Shanghai Auto Purchase Subsidies Continue: Will the Auto Market Rebound?

![]() 01/02 2025

01/02 2025

![]() 784

784

Introduction

In the near term, policy-driven measures continue to serve as a crucial lifeline for the automotive industry.

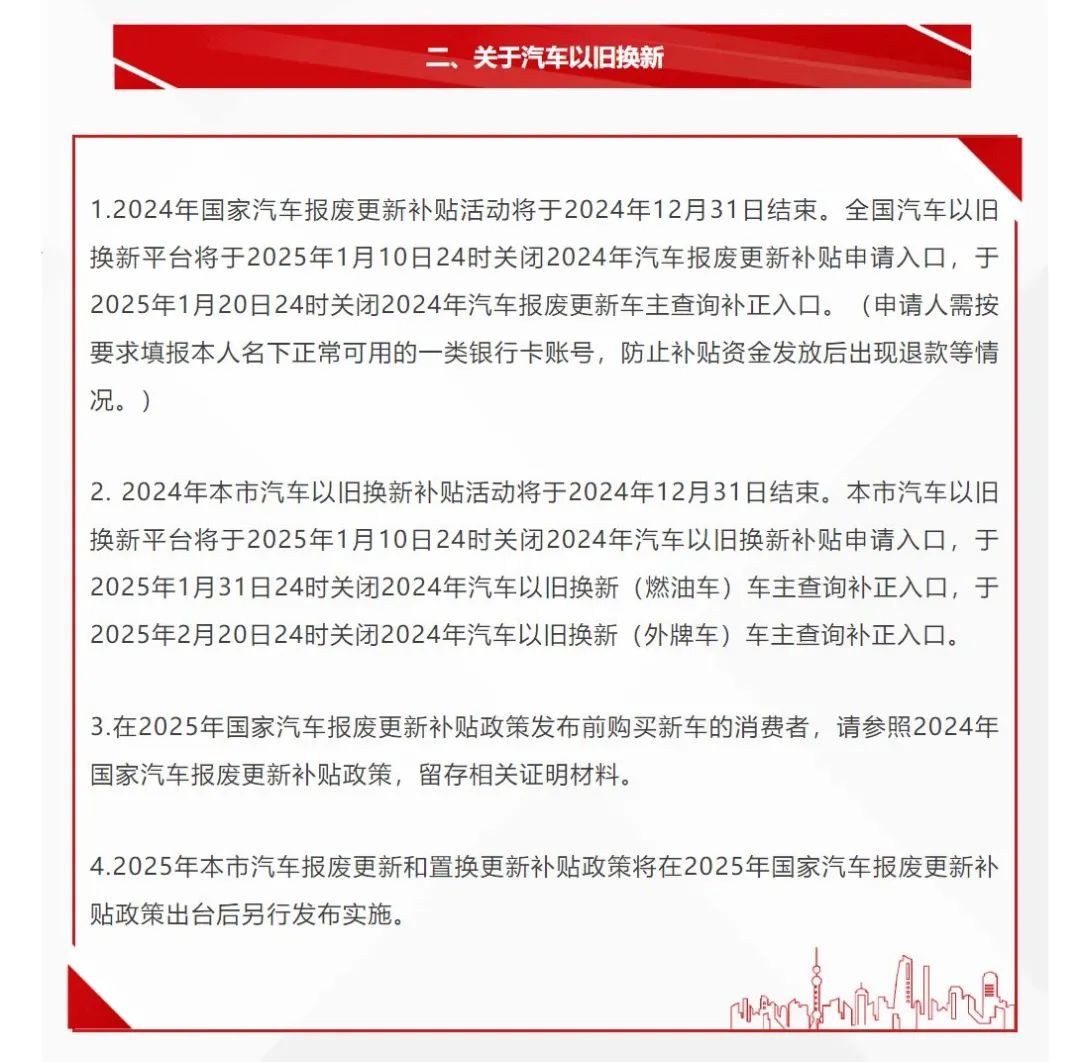

"The 2025 Shanghai vehicle scrapping and replacement subsidy policy will be unveiled and implemented subsequent to the announcement of the national vehicle scrapping and replacement subsidy policy in 2025."

On New Year's Day 2025, 'Shanghai Releases' announced that "Shanghai Will Continue to Carry Out Consumer Goods Trade-In Activities in 2025," signifying that, despite the details yet to be disclosed, Shanghai's auto purchase subsidy policy for this year has been officially confirmed.

Echoing this, in November 2024, Song Yingjie, a second-level investigator in the Department of Consumption Promotion of the Ministry of Commerce, revealed at the 2024 Auto Finance Industry Summit that plans for the continuation of the 2025 vehicle trade-in policy would be formulated in advance.

"In summary, both national and local vehicle scrapping and trade-in subsidies are set to arrive in 2025, likely announced around significant work meetings and the Beijing/Shanghai Auto Show," commented an industry insider.

While spontaneous market growth is generally preferable, the policy-driven market remains a vital force amidst overall economic pressures.

"Subsidies have a tangible impact"

On April 24, 2024, the "Detailed Rules for the Implementation of the Vehicle Trade-In Subsidy Policy" was jointly issued by seven ministries and commissions, including the Ministry of Commerce, Ministry of Finance, National Development and Reform Commission, and Ministry of Industry and Information Technology. The subsidy content can be broadly understood as "a national subsidy of 20,000 yuan for new energy vehicles and 15,000 yuan for fuel vehicles."

So, what was the impact of the 2024 vehicle trade-in subsidy policy on the national and Shanghai auto markets?

According to data provided by Song Yingjie, as of November 2024, the number of national vehicle scrapping and replacement applications had surpassed 2 million, with a cumulative total exceeding 4 million applications. The daily average number of subsidy applications remained high, driving a year-on-year increase of over 50% in national vehicle scrapping and recycling volumes from January to October.

According to Ministry of Commerce data for December, as of December 13, over 2.44 million vehicles were scrapped and replaced nationwide, with over 2.59 million replacements. It is estimated that nearly 2.7 million vehicles were scrapped and replaced throughout the year, and over 3.1 million vehicles were replaced. Since 2024, the overall consumer goods trade-in policy has driven sales of related products to exceed one trillion yuan.

The China Passenger Car Association (CPCA) estimates that due to delays in reporting and declaration times, the total number of scrapped vehicles nationwide should exceed 3 million. Combined, scrapping and replacement totaled over 5 million vehicles, with an estimated subsidy amount of approximately 50 billion yuan for each type, totaling 100 billion yuan.

A June 2024 notice from the Ministry of Finance indicated that the annual funding for vehicle trade-in subsidies totaled 11.19775 billion yuan. Of this, 6.44004 billion yuan came from central funds and 4.75771 billion yuan from local funds.

According to 'Shanghai Releases,' national and local subsidy activities in 2024 ended on December 31, with trade-in platforms closing at 24:00 on January 10, 2025. The inquiry and correction portals for national and local subsidies will close at 24:00 on January 20, 2025, and February 20, 2025, respectively.

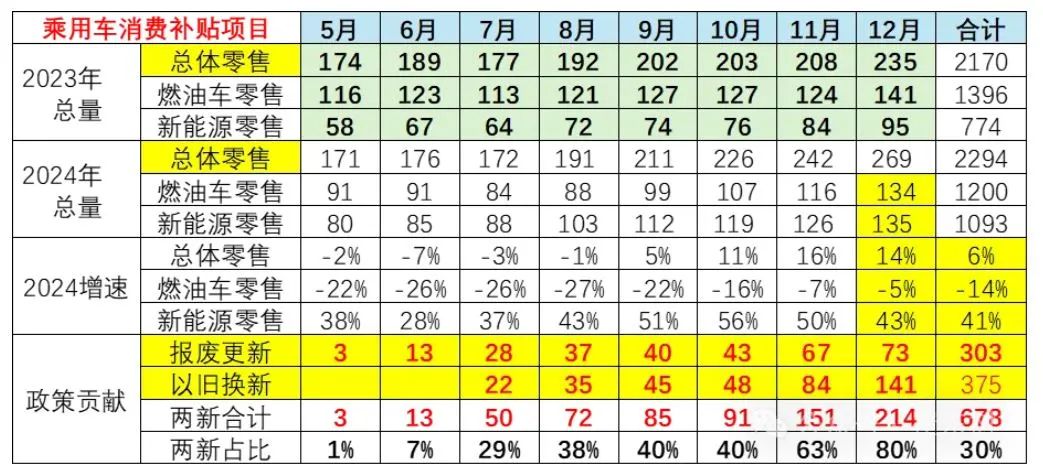

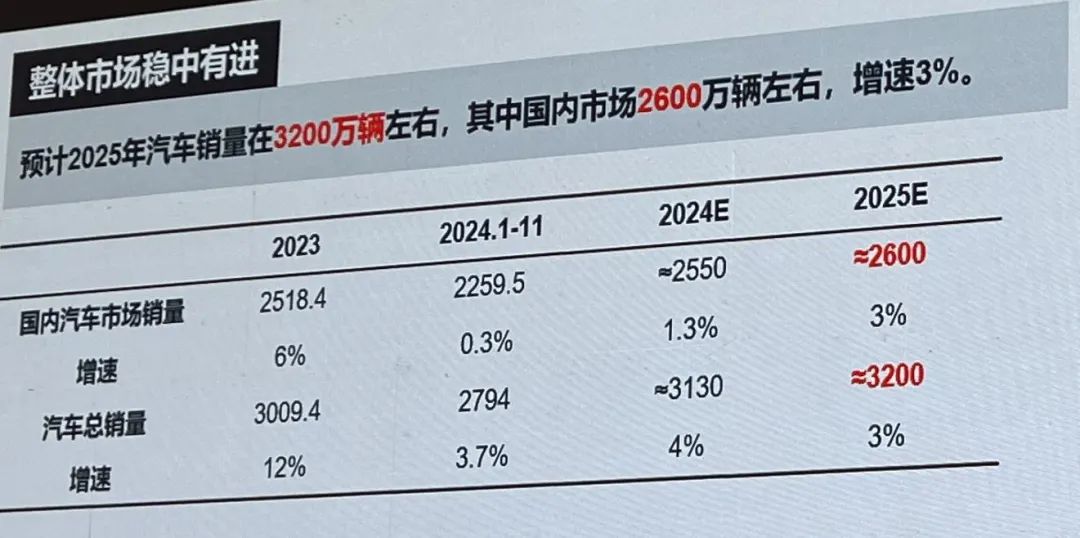

Driven by subsidies, the national auto market trend in 2024 exhibited a U-shaped growth pattern. Based on passenger vehicle retail sales statistics, Cui Dongshu, secretary-general of the CPCA, predicts that total auto sales in 2024 will reach 22.94 million vehicles, a year-on-year increase of 5.7%.

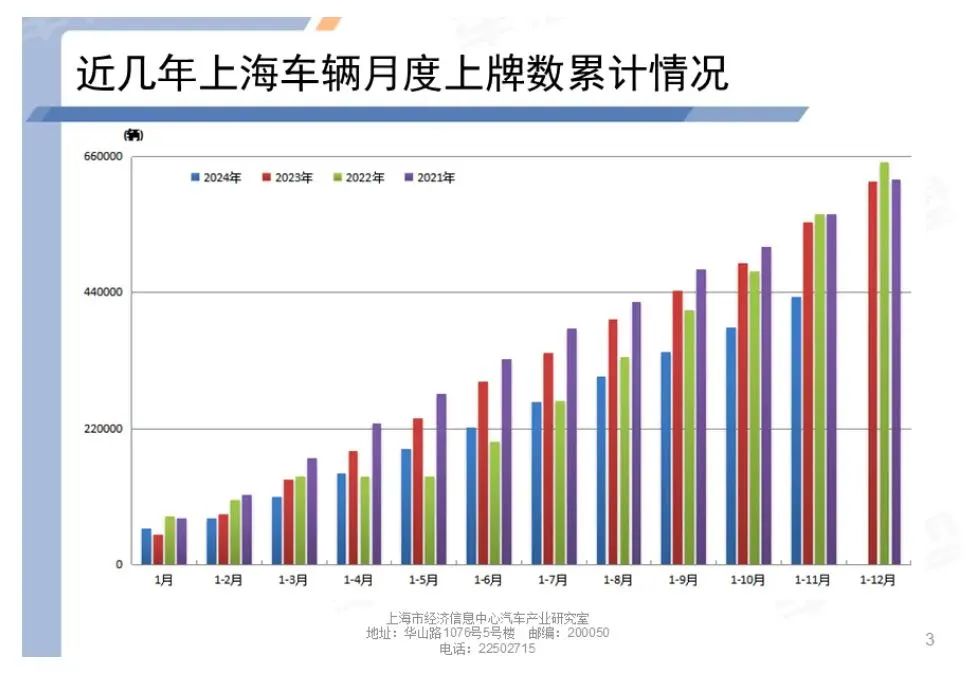

For Shanghai, the total number of new car registrations from January to November 2024 was 433,000, a year-on-year decrease of 21.87%. The monthly registration volume for that month was 49,000, a year-on-year decrease of 26.3%.

However, judging from the cumulative monthly sales curves, auto sales in Shanghai rebounded after the subsidy policy was introduced, particularly during the 'Golden September and Silver October' period.

Two Trillion for a 2% Increase

The 'Golden September and Silver October' period in 2024 heavily relied on the vehicle trade-in policy.

According to Cui Dongshu's estimates, if the 2025 trade-in subsidies maintain the same intensity as in 2024, the overall demand for subsidy funds for scrapping, replacement, and trade-ins is expected to exceed 200 billion yuan, significantly higher than previous peak subsidy levels.

However, the specific level of the 2025 subsidy policy may be comprehensively considered from two dimensions: the performance of the auto industry and national tax revenue.

Cui Dongshu pointed out that in 2022, due to the high growth of new energy vehicles and a 5% tax exemption for fuel vehicle purchases, national tax revenue decreased by 112.2 billion yuan. The current two new subsidy policies are expected to total much more than the 2022 vehicle purchase tax reduction policy in 2025. Therefore, he fears that local subsidy policies in 2025 may have stricter standards after the transition period, and subsidy amounts may decrease slightly.

If the 2025 policy largely continues the intensity of 2024, according to estimates by the CPCA and other institutions, it is expected that domestic auto retail sales will reach 23.4 million vehicles in 2025, a year-on-year increase of 2%, with new energy passenger vehicle retail sales of 13.3 million vehicles, a year-on-year increase of 21%, and a penetration rate of 57%.

Furthermore, the external environment in 2025 is complex, with significant declines in market growth in the European Union and Russia, resulting in an overall growth rate of passenger vehicles expected to drop to around 10%.

"Two trillion for a 2% increase" is not as straightforward as it seems. Currently, industrial liquidity is even more critical than profitability. Both auto price competition and subsidy policies are, to some extent, aimed at aligning auto product prices with subdued purchasing power and consumer confidence.

However, the policy-driven market can also introduce volatility. For instance, some car purchase demand in early 2025 may be released prematurely due to the subsidy policy implemented at the end of 2024. Consequently, auto market performance in January and the first quarter of this year may not be impressive.

Nevertheless, compared to long-term development, short-term performance over a specific period now appears less significant.