Cambrian, Moore Threads, and MetaX Shares Skyrocket to Trillion-Yuan Market Caps Amidst Domestic Substitution Surge in Capital Markets

![]() 12/18 2025

12/18 2025

![]() 617

617

By Yang Jianyong

The realm of information technology has evolved at a breakneck pace, with each technological revolution giving rise to exceptional tech enterprises. Presently, as artificial intelligence (AI) ushers in the era of large AI models, various industries are embracing this transformative trend. They are swiftly integrating large model services to infuse innovation across sectors, thereby expediting the digital transformation of numerous industries.

It is noteworthy that large models epitomize a technology- and capital-intensive industry. They hinge not only on algorithmic innovation but also on substantial investments in AI infrastructure, particularly computing power. This asset-heavy investment paradigm is propelling the global semiconductor industry towards a trillion-dollar scale.

Fueled by AI, the global semiconductor market landscape is undergoing profound restructuring, reshaping the global technology ecosystem. NVIDIA is at the forefront of this transition, shifting from general-purpose GPU computing to GPU-accelerated computing, thereby driving rapid growth in the AI chip market.

According to data released by the World Semiconductor Trade Statistics (WSTS), the global semiconductor market is projected to reach $772 billion in 2025, marking a 22% year-on-year increase, with expectations to soar to $975 billion by 2026.

Leveraging its unparalleled dominance in the GPU sector, NVIDIA plays a pivotal role in numerous AI applications. Particularly, technology firms developing large AI models heavily rely on NVIDIA's high-performance chips, propelling rapid growth in its revenue, net profit, and market capitalization. NVIDIA has not only emerged as the world's largest chip manufacturer but also boasts the highest market cap globally, earning the moniker of the "strongest individual stock on Earth."

Currently, NVIDIA's market cap stands at a staggering $4.15 trillion (approximately RMB 29 trillion), with annual revenue poised to surpass the $200 billion mark. Meanwhile, it holds a staggering $500 billion in unfulfilled chip orders.

Since the dawn of the large AI model era, the market for AI chips has witnessed explosive growth, driving up the valuations of related AI firms.

Amidst this surge, domestic chip firms such as Cambrian, Moore Threads, and MetaX Shares have emerged as focal points in the capital market. They have even been dubbed the "Chinese versions of NVIDIA" by the media, owing to their technological breakthroughs and the benefits of domestic substitution.

These three companies not only actively benchmark against NVIDIA in product development but have also garnered significant recognition in the capital market. Their combined market cap has exceeded RMB 1.2 trillion, reflecting strong market anticipation for domestic AI chip technology.

Cambrian boasts a market cap of RMB 547 billion. Dubbed the "King of Cold" in the capital market after its stock price once surpassed that of Kweichow Moutai, it underscores investors' optimism about AI's commercial prospects amidst unprecedented opportunities brought by large models.

As stalwarts in the domestic GPU chip sector, Moore Threads and MetaX Shares are also viewed as Chinese counterparts to NVIDIA. Their market debuts were highly anticipated, with trading frenzies creating unprecedented capital market miracles. Moore Threads' market cap once exceeded RMB 440 billion, and despite a significant decline, it still stands at RMB 340 billion. MetaX Shares' market cap is RMB 320 billion, showcasing high capital market expectations for domestic chips.

Behind these lofty valuations lie multiple challenges, including technological iteration, software-hardware ecosystems, business model validation, and international competition. A rational assessment of long-term development potential is crucial.

It is pertinent to note that in recent years, the United States has been obstructing domestic firms from purchasing NVIDIA's high-performance chips, attempting to curb China's AI industry development. However, this external pressure has accelerated domestic substitution, providing historical development opportunities for local chip manufacturers.

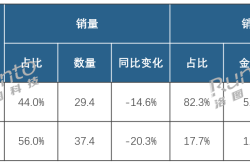

Against the backdrop of accelerated domestic substitution, domestic AI chips have entered a golden development period, with firms like Cambrian, Moore Threads, MetaX Shares, and Biren Technology experiencing rapid growth. In the first three quarters of 2025, Cambrian's revenue reached RMB 4.6 billion, marking a 2386% year-on-year increase, with full-year revenue projected at RMB 5-7 billion. Net profit for the first three quarters was RMB 1.6 billion, turning losses into profits.

Moore Threads, a GPU chip company founded in 2020, aims to become a globally competitive GPU leader, according to its chairman, Zhang Jianzhong. It has successfully launched four generations of GPU architectures and formed a diversified computing acceleration product matrix covering AI intelligent computing, high-performance computing, graphics rendering, computing virtualization, intelligent media, and applications for personal entertainment and productivity tools.

Driven by GPU demand and domestic substitution, Moore Threads' revenue has grown at a compound annual rate exceeding 200% over the past three years. In the first three quarters of 2025, revenue reached RMB 784 million, marking an 182% year-on-year increase, with full-year revenue projected at RMB 1.2-1.498 billion, a 177%-241.65% year-on-year increase.

MetaX Shares, also founded in 2020, is dedicated to independently developing full-stack high-performance GPU chips and computing platforms, providing energy-efficient and versatile computing power for AI computing, general computing, graphics rendering, and other cutting-edge fields. It has grown at an astonishing pace, with revenue surging from RMB 53.02 million in 2023 to RMB 743 million in 2024, a 1301% increase. Full-year revenue for 2025 is projected at RMB 1.5-1.98 billion, continuing exponential growth.

China's chip industry is accelerating domestic substitution to break free from reliance on high-end chips. However, local GPU chip firms still face competitive disadvantages compared to giants like NVIDIA and AMD.

To bolster GPU market competition, Moore Threads has raised nearly RMB 8 billion to enhance its chip market competitiveness. MetaX Shares has also raised RMB 3.9 billion to support continuous iteration and upgrading of its core product lines, boosting overall competitiveness.

Finally, in the GPU chip sector, amidst the trend of domestic substitution, local chip firms have become hot targets in the capital market through technological breakthroughs and policy dividends.

While the market holds high expectations for domestic chips, the risks behind high valuations cannot be overlooked. Accompanying this is a rising tide of skepticism about an AI bubble.

NVIDIA, in particular, has been embroiled in controversy over an AI bubble, leading to a trillion-dollar decline in its market cap. From its historical peak of $5.15 trillion to the current $4.15 trillion, it has corrected by 20%. Despite surpassing expectations and having substantial orders, market panic over an AI bubble has not fully dissipated.

Overall, while enjoying the benefits of domestic substitution, investors should also remain vigilant about the risks behind high valuations and rationally assess long-term development potential. Of course, amidst the rising heat of domestic AI chips, with newly raised funds, chip technology can be improved, and software-hardware ecosystems can be enhanced, hoping to foster a vibrant domestic GPU chip industry.

Yang Jianyong, a Forbes China contributor, expresses personal viewpoints. He is dedicated to in-depth analysis of cutting-edge technologies such as large AI models, artificial intelligence, the Internet of Things, cloud computing, and smart hardware.