New Car Sales Surge, Yet US Automakers Remain Skeptical of Trump's Impact

![]() 05/07 2025

05/07 2025

![]() 553

553

The recent surge in car sales is seen as a fleeting frenzy.

While domestic automakers flaunt their sales posters, the US government has also raced to share good news for the automotive industry across the pond.

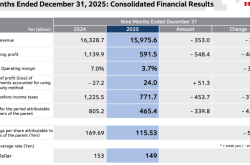

On May 2, the Bureau of Economic Analysis of the US Department of Commerce released April's car sales data. Car sales in the US reached 1.5041 million units in April, marking a 10.8% year-on-year increase. This growth follows a rapid uptick since March, driving sales in the first four months to increase by 6.2% year-on-year.

From these results, it appears that Trump's policies since taking office have played a role in boosting the economy. Notably, since the announcement of the reciprocal tariff policy in March, US car sales have soared, surpassing 1.5 million units for two consecutive months.

More significantly, despite tariff impacts, the US automotive industry remains robust. In March, domestic sales of light trucks (including SUVs) reached 1.01 million units, a 30% year-on-year increase. In April, sales remained high at 950,000 units.

However, US automakers continue to pour cold water on the market. Many, including General Motors and Ford Motor Company, have withdrawn their previously announced sales targets for 2025, stating they will face significant losses.

This counterintuitive phenomenon precisely captures the current situation faced by the US automotive market. To the general public, these automakers seem like deceitful "capitalists" constantly misleading consumers.

Struggling Domestic Automakers

Amidst complaints from many US automakers that Trump's new policies will have a negative impact, the only US automaker so far affected is Tesla, with Musk being the closest to Trump.

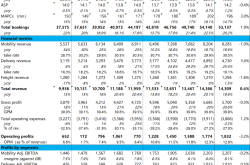

Both General Motors and Ford Motor Company have reported their best first-quarter financial results, achieving the first sales growth month since the end of 2024, marking a significant step forward for the US automotive industry.

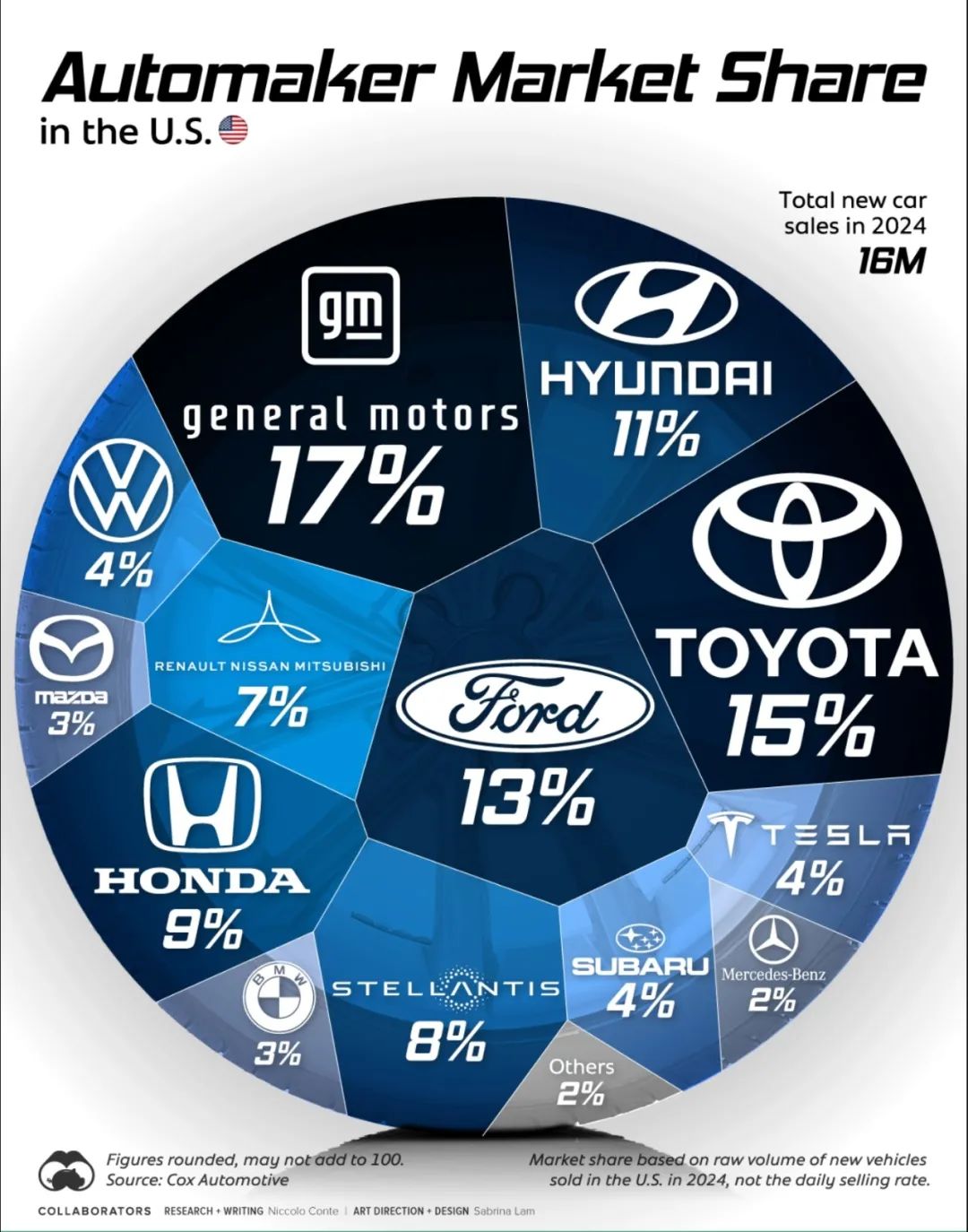

According to General Motors' financial report, first-quarter net income reached a staggering 44 billion US dollars, with a net profit of 2.8 billion US dollars. It was specifically mentioned that General Motors' market share in the US increased to 17.2%, and electric vehicle sales nearly doubled, making it the runner-up in the US market after Tesla.

In its financial report, General Motors stated that it would lower its expected earnings for 2025 based on the current impact of tariff policies, expecting losses due to tariffs to exceed 5 billion US dollars.

Ford Motor Company faces a similar dilemma. Although sales have increased by 16%, the impact of tariffs has begun to take effect. First-quarter net profit fell by 60% to only 473 million US dollars.

Ford warned that the worse situation will emerge in the second quarter. Despite achieving a profit of 1 billion US dollars in the first quarter, tariffs will still cause a loss of 1.5 billion US dollars.

Behind this lies the different factory layouts of General Motors and Ford. Many of General Motors' popular models are not produced in the US. For instance, the second best-selling Chevrolet Equinox in the US sold over 207,000 units in 2024, but it was manufactured in Mexico.

While Ford also produces cars in Mexico, these are more new energy vehicles like the Raptor EV and Mustang Mach-E. The main fuel vehicles are still produced in the US.

In response to tariff shocks, Ford made large-scale factory adjustments in the first quarter, including its automobile factory in Kentucky.

Ford executives emphasized that having multiple manufacturing bases in the US will be an advantage for future operations. Although the 25% tariff on auto parts took effect on May 3, parts supply will be maintained until July, which will reduce the tariff losses faced by Ford.

Certainly, the most challenging situation is faced by Tesla. After CEO Musk funded Trump's rise to power, Tesla's sales in the US began to decline. In the first quarter, only 128,000 new cars were delivered in the US market, a year-on-year decrease of 8.6%. Moreover, Tesla's market share in the US electric vehicle market fell from 51% to 44%.

Simultaneously, while Tesla's factories are all in the US, its parts are not 100% made in the US. According to statistics, 20%-25% of Tesla's parts come from Mexico and are still facing a 25% tariff sanction.

Faced with such severe business challenges, rumors abound that Tesla's board is considering seeking a new CEO to replace Musk, reducing Tesla's ties with the Trump administration, and alleviating public pressure.

It can be said that under the influence of Trump's policies, US domestic automobile companies are facing their most severe challenges. The short-term sales growth is merely a fleeting carnival. The long-term impact has begun to emerge, and the market will usher in a winter.

Japanese and Korean Peers, European Layoffs

Unlike US domestic automakers such as General Motors and Ford, foreign automakers with different intentions have shown varying performances in the face of Trump's tariff sanctions.

In terms of sales, foreign automakers are in a similar situation as US domestic enterprises. Starting from March, sales have increased significantly, especially for Japanese and Korean automakers. Toyota's sales increased by 7.5% year-on-year in March, and the popular model RAV4 was even hard to find. Honda, Subaru, and Mazda have also seen double-digit sales growth.

Korean automakers have also benefited from policy dividends in the US. Hyundai and Kia have maintained a sales growth rate of 13% and have set new monthly sales records for six consecutive months, becoming the automakers most benefited from the growth of the US market.

On the other hand, European cars are completely lacking in competitiveness. Only Volkswagen has maintained a positive growth rate of 2.8%. Mercedes-Benz, BMW, Audi, and Volvo have all seen varying degrees of sales decline.

Simultaneously, the response policies also differ. The Stellantis Group suspended production at factories in Canada and Mexico from April 3 and temporarily laid off 900 people at five factories in the US, choosing to confront the US government.

On the other hand, Stellantis Group CFO Douglas Ostermann said that with a domestic assembly rate of 58% and a local or USMCA sourcing ratio of 80% for parts, Stellantis is expected to benefit from tariff protection in the future.

Japanese automakers have taken different attitudes towards the US market. Mitsubishi Motors stopped exporting cars to US dealers from the beginning of April.

However, more automakers have chosen to expand production in the US. Toyota plans to produce the new RAV4 in the US, while Honda plans to localize 90% of its US sales, increasing production by 30% and shifting production focus from Canada and Mexico to the US.

The choice of Korean automakers is even clearer. They have increased investment in the US. Hyundai Motor announced that it will invest over 21 billion US dollars to expand production in the US and has even established a special working group on US tariff policies to handle specific plans for capacity transfer to the US.

It can be said that under the influence of the US tariff policy, most foreign automakers have begun to manufacture and return to the US according to the route envisioned by Trump, announcing numerous investment plans, making Trump believe that the future of Made in America is promising.

However, the real dilemma is that most popular car models in the US are still produced in Canada and Mexico. It remains difficult to return to US manufacturing in the short term. American consumers can only bear the increase in car prices.

According to predictions by multiple institutions, tariffs will cause the price of new cars in the US to increase by over 3,000 US dollars. The pickup truck models that American consumers favor the most will increase by at least 9,000 US dollars. Simultaneously, the Insurance Institute predicts that car insurance costs will increase by 8% in 2025.

If an American consumer plans to buy a new car in 2025, their budget will have to increase to over 40,000 US dollars, as most models priced at 30,000 US dollars are imported from overseas. Under a 25% tariff, the selling price will exceed 40,000 US dollars.

This has also led to the average price of new cars in the US market reaching 48,000 US dollars, with long-term loans of over 7 years becoming the norm for car purchases.

Faced with the impact of tariffs, the only advice research institutions give to American consumers is that those intending to buy a car should do so as soon as possible.

Under this influence, the US automobile market has witnessed the craziest March and April, with rapid sales growth and a sharp decline in dealer inventory capacity, creating a prosperous market.

However, in the long run, the US automobile market will usher in a winter after this madness. Cox Automotive Consulting has lowered its forecast for US annual car sales in 2025 from 16.3 million to 15.6 million vehicles. It even stated that if there are more tariff adjustments, overall sales may fall below 15 million vehicles.

More importantly, under the influence of uncertain tariffs, many US automakers have delayed the release of new models, which will restrict the development of the entire automotive industry and slow down US automakers that are already lagging behind the global market in terms of electrification and intelligence of automobiles.

It can only be said that Trump's tariff policy has indeed created a successful short-term situation, with car sales growing and manufacturing beginning to return to the US, but US automakers are not grateful for the opportunities created by Trump.

This complex situation of "short-term prosperity and long-term hidden worries" will bring more uncertainty to the US auto market. Although pre-policy rush buying pushes up sales, rising costs, industrial chain turbulence, and global trade frictions will restrict the industry's development in the long run.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for deletion.