When a Single Product Props Up a Listed Firm: Hehinfo Seeks Fresh Strategies for Its Hong Kong IPO

![]() 12/31 2025

12/31 2025

![]() 378

378

Over the past two years, AI efficiency tools targeting consumers (C-end) have shifted from a phase of rapid technological breakthroughs to a more stable competitive landscape, with a focus on user retention, payment models, and scalability. When capabilities like OCR (Optical Character Recognition), document scanning, and text extraction are no longer rare, the industry's competitive edge has moved from "who can build it" to "who can sustainably monetize it."

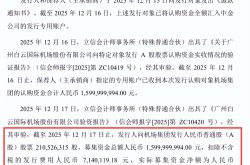

Against this backdrop, Hehinfo, an AI firm that rose to prominence with its flagship product "CamScanner," went public on China’s Science and Technology Innovation Board in September 2024, raising RMB 1.38 billion. Less than a year later, it filed for a listing on the Hong Kong Stock Exchange, aiming for a dual "A+H" share structure.

A Secondary Listing Despite Strong Cash Flow: More Like a Strategic Move for the Future

In recent years, AI productivity tools have emerged as one of the few "sure bets" in the global AI sector. Unlike large-scale AI infrastructure or enterprise-level solutions, products like scanning, OCR, and document management offer clear revenue paths, mature business models, and steady cash flows. Hehinfo exemplifies this trend.

Financially, it stands out as a "fundamentals powerhouse." With high gross margins, consistent profitability, and a low debt-to-asset ratio compared to peers, its subscription-based C-end revenue demonstrates strong compounding growth. From 2022 to 2024, CamScanner contributed 72.3%, 76.2%, and 77.3% of total revenue, respectively, peaking at 81.1% in Q1 2025.

Even after its initial public offering (IPO), the company retains significant idle cash for wealth management, with no urgent need to accelerate funded projects. This raises questions about the motives behind its secondary listing.

According to its prospectus, proceeds from the Hong Kong IPO will primarily fund R&D, market expansion, and potential M&A deals—overlapping heavily with the goals of its A-share listing. Meanwhile, delays in several key projects from its previous funding round suggest sluggish capital deployment.

This pattern of "raising new funds before fully utilizing prior ones" risks signaling to markets that Hehinfo’s true concern isn’t short-term liquidity but mid-to-long-term growth certainty.

From a capital structure perspective, the Hong Kong market offers strategic advantages. With robust southbound capital flows and sustained investor interest in AI, a dual "A+H" listing enhances global visibility and provides greater flexibility for M&A and equity incentives.

However, in today’s market, investors no longer reward vague growth narratives. They demand clarity on capital efficiency and deliverable growth paths.

This means a Hong Kong IPO isn’t an automatic "plus." Instead, it amplifies a critical question: When financing outpaces business evolution, does the company risk preemptively depleting its future?

CamScanner Holds Steady, but Hehinfo Faces Uncertainty

A deeper look at Hehinfo’s business reveals that its strengths—and vulnerabilities—are concentrated in CamScanner.

The app is a C-end success story. With a massive user base, high engagement, and stable paid conversion rates, it serves essential needs for students, white-collar workers, and legal professionals. Such products are rare in the AI productivity space, explaining why CamScanner has long accounted for over 70% of revenue—exceeding 80% in Q1 2025.

But here lies the problem.

The core of tool-based apps is specialization. When scanning, text recognition, and PDF conversion become standard features in operating systems or super apps, competitive barriers dissolve quickly.

Whether it’s built-in scanning modules in office software or document capabilities integrated into browsers and cloud storage, free or low-cost alternatives are eroding users’ willingness to pay.

Meanwhile, a new wave of AI products is embedding recognition into broader interaction frameworks. OCR is no longer the endpoint but a stepping stone for understanding, querying, and generating content. As users grow accustomed to "taking a photo and receiving instant insights," standalone scanning tools risk becoming obsolete.

Hehinfo isn’t blind to these shifts. It has attempted to diversify into B-end services and expand scanning into complex document analysis and multimodal processing. Yet, the B-end market is even more cutthroat.

In enterprise document recognition, cloud giants dominate with ecosystem and pricing advantages; in commercial data and decision-making tools, incumbents hold years of accumulated expertise.

While Hehinfo’s B-end revenue is rising, its share of total revenue is shrinking—dropping from 17.1% in 2022 to 12.8% in Q1 2025. This fails to show a "second growth curve" capable of offsetting C-end risks.

Compounding these challenges are data compliance and user trust issues.

Scanning apps handle vast amounts of personal and corporate data, making compliance controversies a direct threat to user security perceptions. Amid global scrutiny over AI’s "data abuse," regulatory pressures will only intensify.

For a company serving both global consumers and institutional clients, compliance costs are becoming a long-term structural burden.

Under these pressures, Hehinfo’s move to expand financing channels reflects strategic foresight. However, what investors truly care about isn’t just its ability to generate revenue but whether it has a compelling growth story beyond CamScanner.

Conclusion

Hehinfo has successfully transformed a simple scanning tool into a globalized, high-margin business through technological innovation. This is a commendable entrepreneurial achievement.

Yet capital markets don’t reward past successes alone. Behind its secondary listing lie higher expectations—and stricter scrutiny. Amid fierce competition, tightening regulations, and shifting product boundaries, Hehinfo’s real challenge isn’t securing funds but answering: Where will its next phase of growth come from?