Shanghai Auto Show 40 Years: The Great Rivers of China's Auto Industry

![]() 05/05 2025

05/05 2025

![]() 639

639

Author | Wu En

Declaration | The cover image is sourced from the internet. For reprinting of original articles from Jingzhe Research Institute, please leave a message to apply for authorization.

Waves rolling, rivers flowing, the boundless waters never cease.

In 1985, the powerful voice of singer Yip Lai-yi accompanied the introduction of the TV series "Shanghai Bund" from Hong Kong to mainland China. That same year, the inaugural Shanghai Auto Show unexpectedly arrived, gradually unveiling the tumultuous development of China's auto industry.

In 2025, as the spring breeze sweeps across the Huangpu River, the Shanghai Auto Show commemorates its 40th anniversary. Although the hustle and bustle under the spotlight may not be as intense as in previous years, and the absence of Lei Jun has left the exhibition hall without a "top-tier" fulcrum, relying solely on episodes like "Zhou Hongyi being fed by the goose seller" to generate buzz, the Shanghai Auto Show has fully chronicled the vicissitudes of China's auto industry development over the past four decades.

From an open-air plaza to a 360,000-square-meter exhibition hall, from 328 exhibitors at the first auto show to nearly a thousand related enterprises in the auto industry today, China's auto industry has transformed from a "market for technology" to a "technology exporter" and from "scale expansion" to "value leadership". Each decade reflects the profound logic of China's auto industry's transformation and upgrading.

The First Decade (1985-1994): Joint Venture Collaboration

In 1985, China's economy was in the early stages of transitioning from a planned economy to a market economy. Chinese consumers' curiosity about household cars and automakers' interest in the Chinese market turned the first Shanghai Auto Show into a "two-way journey".

On July 3, the auto show opened amidst the blazing sun in an open-air setting, but the scorching weather could not deter the enthusiasm of the Chinese people eager to see the world. By 7 a.m., long queues of spectators had already formed at the entrance.

A foreign media reporter wrote: "An old man in a Mao suit stared at the chrome hubcaps of a Toyota Crown for half an hour. He might not be able to afford this car in his lifetime, but there are a billion pairs of eyes like his in China." On the opening day of the first auto show, more than 20,000 people attended with such anticipation.

They were not only admiring world-class industrial products but also eagerly absorbing all the knowledge they could. Many technicians used vernier calipers to meticulously measure automotive part data, took avid notes during lectures given by foreign engineers, and even used telescopes from the back rows. It is said that due to the large number of people copying materials, the photocopiers in nearby restaurants were directly burned out from overload. Some people even copied materials by hand overnight.

Foreign automakers also valued this opportunity to gain a deeper understanding of the "mysterious Chinese market". The first Shanghai Auto Show attracted a total of 328 automakers from 22 countries and regions. To participate in the Shanghai Auto Show, staff from Italy's Fiat even drove Panda sedans and Iveco trucks, setting off from Italy two months in advance and driving 20,000 kilometers to China.

Among all the exhibited models, the most eye-catching was the first model of the newly established Shanghai Volkswagen - the Santana.

*The Santana surrounded by crowds at the first Shanghai Auto Show (Image source: SAIC Volkswagen)

At that time, due to technological and licensing restrictions, only state-owned enterprises in China could manufacture cars, but there was a severe lack of car manufacturing technology. Foreign automakers possessed mature technology and were eager to enter the Chinese market. Therefore, joint ventures became the primary development model for China's auto industry in its early stages.

In 1983, Beijing Jeep, jointly established by Beijing Automobile Works and American Motors Corporation, became China's first joint venture automaker. In 1985, the Sino-German joint venture Shanghai Volkswagen Automotive Co., Ltd. was established. The Santana was the pioneering work of Shanghai Volkswagen and became an iconic model, selling out as soon as it was launched. As a result, there were often people pleading with bags of money at the gate of Shanghai Volkswagen to buy cars.

In the 1990s, the cost of a Santana was over 70,000 yuan, with a national selling price of over 120,000 yuan. However, after markups at various levels, the market price reached 220,000 yuan. This price could buy a 200-square-meter house in Shanghai at that time.

The success of the Santana made many foreign automakers see the huge potential of the Chinese market. In 1985, Guangzhou Yangcheng Automobile Factory and French automaker Peugeot jointly established Guangzhou Peugeot Automobile Co., Ltd.; in 1991, China FAW Group and German automaker Volkswagen established FAW-Volkswagen; in 1992, Dongfeng Motor Corporation and French automaker Citroen jointly established Dongfeng Peugeot Citroen Automobile Company Ltd.

In subsequent Shanghai Auto Shows, joint venture cars occupied center stage. Shanghai Volkswagen and FAW-Volkswagen exhibited jointly for the first time, launching classic sedans such as the Santana, Golf, Jetta, and Audi, all of which became legends in the Chinese auto market. However, under the growing halo of joint venture brands, China's indigenous brands, already weak in foundation, fell silent in the shadows, and some even left the stage in disappointment.

In 1991, when the joint venture brand Shanghai Volkswagen was at its peak, Shanghai Automobile Factory held a ceremony for the last Shanghai-brand sedan. With the last Shanghai-brand sedan being pushed off the production line, this 28-year-old Chinese sedan brand exited the stage due to the impact of joint venture cars, becoming an epitome of state-owned enterprises-led indigenous brands at that time.

However, under the influence of the reform spring breeze, a new automotive force was quietly gathering strength.

The Second Decade (1995-2004): Dormancy of Indigenous Brands

In 1994, the issuance of the "Automotive Industry Policy" for the first time included encouraging private car purchases in the policy text, turning the Chinese market of over a billion people into a treasure trove about to open its doors. During this period, behind the lively auto shows, there were also more people with eager eyes. Among them were Chinese citizens who had become wealthy and were ready to buy cars, more foreign manufacturers with covetous eyes, and local pioneers ready to tackle the Chinese auto market.

Half of China's indigenous auto brands also emerged during this period.

In 1993, Wei Jianjun, a 29-year-old man from Baoding, manually assembled the first batch of "Great Wall sedans"; in 1996, Li Shufu, who had made refrigerators, speculated on real estate, and sold motorcycles, dismantled two Mercedes-Benz cars and prepared to start making cars by copying them; also in 1996, Yin Tongyue, who had become the director of the final assembly workshop of FAW-Volkswagen, chose to join Chery and began writing a new entrepreneurial story in Anhui.

Although a skyscraper must be built from the ground up, for private enterprises with nothing, laying this foundation was exceedingly difficult. Yin Tongyue later recalled, "At that time, Chery indeed had no money, no people, and no technology."

Being "three no's" was not the biggest pain in the development of indigenous brands. The licensing restrictions almost prevented these ambitious tycoons from crossing the industry threshold. Although the "Automotive Industry Policy" encouraged private car purchases, it also implemented a "catalog" management system for the automotive industry, meaning that only cars with a "license" could be sold on the market. As a result, Great Wall's sedans had to be discontinued due to not being included in the relevant catalog; Geely produced the first batch of Geely Haoqing but could not sell them due to the lack of a license; even Chery, which was a state-owned enterprise at that time, encountered license issues.

Like entrepreneurs in various industries, auto tycoons also had to wade through the searing flames to reach the forefront of the industry.

Soon, in 1995, after visiting the United States, Europe, and Thailand in Southeast Asia, Wei Jianjun decided to focus on pickup trucks upon his return. In 1998, Great Wall's Deer pickup truck achieved an annual sales volume of 7,518 units, becoming the sales champion of pickup trucks that year. In the following 26 years, Great Wall's pickup trucks have consistently ranked first in domestic sales.

Li Shufu managed to attach Geely to an automobile factory subordinate to a prison, allowing Geely Haoqing to be sold smoothly. In 1999, Li Shufu sold over 1,000 Geely Haoqing, and in 2000, he sold 10,000 units.

Yin Tongyue paid the price of 20% equity to obtain the qualification of SAIC Motor. Starting from December 18, 1999, when the first Chery Fengyun rolled off the production line, it took 382 days for the 10,000th Chery sedan to roll off the line.

These achievements became the "first pot of gold" for future Chinese auto tycoons to establish themselves in the industry. And all these achievements happened quietly outside the Shanghai Auto Show. Inside the auto show, it was still foreign and joint venture brands that were vying for attention. More joint ventures were established like mushrooms after rain during this period. Over the decade, one after another legendary car was continuously launched.

*Situation of joint venture automakers (Chart by Jingzhe Research Institute)

The 1995 Shanghai Auto Show was exceptionally popular. After a decade of tempering, the total exhibition area of the Shanghai Auto Show reached 33,000 square meters, attracting nearly 400 multinational automakers from 24 countries and regions, exhibiting 130 complete vehicles, and 115 engine and other parts enterprises.

In terms of models, the Shanghai Passat, as the successor to the Santana, made its debut at the 1995 auto show and became the biggest focus; at the 1997 auto show, the unveiling of the Audi A4, Audi A6, and Audi A8 was a feast for the audience's eyes; at the 1999 auto show, General Motors introduced the Cadillac in China for the first time. Almost all world-renowned automotive brands followed the market development path of "debuting at the Shanghai Auto Show first, then driving into the streets and alleys of China".

During this period, only one concept car, the "Qilin", was released by indigenous brands at the 1999 auto show, and then it quickly disappeared into the depths of history. At this time, indigenous brands were still quietly accumulating their strength.

The Third Decade (2005-2014): Collective Efforts of China's Auto Industry

In 2005, the 20th Shanghai Auto Show became a turning point in the fate of indigenous brands. That year, China's unified auto tariff was reduced to 30%, a "tariff + displacement consumption tax" policy was implemented, and the import quota licensing system was abolished, finally eliminating the need for approval to sell cars.

As a result, market competition intensified sharply, but it also opened up two paths for indigenous brands: one was to continue learning within the joint venture system, and the other was to dive into the deep waters of the global market. Indigenous brands chose the latter.

At that year's Shanghai Auto Show, indigenous brands, which had long been overshadowed by joint venture brands, bravely stepped onto the stage. Companies such as Chery, Changan, Geely, and BYD exhibited more than 10 domestically developed and designed models. Although they were all concept cars, it was a significant step forward for indigenous brands.

At the 2007 Shanghai Auto Show, indigenous brands bravely bloomed. Although the product mix of Chery A1 and A3, BYD F3 and F6, Geely Automobile, Shuanghuan Xiao Guizu, and Changfeng Leopard may seem somewhat weak in strength now, for China's indigenous brands, this collective appearance marked the comprehensive rise of indigenous brands. Since then, indigenous brands have become an important pole in China's auto industry and have begun to be active at the Shanghai Auto Show.

*The 1 millionth Chery car rolled off the production line in August 2007 (Image source: Chery's official website)

Two years later, at the 2009 Shanghai Auto Show, in addition to the first gathering of China's six major auto groups - FAW, SAIC, Dongfeng, Changan, GAC, and BAIC - brands such as Geely, Chery, Great Wall, BYD, Lifan, Haima, and Brilliance also launched a full-scale attack, not only showcasing the magnificent scenery of China's auto market but also demonstrating the "fierce attack" of indigenous brands in the market.

The Chery QQ, which was launched as early as 2003, relied on its starting price of 33,800 yuan for its "ultimate cost-effectiveness". Compared to the Santana and Jetta, it could "save" the down payment for a house and was about half the price of the original improved Chevrolet Spark. Its sales volume exceeded 50,000 units in the first year and reached over one million by the time it was discontinued in 2013, even being sold overseas.

In 2007, Great Wall Motor finally obtained a sedan qualification, marking the beginning of a new journey. In 2011, the "national god car" Haval H6, targeting the SUV segment, emerged. In the following ten years, its global cumulative sales exceeded 3.5 million units, and it has been the domestic SUV sales champion for many years. In December 2016, Haval H6 set a record for monthly sales of a single model in China with over 80,000 units sold in a single month.

The ascendancy of indigenous brands fostered immense pride in their founders. In 2007, Wang Chuanfu, who had transitioned from batteries to automobiles, boldly proclaimed: "To attain domestic supremacy by 2015 and global dominance by 2025." In 2010, Li Shufu, relentless in his quest for funds, amassed $1.8 billion and stunned the world by signing an agreement to acquire Volvo in Stockholm.

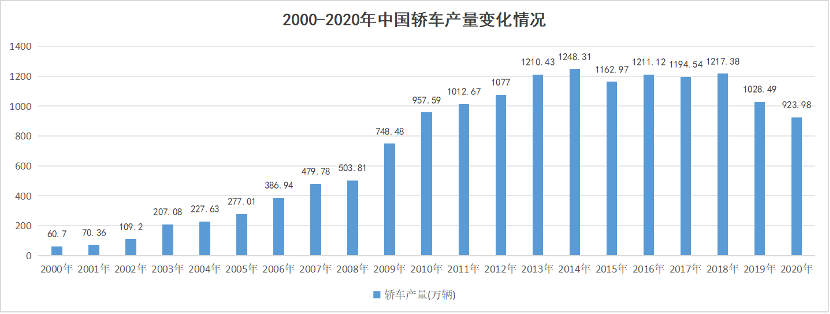

Behind these remarkable feats lay a common ambition: none of the indigenous brands wanted to miss out on the golden era of China's automotive industry. According to National Bureau of Statistics data, from 2005 to 2014, China's car production soared from 2.77 million to 12.48 million, marking the swiftest period of growth in the country's automotive history.

It's worth noting that, despite this rapid development, Chinese brands primarily ventured into the low-end market, shunned by foreign brands. Due to a substantial gap in core technology, indigenous brands struggled to compete in the mid-to-high-end segment. Consequently, Wang Chuanfu lamented, "We must switch lanes to overtake." Subsequently, new energy and electrification emerged as new battlegrounds for indigenous brands.

At the 2007 Shanghai Auto Show, Geely Automobile showcased new energy models, marking the beginning of a consistent presence at every subsequent show. In 2009, Geely launched another high-performance electric vehicle, Chery exhibited four self-developed pure electric and hybrid models, and BYD also presented its electric vehicle series.

Autonomous brands deeply engaged in exploring new territories soon witnessed a "spring breeze" of opportunity.

In 2011, the Outline of the 12th Five-Year Plan outlined a clear development path for seven major strategic emerging industries, including new energy and new energy vehicles, aiming to become a global benchmark in a decade. In 2012, the "Development Plan for Energy-Saving and New Energy Vehicle Industry (2012-2020)" was officially released, affirming that China's primary strategic direction for new energy vehicles is pure electric vehicles.

With policies and innovations by autonomous brands converging, the 2013 Shanghai Auto Show witnessed not only Chinese automakers but also many foreign brands unveiling new energy vehicle models, heralding another industrial trend for the Chinese automotive industry.

The Fourth Decade (2015-2024): New Energy Overtaking

A historic shift occurred at the 2015 Shanghai Auto Show: a dedicated new energy area was established for the first time. Additionally, Tesla, making its debut, became the center of attention, drawing large crowds to its booth.

The heightened focus on new energy vehicles at the Shanghai Auto Show fortified autonomous brands' resolve to develop this sector. In 2015, Li Shufu proposed the "Blue Geely Initiative," a new energy vehicle development strategy, setting an ambitious goal: "By 2020, new energy vehicle sales will exceed 90% of overall sales."

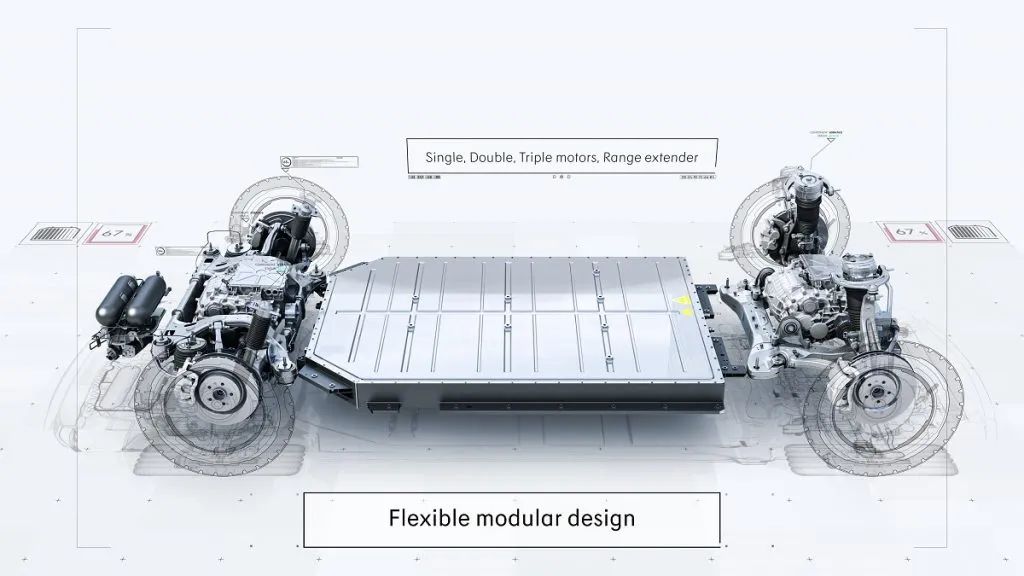

*In 2020, Geely launched the world's first open-source electric vehicle architecture (Source: Geely's official website)

While BYD didn't attain the national top spot in 2015, Wang Chuanfu persisted in investing in electric vehicles, developing the dual-mode F3DM and pure electric E6. These early endeavors laid the groundwork for BYD's future success.

At the 2017 Shanghai Auto Show, BYD's Dynasty concept cars made a collective debut, showcasing a full range of models including Qin 100, Tang 100, Qin EV, Song DM, Song EV300, Yuan DM, and Yuan EV, reflecting BYD's confidence in establishing a "new energy vehicle dynasty." In 2022, BYD announced it would cease fuel vehicle production from March 2022, becoming the world's first automaker to publicly announce such a move.

In contrast to traditional automakers' transformation, newcomers appeared more relaxed.

In November 2014, Li Bin, the founder of BitAuto, established NIO after raising $300 million, targeting the pure electric vehicle swapping market. Interestingly, Lei Jun, who later ventured into automaking, participated in the funding. In 2015, Li Xiang, the founder of AutoHome, founded Li Auto, focusing on the electric vehicle sector. In 2017, He Xiaopeng left Alibaba, forgoing stock options worth hundreds of millions, to found XPeng Motors.

At the time, some online discussions viewed newcomers lacking a "vehicle manufacturing foundation" as "amateurs joining the fun" or accused them of a conspiracy to "defraud subsidies." However, the comprehensive rise of the new energy industry laid the groundwork for the acceleration and overtaking of China's automotive industry in the electric vehicle sector.

*Source: XPeng Motors' official website

At the 2019 Shanghai Auto Show, over 130 new energy vehicle models were displayed. For the entire year, sales of new energy passenger vehicles in China surpassed one million for the second consecutive year. During the 2023 Shanghai Auto Show, the number of displayed vehicles reached 1,413, with over 150 global premieres and concept models, and Chinese automakers accounted for more than half of the new energy vehicle models.

Beyond emerging in the new energy market, Chinese autonomous brands have shed the stereotype of low quality and low prices, moving towards the mid-to-high-end sector and capturing market share from foreign brands.

Looking back to 2019, Hyundai's sales peaked at 700,000 units but plummeted to less than 160,000 units in 2024, with Korean cars' share in China falling to 1%. In 2024, Honda's sales in China declined by 30.9%, hitting a low since 2014; Nissan's sales fell by 12.2%, reaching a low since 2008, and Toyota's sales dropped by 6.9%. Additionally, German and American brands have all experienced varying degrees of decline.

In the new energy sector, Chinese automakers have overtaken through diligence and embarked on global expansion. In 2023, China surpassed Japan to become the world's largest automobile exporter, retaining this position in 2024. In the shift of discourse power between old and new markets, Chinese autonomous brands are advancing towards a grander stage.

*Source: FAW Hongqi's official Weibo account

Online data reveals that, among the top 10 global automakers in sales in 2024, 8 experienced declines, with only BYD and Geely from China seeing increases. Even expanding the scope to the top 20 global automakers in sales, only 6 maintained sales growth, with 4 of these being Chinese enterprises, highlighting the robust growth momentum of Chinese automakers.

According to media reports, at this year's Shanghai Auto Show, foreign engineers were seen squatting under the chassis of domestic cars, studying them intently. Earlier, foreign automakers' "tape measure departments" appeared at the auto show, physically measuring the exterior dimensions of domestic cars. This is a reversal of the scene in 1985 when Chinese engineers meticulously measured Santana parts with vernier calipers.

Forty years have swiftly passed, like a lifetime. Flowing water doesn't rush ahead; it strives to be unceasing. And the global automotive landscape, as seen through the Shanghai Auto Show, has already sparked a new wave of trends.

*This article is a joint production of Jingzhe Research Institute and The Paper's Paike Finance