auto market will surely intensify in 2025, leaving no room for the weak.

Among them, the most representative scenario will definitely be: 'The remaining niche blue oceans will all turn red.'

Whether it's sedans, SUVs, MPVs, hardcore off-road vehicles, or even executive-level flagship models, as long as there is profit to be made, 'unscrupulous' automakers will rush in, with the unspoken message being: 'What if it works out?'

For the upcoming 365 days, as end consumers, we will surely be delighted. We will witness an era of overwhelming brand marketing, endless new product launches, and sincere final pricing, with the market completely transitioning from a seller's market to a buyer's market.

In contrast, for automakers, this can only be considered an era where crisis and opportunity coexist. Looking back is a precipice, but looking up, one can also see the peak.