Warren Buffett Highlights Trillion-Yuan Intelligent Driving Insurance Market Opportunities

![]() 05/07 2025

05/07 2025

![]() 601

601

Author | Zhen Yao | Editor | Li Guozheng | Produced by | Bangning Studio (gbngzs)

On May 3, 2025, Omaha, Nebraska, played host to the annual Berkshire Hathaway Corporation Shareholders Meeting, a highlight of the investment calendar. Dubbed the "Spring Festival Gala" of the industry, the event was presided over by Warren Buffett.

During the four-and-a-half-hour Q&A session, the 94-year-old Buffett, alongside his successor Greg Abel and insurance executive Ajit Jain, addressed queries from investors on succession planning, AI investments, Japanese investments, cash reserves, and investment philosophy.

At the session's close, Buffett announced Abel's nomination to the board of directors as his successor as CEO, marking the start of the transition process for this financial giant valued at over $1.11 trillion.

Notably, when discussing the automotive industry's intelligent transformation, Buffett and Jain focused on the disruptive impact of autonomous driving on the insurance sector.

Jain stated bluntly, "The advent of autonomous vehicles will revolutionize auto insurance. Insurers are preparing for this shift, transitioning from covering driver errors to insuring product defects."

Buffett added, from a risk pricing perspective, "This is a critical issue. Clarifying product liability and accidents caused by autonomous driving is essential. In accidents, repair costs will soar due to technological advancements."

To support this, he cited an example: in 1950, when he first joined Geico, the average annual premium was $40, whereas today, $2,000 is common.

As a benchmark for value investing, Buffett's team's focus on the autonomous driving insurance sector signifies a continuation and evolution of his investment philosophy.

Reviewing his investment journey, from heavily investing in Coca-Cola in 1988 (with current holdings yielding over 1300%), acquiring a stake in Apple in 2016 (with cumulative floating profits exceeding $120 billion), to buying BYD shares at HK$8 each in 2008 (with 14-year holdings yielding over 33 times), Buffett has consistently positioned himself at the cusp of industrial transformations.

Taking the BYD investment as an example, Buffett's decision was underpinned by his prescient judgment of the "Chinese Tesla." During the 2008 global financial crisis, Berkshire Hathaway subscribed to 225 million H shares of BYD for HK$1.8 billion, when its P/E ratio was 10.2 times and P/B ratio was 1.53 times. Over the next 14 years, Buffett withstood short-term volatility and didn't initiate the first reduction in holdings until 2022 (at an average price of HK$277.1), realizing over 33 times profit on a single transaction.

With Abel's succession plan in place, speculation about Berkshire Hathaway's strategic shift intensifies. The intelligent driving insurance signal at this year's shareholders' meeting is viewed by multiple investment banks as a key move in its second growth curve strategy.

On the brink of intelligent driving insurance explosion?

Buffett's team's assertion about autonomous driving reshaping the insurance industry aligns with McKinsey's latest forecast—by 2030, the global autonomous driving insurance market will exceed $120 billion, with a CAGR of 27%.

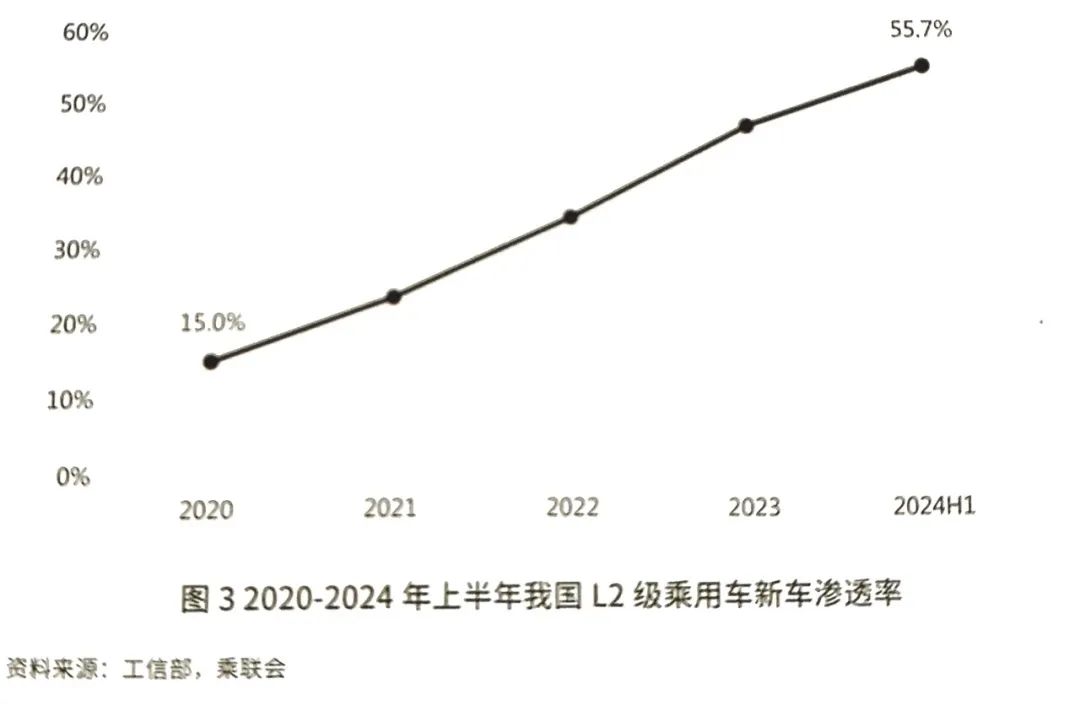

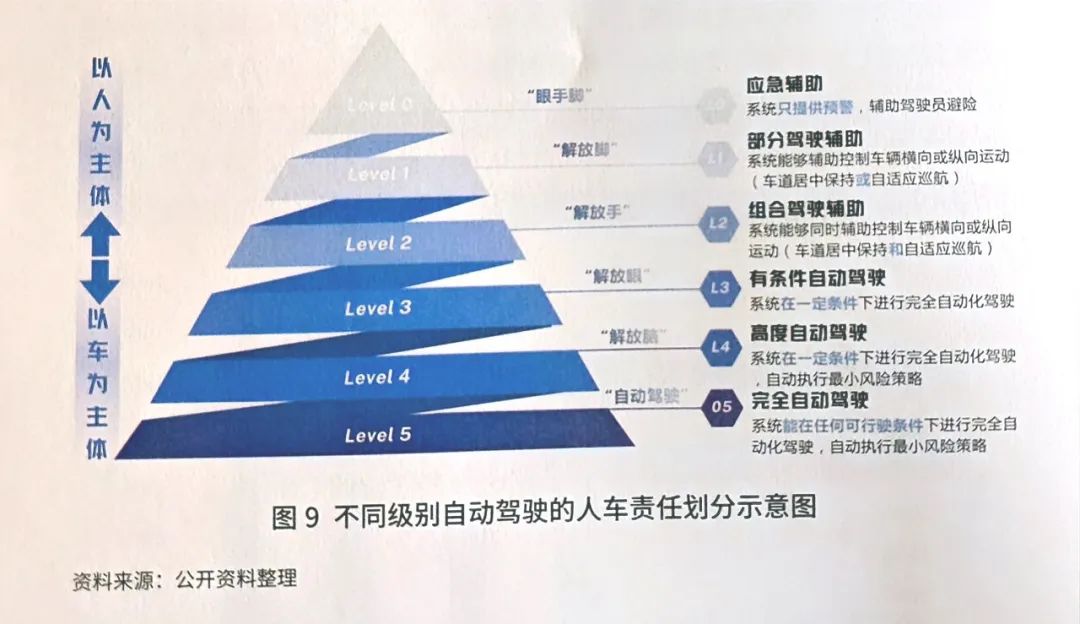

Moreover, with AI technology on the rise, high-level autonomous driving assistance is moving towards mass application. According to data from the China Passenger Car Association and CRI Consulting, in 2024, the installation rate of L2 and above auxiliary driving functions in new energy passenger vehicles reached 67.8%, surpassing the 52.8% for traditional fuel passenger vehicles.

Research predicts that by 2030, the penetration rate of new vehicles with L2 and above autonomous driving in China will reach 90%. Amidst the rapid expansion of the new energy intelligent vehicle market, the vehicle insurance industry is undergoing profound changes to adapt to new demands.

▲Photo source: Chebaizhiku

Chinese automakers are leading the transformation of this industrial blueprint into market practice, with companies like Xpeng, Hongmeng Zhixing, Xiaomi, and GAC Aion successively launching customized intelligent driving insurance products, propelling the intelligent mobility industry into an era driven by both "technology + insurance."

On April 28, 2025, Xpeng Motors' official WeChat account announced the launch of its intelligent driving assistance service, providing "intelligent driving insurance" coverage for owners using Xpeng's AI intelligent driving assistance.

According to Xpeng Motors, this collaboration covers five insurance companies: PICC, Ping An Insurance, China Pacific Insurance, Zhonghua Insurance, and Sunshine Insurance. The purchase fee is 239 yuan per year and is available for all Xpeng models and both new and existing owners.

Xpeng's intelligent driving insurance boasts three highlights: low premiums (6 cents per day), high coverage (up to 1 million yuan per accident), and comprehensive coverage (all models and driving scenarios, with unlimited compensation and coverage still available within 5 seconds after NGP exits).

Upon announcement, competitors were taken aback. An executive from a new force automaker posted a "bleeding" emoji on WeChat Moments, bluntly stating, "How can we compete with this?"

Xpeng Motors clarified, "This service is for the service benefits of Xpeng Motors' intelligent driving assistance functions and does not replace compulsory traffic insurance and commercial vehicle insurance. It is only available for new and renewing customers who purchase vehicle insurance through Xpeng Motors' official cooperation channels."

Xpeng's intelligent driving insurance not only addresses users' concerns about intelligent driving but, with its unique advantage of 'low price, high coverage,' reignites discussion about this emerging insurance category in the industry.

Other early adopters include Xiaomi Motors and Hongmeng Zhixing.

In early March 2025, Xiaomi Motors stated it would join forces with leading insurance institutions to launch the "Xiaomi Intelligent Driving Assurance Service," planning to provide users with a maximum coverage amount of 3 million yuan.

The same month, GAC Group announced that its Zhongcheng Insurance would launch intelligent driving insurance with a maximum coverage of 3 million yuan, covering the Aion, Trumpchi, and Enverge brands, as well as scenarios such as intelligent parking assistance (APA), remote parking assistance (RPA), valet parking assistance (AVP), lane cruise assistance (LCC), and intelligent driving navigation assistance (NDA).

In November 2024, Hongmeng Zhixing launched a limited-time intelligent driving worry-free service. Official information shows that during the event period, those who order models under Hongmeng Zhixing will receive intelligent driving assurance benefits covering scenarios such as intelligent parking assistance (APA), valet parking assistance (AVP), remote parking assistance (RPA), lane cruise assistance (LCC), and intelligent driving navigation assistance (NCA).

Among them, the maximum coverage amount for the AITO M5, M7, and Zhijie R7, S7 is 3 million yuan, while the maximum coverage amount for the AITO M9 and Xiangjie S9 is 5 million yuan.

According to incomplete statistics, currently, seven automakers have launched services such as intelligent driving insurance, claiming values of thousands of yuan, with maximum compensation of up to millions of yuan. Some automakers have chosen to cooperate with insurance companies, but most have not disclosed information about their partners, and their guarantee forms may be closer to extended warranty services.

Competing for a trillion-yuan market

Despite high market enthusiasm, intelligent driving insurance faces a triple dilemma: divided user needs, ambiguous liability determination, and lagging product innovation. Collaborative efforts from policymakers, automakers, and insurers could break this deadlock and reshape the trillion-yuan automotive aftermarket.

On social media platforms, the controversy surrounding intelligent driving insurance is clearly divided:

Some car owners complain, "I spent 30,000 yuan on intelligent driving functions and another 2,000 yuan on insurance. What's the difference between this and smartphone manufacturers selling screen protection insurance? Automakers are shifting the cost of technology verification onto consumers, which is unsightly."

However, other car owners hold a different view: "This is a thoughtful guarantee. The fact that automakers dare to launch it shows they're confident in their technology, making us feel more at ease using it."

This division essentially reflects different perceptions of technology maturity. The J.D. Power 2024 China New Energy Vehicle Product Attractiveness Index study revealed that the optional rate of L2+ intelligent driving functions is negatively correlated with user age (67% for users under 30 years old and only 38% for those over 40 years old), indicating that younger groups have a higher tolerance for technology risks.

▲Photo source: Chebaizhiku

A deeper challenge lies in determining liability for intelligent driving accidents.

First, accident attribution is difficult. According to 2024 NHTSA data in the United States, 37% of traffic accidents caused by L2 intelligent driving systems involve disputes over evidence in the "instant of human-machine authority switch."

Second, the subject of liability is ambiguous. In April 2025, a rear-end collision accident occurred in the Yizhuang autonomous driving test zone in Beijing, and due to the inability to determine whether the system took over or human intervention occurred at the time of the accident, the compensation dispute could not be settled.

Third, there are disputes over data sovereignty. A joint venture brand once refused to open EDR (Event Data Recorder) data to insurance companies, resulting in a dispute over a compensation amount of 1.2 million yuan.

A turning point is emerging. China is accelerating the construction of a legal framework for intelligent and connected vehicle insurance. On the policy front, national and local governments have put forward clear insurance requirements for the access and pilot work of intelligent and connected vehicles.

For example, the "Notice on Carrying Out Pilot Work on the Access and Road Travel of Intelligent and Connected Vehicles" issued by four ministries and commissions in November 2023 states that pilot users should purchase insurance for vehicles as required.

The "Regulations on Autonomous Vehicles in Beijing" passed in December 2024 stipulates that vehicles conducting tests and pilots should purchase compulsory traffic insurance and commercial insurance, and encourages insurance companies to independently or in cooperation with automakers to develop insurance products suitable for the characteristics of autonomous vehicles.

During this year's National People's Congress and Chinese People's Political Consultative Conference, He Xiaopeng, chairman of Xpeng Motors, submitted suggestions directly addressing the two core issues of liability division and product adaptation: he suggested revising the "Road Traffic Safety Law" to clarify that automakers are responsible for L3-level system failures and introducing a "vehicle-road coordination" sharing mechanism for L4-level; at the same time, he encouraged automakers and insurance companies to jointly develop customized products, such as "NOA exclusive insurance" that adjusts premiums based on intelligent driving mileage.

Industrial transformation has begun.

On one hand, insurance companies are transforming from risk undertakers to technology enablers.

For example, Ping An Property & Casualty Insurance has established an "intelligent driving risk database" that includes: 120 million kilometers of driving data covering over 300 risk indicators such as sudden braking and lane departure; 20 million accident cases with key attributions such as system misjudgment and sensor obstruction extracted through NLP technology; and real-time risk control models that have increased accident prediction accuracy from 62% to 89%.

On the other hand, leading automakers such as Tesla and BYD have either established their own insurance companies, forming a closed-loop ecosystem of "vehicle manufacturing - insurance sales - claims handling."

In 2024, Tesla's insurance business raked in $1.2 billion in revenue, boasting a gross profit margin of 38%—a full 15 percentage points higher than its automotive business. BYD, on the other hand, introduced an innovative "insurance-maintenance-used car" ecosystem, where customers opting for intelligent driving insurance enjoy a lifetime battery warranty, while simultaneously boosting the resale value of their used cars by 5%.

As Warren Buffett wisely noted, "When industrial transformation arrives, it is often those from different fields who first detect the opportunities." In this insurance revolution spearheaded by automakers, the trifecta of technological prowess, data assets, and compliance capabilities will be pivotal in determining who emerges victorious in sharing the trillion-yuan market pie.