Why Thalys' Zhang Xinghai Chose to List in Hong Kong Now

![]() 05/07 2025

05/07 2025

![]() 528

528

As a company experiencing continuous growth, what should be the next step after achieving impressive market data and performance? The answer, undoubtedly, is financing.

Thalys, already listed on the A-share market, isn't content with its current status. Recently, Thalys officially announced plans for an IPO in Hong Kong. Concurrently, Thalys' holding subsidiary intends to raise up to 5 billion yuan in capital, introducing strategic investors such as ICBC Financial Asset Investment Co., Ltd.

The confidence behind this move stems from Thalys' turn to profitability in 2024, showcasing its enhanced market competitiveness, which naturally adds points to its Hong Kong IPO prospects. Thalys stated that the company's planning for this issuance and listing is to further promote its global strategic layout, establish an international capital operation platform, and bolster its comprehensive competitiveness.

From an industry cycle and market trend perspective, the current new energy vehicle industry is in a golden period of rapid development but also faces challenges such as accelerated technological iteration and policies favoring innovative R&D enterprises. Thalys' capital operation at this juncture undoubtedly capitalizes on the favorable "right time" of the industry cycle, the "right place" with policies such as vehicle purchase subsidies, tax exemptions, and charging infrastructure construction, and the "right people" with its own performance improvement.

Rising in Chongqing, Collaborating with Huawei to "Upgrade its Weaponry"

Thalys, closely associated with Huawei, is led by Zhang Xinghai, a "post-60s" native of Chongqing. Starting with motorcycles and minivans, he ultimately expanded and strengthened his new energy vehicle territory through collaboration with Huawei, creating Thalys with a market value of 200 billion yuan on the A-share market.

In Chongqing, a hub of heavy industry, there are giants like Changan Automobile and Lifan Automobile, whose controlling shareholders once topped the list of Chongqing's richest individuals. Zhang Xinghai and his automaker Xiaokang Stock were undoubtedly at the "younger brother" level. Xiaokang Stock's initial company was founded in 2003, initially manufacturing auto and motorcycle parts, and later relying on Dongfeng Automobile to produce Dongfeng Xiaokang brand minivans, obtaining vehicle manufacturing qualifications.

In 2011, Zhang Xinghai's car manufacturing achieved a milestone with the rollout of the 1 millionth Dongfeng Xiaokang, ranking among the "top three Chinese minivans." Xiaokang Stock also successfully listed on the A-share market in 2016, becoming the third Chongqing-based A-share listed automaker.

If Xiaokang Stock had continued to produce minivans, it might have faded into the background of China's auto manufacturing. The turning point came in 2021 when Xiaokang Stock announced a collaboration with Huawei, ushering in a series of changes. At that time, Huawei chose Xiaokang Stock not only because it had vehicle manufacturing qualifications and assembly lines but also because Xiaokang Stock was a blank slate in the new energy vehicle field.

Before engaging with Huawei, there was no news of Xiaokang Stock involvement in new energy vehicle manufacturing, which was rare in the then-booming new energy vehicle sector. This allowed it to position itself correctly in its collaboration with Huawei, especially since Huawei does not "personally" manufacture vehicles and needed an excellent "front-stage" partner.

In the year of their collaboration, Huawei and Xiaokang Stock jointly released the first mass-produced model, Thalys SF5, and announced that the model would be sold jointly through both parties' channels. As a result, for the first time, cars appeared in Huawei stores, and since then, Xiaokang Stock has undergone tremendous transformations.

Huawei deeply participates in Thalys' research and development across numerous technological fields, from chips to the cloud, while Xiaokang Stock converts its 20 years of experience in the automotive market into a "dark factory" with a 98% automation rate.

Both parties were first-time forays into the new energy vehicle field. The Thalys brand initially faced setbacks, and car sales were ultimately unsatisfactory. However, the name Thalys has been etched into many minds, and Xiaokang Automobile naturally changed its name to the now well-known Thalys.

In August 2022, Xiaokang Stock's securities abbreviation was officially changed to Thalys. Simultaneously, the company also completed the industrial and commercial registration change procedures, changing its name from Chongqing Xiaokang Industrial Group Co., Ltd. to Thalys Group Co., Ltd.

Since then, the name "Thalys" has become the company's moniker, replaced by AITO (Wenjie), the high-end automotive brand resulting from Thalys' collaboration with Huawei. With the release of the Wenjie M5, considered the "first HarmonyOS car," at the end of 2021, the Wenjie M7 and Wenjie M9 have successively been launched in the following years, quickly ranking at the top of their respective market segment sales charts.

400,000 Units Sold in One Year, Highlighting Urgent Funding Needs

Driven by policies and with a maturing market, major automakers are constantly breaking sales and performance records for new energy vehicles. Thalys has also recently announced impressive financial report data.

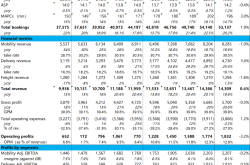

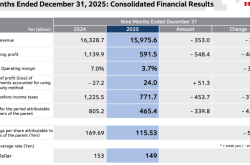

According to Thalys' 2024 annual report, the company's annual revenue soared to 145.176 billion yuan, a year-on-year increase of 305%, and its net profit successfully turned around, achieving an excellent result of 5.946 billion yuan, making it one of the new energy automakers that have met profitability targets.

Relevant data shows that Thalys sold 426,900 new energy vehicles in 2024, a significant year-on-year increase of 182.84%, successfully doubling its sales target. Among them, the cumulative deliveries of the Wenjie M9 exceeded the 150,000-unit mark, and the deliveries of the new Wenjie M7 series approached 200,000 units.

Besides significant performance growth, Thalys has continued to expand its investment territory. In January 2024, Huawei registered and established Shenzhen Yinwang Intelligent Technology Co., Ltd. (hereinafter referred to as "Yinwang") and selected the Huawei headquarters office building in Shenzhen as its address. This move aims to promote the independent market-oriented operation of Huawei's vehicle BU.

At the end of July of the same year, Thalys announced plans to invest in Yinwang. Less than a month later, both parties successfully completed an equity investment of 11.5 billion yuan. Thalys thus became the second automaker to invest in Yinwang after AITO.

In March of this year, Thalys announced that it had acquired a 100% stake in Chongqing Liangjiang New Area Longsheng New Energy Technology Co., Ltd. (hereinafter referred to as "Longsheng New Energy") for 8.164 billion yuan and had completed the transfer procedures.

Relevant information shows that Longsheng New Energy was established in September 2022 and is the implementation entity for the infrastructure supporting project of the intelligent and connected new energy vehicle industrial park in Longxing New City, Liangjiang New Area. It is a project company specifically established to serve the production and manufacturing of new energy vehicles. Prior to this transaction, Thalys leased factories from Longsheng New Energy, primarily for the production of the Wenjie M9 series models.

From this series of actions, it can be seen that Thalys, on the one hand, continues to deepen its close ties with Huawei, becoming an indispensable part of Huawei's new energy vehicle strategy through all-round collaboration in "business + equity." On the other hand, it solidifies its control over product lines, fully preparing for subsequent undertakings of Huawei's new energy vehicle business.

Zhang Xinghai, the actual controller of Thalys, who has always been extremely low-key, has also frequently appeared in public to support Thalys in recent years and clearly set the goal of "exceeding one million new energy vehicle sales by 2027."

Behind its impressive performance, Thalys also faces funding constraints. The annual report shows that Thalys' net outflow of investment activities expanded to 16.509 billion yuan in 2024, and the net outflow of financing activities was 4.166 billion yuan, with an asset-liability ratio as high as 87.38%, revealing the magnitude of its capital pressure.

More worryingly, the company's vehicle sales continued to decline in the first three months of 2025, with total sales in January to March falling by 45%, 39%, and 34% year-on-year, respectively. The sales of the core brand Wenjie series declined most significantly.

To alleviate capital pressure, on March 31, Thalys announced a capital increase plan of no more than 5 billion yuan. Its holding subsidiary Thalys Automobile plans to introduce multiple strategic investors and has indicated the completion of the signing of relevant agreements.

Therefore, it is not surprising that Thalys chose a Hong Kong IPO. Against the backdrop of the company's impressive performance in 2024, this is undoubtedly an excellent opportunity to leverage capital leverage to amplify Huawei's technological dividends, effectively alleviating the company's capital needs and more easily convincing investors.

Automaker Reshuffle: How to Address Thalys' "Hidden Worries of Growth"?

From Xiaokang Stock, once under performance pressure and with a bleak future, to Thalys, now proudly advancing to the forefront of new auto forces and having surged past the 200 billion yuan mark in A-share market value, it actually harbors its own "hidden worries of growth."

Currently, the survival situation of new energy automakers is both prosperous and stormy. On the one hand, industry giants like Tesla and BYD have seen their sales and profits soar; on the other hand, new forces such as Hopon and WM Motor are on the decline, gradually fading into obscurity. The reshuffle and restructuring of the industry are in full swing.

The main reason is the intense price war in the new energy vehicle market, which has ruthlessly compressed automakers' profit margins. As a mid-tier enterprise, Thalys still has a considerable gap with industry leaders and cannot be complacent.

Relevant data also reveals new changes brewing in China's new energy vehicle market. According to data from the Ministry of Industry and Information Technology, new energy vehicle sales exceeded the 12 million-unit mark in 2024, but the market concentration CR10 (the sales share of the top ten enterprises) has climbed to a high of 77.9%, meaning that the survival space for tail enterprises is being squeezed almost to the point of suffocation.

Policy dividends are favoring top automakers, exposing the shortcomings of some enterprises' insufficient technological reserves. Blind expansion fueled by capital has also left behind long-standing problems of weak R&D links. The short-sighted strategy of "emphasizing marketing over innovation" has trapped some new energy automakers in a quagmire of homogeneity and made it difficult for them to extricate themselves. For Thalys, closely relying on Huawei, this lush "big tree," has become the foundation for its survival.

In the technology field, Thalys' new energy vehicle manufacturing system heavily relies on Huawei's technological support. Simultaneously, its product structure also depends on the Wenjie series models. As Huawei's collaboration with automakers such as Chery and SAIC continues to deepen and expand, Thalys' competitive advantage within the "Huawei system" is gradually being eroded and faces fierce competition and challenges from "sibling brands" such as Zhijie and Shangjie.

Today, in Huawei stores, not only the Wenjie series models are on display, but Zhijie and Shangjie have also emerged like mushrooms after rain. In terms of product positioning and pricing, the Wenjie series is positioned as high-end and luxurious, targeting high-net-worth individuals. However, this significantly reduces its appeal to younger consumer groups. The editor of Zijin Finance has repeatedly heard consumers complaining about the outdated and unfashionable appearance of Wenjie models, and most of these consumers are young people with different purchasing power and aesthetics from high-net-worth individuals.

Thalys' target audience is mid-to-high-end consumers who value technology and family travel needs, with SUVs as its main product type. It has already established a presence in the mid-to-large SUV market. These product and brand characteristics are obviously not within Thalys' control but are the result of the overall strategic layout of "Huawei system" automobiles.

With the expansion of production capacity and capital reserves, it is conceivable how difficult it will be for Thalys to achieve brilliant results in the originally small mid-to-high-end market. After all, once the Hong Kong IPO is realized, Thalys must demonstrate more outstanding market performance to support a higher market value. To extend its reach to more consumer groups and increase its model range, Thalys must first obtain Huawei's "technological support."

Conclusion

In the past year, capital activities in the new energy vehicle sector have been exciting, with multi-billion-yuan financing projects coming one after another.

At the end of 2024, BAIC BluePark announced that its subsidiary Beijing Electric Vehicle Co., Ltd. had successfully completed a major capital increase and share expansion, successfully introducing 11 external strategic investors and Beijing Automobile, with a total capital increase of up to 10.15 billion yuan.

Almost simultaneously, IM Motors announced the successful completion of the B1 round of equity financing, receiving continuous support and empowerment from state-owned investment institutions and market-oriented investment institutions. As early as last March, IM Motors had successfully secured over 8 billion yuan in B-round equity financing. As of now, the overall B-round financing has raised a cumulative total of 9.4 billion yuan, laying a solid financial foundation for its subsequent development.

Likewise, AVATR Technology concluded its successful C-round financing towards the end of last year, securing over 11 billion yuan. Consequently, the company's valuation now surpasses 30 billion yuan. This year, it has further advanced by finalizing the investment funds for Yinwang.

Thalys' pursuit of a Hong Kong IPO at this juncture is undoubtedly buoyed by the capital market's welcoming embrace of new energy vehicles. Intriguingly, these automakers, who are actively engaging in investment and financing, share a distinct commonality: they are all high-end brands in the new energy vehicle sector.

As competition in the new energy vehicle market intensifies, whether it involves technological rivalry in intelligent driving, brand enhancements, or proactive overseas expansion, each endeavor necessitates robust financial backing. Nonetheless, capital alone is not a panacea. Upon securing funds, enterprises must innovatively strategize on how to utilize them effectively, enhancing their products' market competitiveness and thereby ensuring sustainable enterprise development.