Annual Report | China's Soundbar Market Sees 17% Sales Decline in 2025; Domestic TV Brands Rise; KTV and Products Priced Above 8,000 Yuan Buck the Trend

![]() 02/10 2026

02/10 2026

![]() 377

377

This article contains approximately 3,600 words and requires 15 minutes to read. We recommend bookmarking, following, or selecting specific sections to read first.

According to the latest data from Runto, in 2025, China's soundbar market across all online and offline channels recorded sales of 740,000 units, a 17.2% year-on-year decline.

The soundbar product form entered the Chinese market relatively late, by which time the country's e-commerce ecosystem was already mature. Consequently, the Chinese soundbar market has long been dominated by the online channel. Runto data also shows that in 2025, China's online soundbar market across all platforms recorded sales of 668,000 units, a 17.8% year-on-year decline, with sales revenue reaching 650 million yuan, a 5.3% year-on-year decrease.

The national subsidy policy initiated in the fourth quarter of 2024 effectively drove market consolidation, leading to the exit of some low-end white-label and OEM players from the market and a significant decline in sales of products priced below 1,000 yuan. This was the primary reason for the overall market sales decline. Additionally, the product mix upgraded under the influence of national subsidies, with notable sales growth in mid-range to high-end products, resulting in a far smaller decline in revenue compared to sales volume.

I. Channel Structure:

Emerging e-commerce sales drop over 20%; accounts for over half of sales volume but less than 20% of revenue

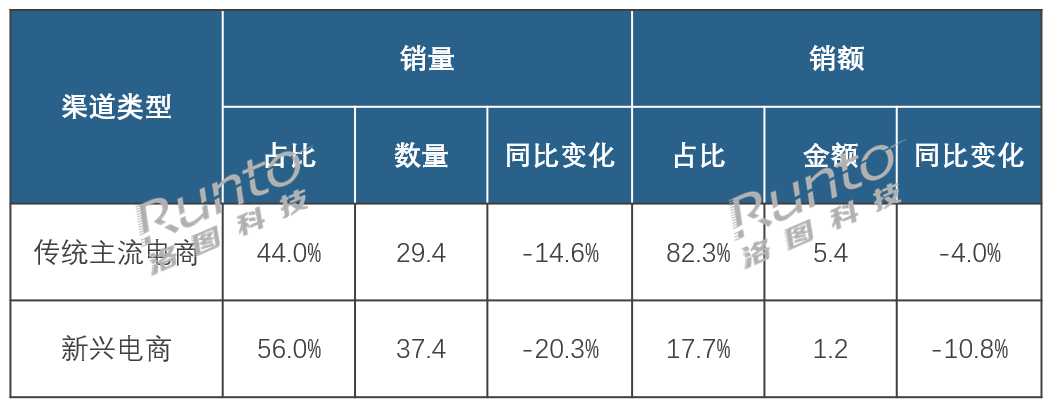

Runto categorizes online channels into traditional mainstream e-commerce, represented by JD.com, Alibaba, and Suning.com, and emerging e-commerce, represented by Douyin, Kuaishou, and Pinduoduo. The products and average prices sold through these two channel types vary significantly. The average price in traditional mainstream e-commerce is 1,830 yuan, with most mid-range to high-end products priced above 3,000 yuan sold through these channels. In contrast, over 90% of products sold through emerging e-commerce are ultra-low-end white-label products priced below 200 yuan, with an average price of just 320 yuan.

According to Runto's online data, in 2025, traditional mainstream e-commerce platforms accounted for 44.0% of China's online soundbar market sales, totaling 294,000 units, a 14.6% year-on-year decline. Emerging e-commerce recorded sales of 374,000 units, with a significant 20.3% year-on-year decline due to the substantial reduction in low-end products such as white-label and OEM items, surpassing the overall market decline.

In terms of sales revenue, in 2025, traditional mainstream e-commerce generated 540 million yuan in revenue, a 4.0% year-on-year decline, accounting for 82.3% of the total online market. Emerging e-commerce generated 120 million yuan in revenue, a 10.8% year-on-year decline.

China's Online Soundbar Market Sales Performance by Channel Platform in 2025

Data Source: Runto's Online Full-Channel Data, Units: 10,000 units, 100 million yuan, %

It is evident that although emerging e-commerce accounted for over half of the total online market sales volume, its revenue share was less than 20%. Therefore, to reflect the development status of the mainstream market, this article primarily analyzes sales performance on traditional e-commerce platforms.

II. Sales Rhythm:

Quarterly sales decline across all four quarters, with Q4 plummeting by 30%

Compared to overseas markets, Chinese consumers have shown relatively later and lower interest in sound quality. Consequently, soundbars remain a niche market in China, even serving as a derivative market for televisions.

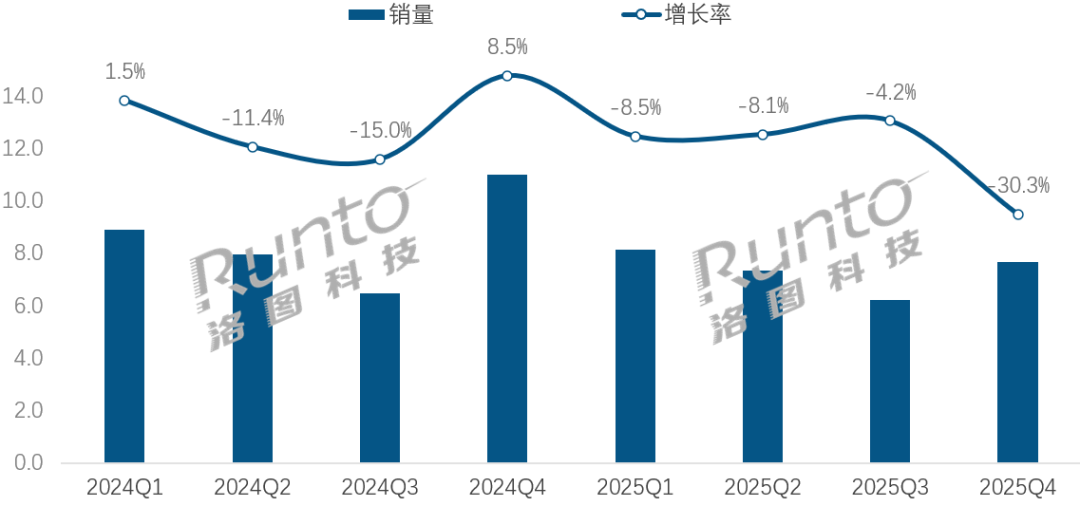

Since the introduction of national subsidies for home appliances in the fourth quarter of 2024, along with the recovery of the smart TV market, China's soundbar market experienced a brief resurgence. However, this also partially preempted market demand in advance.

In 2025, quarterly sales declined throughout the year, with the fourth quarter seeing a sharp 30.3% drop.

China's Soundbar Sales Volume and Changes by Quarter on Traditional Mainstream E-commerce Platforms (2024-2025)

Data Source: Runto's Traditional Mainstream E-commerce Data, Units: 10,000 units, %

From a sales revenue perspective, in the first three quarters of 2025, revenue in the soundbar market on traditional mainstream e-commerce platforms increased by 8.2% year-on-year. For the full year, despite the negative impact in the fourth quarter, revenue only declined slightly by 4.0%.

On one hand, leading domestic and foreign brands actively launched high-end flagship products priced above 8,000 yuan during the national subsidy period, responding to more substantial discounts under the policy and stimulating demand in the high-end market. On the other hand, as supplementary audio equipment for televisions, the popularity of mid-range to high-end TV products such as large-screen and Mini LED models also drove sales growth of high-end soundbar products.

III. Price Distribution:

Significant decline in low-end market below 500 yuan; market for products priced above 8,000 yuan nearly doubles

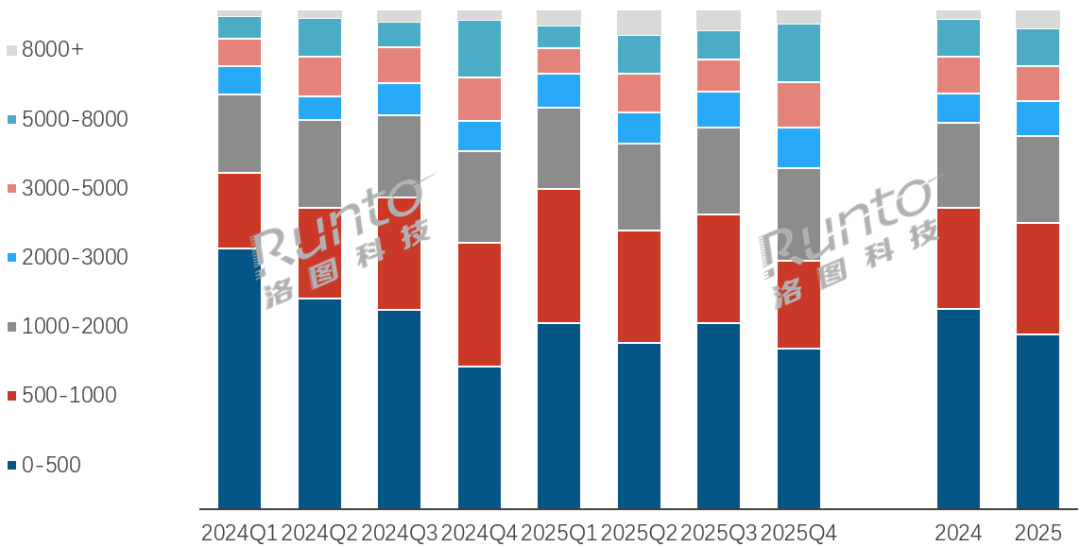

As mentioned earlier, on traditional mainstream e-commerce platforms, the average market price of soundbars was 1,830 yuan, up 200 yuan or 12.3% from 2024.

According to Runto's online data, in 2025, the sales volume in the price segment above 8,000 yuan exceeded 10,000 units, with an 84.5% year-on-year growth rate. Its sales share reached 3.6%, up 1.9 percentage points year-on-year, making it one of the fastest-growing market segments across all price ranges.

During the national subsidy policy period, leading foreign brands such as Samsung, Sony, and JBL offered significant discounts on their flagship models. High-end models priced above 10,000 yuan, including the Sony HT-A9000, Samsung HW-Q990F, and JBL BAR1300, were all reduced to below 10,000 yuan, leading to a noticeable increase in market sales.

Domestic brands also began to enter the high-end market. Sansui launched numerous high-end models in 2025, with its high-end Dolby Atmos product featuring a KTV system performing exceptionally well. In the second quarter, Huawei's Yuezhang Home Theater was launched, not only addressing the lack of competitiveness among domestic brands in the high-end soundbar market but also driving growth in the 8,000 yuan soundbar market.

China's Traditional Mainstream E-commerce Platform Soundbar Sales Structure and Changes by Price Segment in 2025

Data Source: Runto's Traditional Mainstream E-commerce Data, Units: %

In the low-end market, the sales share of the market segment below 500 yuan declined to 35.0%, down 5.1 percentage points year-on-year, as inferior hundred-yuan products were phased out of the market.

On the other hand, white-label and OEM products began to consolidate under the national subsidy policy, with some brands gradually exiting the market. According to Runto data, in 2025, on traditional mainstream e-commerce platforms, the number of effectively available brands in the market segment below 500 yuan was 130, down 14 year-on-year.

However, overall, with new product launches from domestic TV brands such as Huawei, Skyworth, and Konka, as well as foreign audio manufacturers like Marshall and KEF, the total number of brands in the 2025 market reached 230, up 12 year-on-year.

IV. Brand Competition:

Strong rise of domestic manufacturers; market share of foreign pure audio brands generally declines

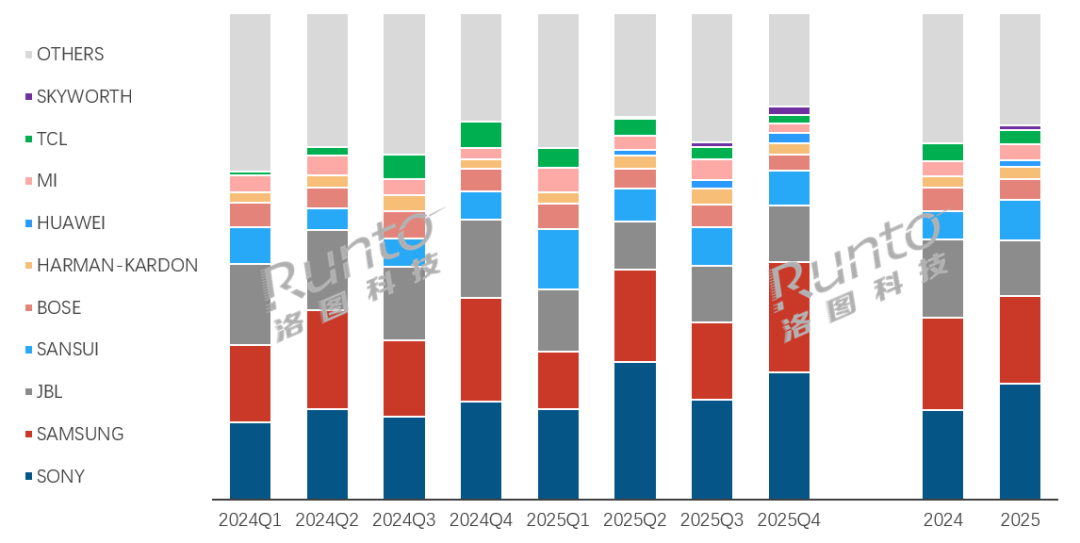

According to Runto data, in 2025, Sony, Samsung, and JBL remained the top three brands in terms of sales revenue on mainstream e-commerce platforms for soundbars.

Sony, with outstanding performances from its previously mentioned HT-A8000, HT-A9000, and new HT-B600 models, saw its market share increase by 5.6 percentage points to 23.9%. Samsung's products, now in their fifth year of iteration, saw a decline in competitiveness for its F-series compared to previous models, resulting in a slight 1.1 percentage point drop in market share to 17.9%.

Squeezed by TV brands with a living room ecosystem advantage, foreign audio manufacturers generally saw their market shares decline. JBL, BOSE, and brands outside the top 10, such as B&W and SONOS, all experienced varying degrees of share decline.

China's Traditional Mainstream E-commerce Platform Soundbar Brand Sales Revenue Share and Changes in 2025

Data Source: Runto's Traditional Mainstream E-commerce Data, Units: %

Notably, in 2025, domestic brands challenged the foreign-dominated mid-range to high-end soundbar market. Sansui saw explosive growth with its soundbar products featuring a large-screen KTV system, increasing its share by 2.5 percentage points to 8.3%, ranking fourth in the online market.

TV manufacturers such as Huawei, Xiaomi, and Skyworth actively layout (Note: ' layout ' is kept as is since it's a specific term that may not have a direct equivalent in English, but for context, it means 'strategically positioned' or 'entered') their soundbar product lines across various segments, all achieving share growth. Among them, new players Huawei and Skyworth ranked in the top 10 by the fourth quarter of 2025.

In addition, domestic home appliance brands such as Konka, Haier, and Dreame also one after another (Note: ' one after another ' is translated as 'also began to' for context) released new products. Although soundbar products remain a niche market in a declining state, domestic home appliance manufacturers are increasingly prioritizing soundbars: partly to seek a correlated second growth curve and partly due to a general recognition of the necessity of soundbars for high-end audio-visual enjoyment.

With Chinese TV manufacturers fully entering the soundbar market, domestic brands have effectively challenged international brands that have long monopolized China's mid-range to high-end soundbar market, bringing more choices to Chinese consumers and adding vitality to the market.

V. Product Trends:

Dolby Atmos and combined products face obstacles in development, while KTV soundbars buck the trend

According to Runto data, in 2025, in the traditional mainstream e-commerce market for soundbars, products with Dolby Atmos decoding functionality and combined products with subwoofers and rear speakers accounted for 68.8% and 34.9% of sales revenue, respectively, down 0.4 and 0.5 percentage points year-on-year.

This marked the first annual share decline for Dolby Atmos products. The reason lies partly in the overall contraction of Dolby Atmos products from foreign audio manufacturers, as mentioned earlier, which dragged down the development of this market segment. Additionally, Huawei broke into the soundbar market with its self-developed acoustic technology, posing a certain impact on Dolby's monopoly in the soundbar field.

Furthermore, amid the persistently sluggish market, KTV soundbars equipped with KTV systems and microphones bucked the trend. According to Runto data, in 2025, KTV soundbars accounted for 16.4% of sales revenue in the traditional mainstream e-commerce market, up 2.5 percentage points year-on-year. Meanwhile, products evolved into higher-end KTV equipment by adding song selection touchscreens and voice interaction systems.

Runto believes that the KTV function has added collective entertainment, interaction, and social attributes to soundbars, which are expected to maintain significant growth in the future.

VI. Market Outlook:

China's soundbar market to see further sales decline in 2026, but long-term prospects remain promising

Runto believes that in the short term, the continuous decline in market sales is likely to persist at least until the first half of 2026, with significant room for further decline in the low-end market, which accounts for a larger market share.

In the long term, given China's vast household population and extremely low current ownership rate, with a TV matching rate of less than 1%, and considering users' enduring and growing entertainment demand for high-quality audio-visual content, this market presents opportunities for Chinese manufacturers to cultivate and seize, particularly in the mid-range to high-end market dominated by foreign brands.

Runto believes that a stable, niche market state may persist for two to three years. It predicts that total soundbar sales across online and offline channels in China will reach 704,000 units in 2026, a 4.8% year-on-year decline.

The future market drivers will be AI acoustics, spatial audio, and integrated content services. The period from 2026 to 2028 will witness key inflection points toward high-endization, scenario-based applications, and service-oriented development, with increased market concentration and accelerated consolidation of low-end, undifferentiated products.

Runto suggests that industry participants focus on several development paths: ① Deep integration of AI edge-side large models with acoustic algorithms; ② Spatial audio and immersive experience upgrades, with comprehensive support for Dolby Atmos/spatial audio, and features like virtual private rooms and AR interactive song selection becoming high-end standards; ③ Cloud-edge collaboration and service-oriented transformation, with a local+cloud hybrid architecture reducing edge-side computing costs, and "acoustics as a service" (subscribing to advanced reverb, celebrity voice timbres, virtual choirs, etc.), while expanding the KTV device content ecosystem from song libraries to customized interactive content; ④ Interconnectivity and modular architecture, with standardized specifications promoting cross-brand compatibility and modular design reducing iteration costs; ⑤ Multi-scenario household coverage, extending from living room theaters to small spaces like bedrooms and balconies, supporting multi-room linkage and independent sound field memory; ⑥ Green recycling and compliance, with leading brands establishing recycling networks before the peak in product scrappage arrives, reducing costs through recycled materials.

Thank you for reading. If you found this insightful, please like, share, and follow us.