From AI Glasses to Humanoid Robots: Why Are Emerging Automakers So Eager to Innovate?

![]() 12/31 2025

12/31 2025

![]() 417

417

XPENG AI Robot IRON

Written by / Li Jinlin

Edited by / Chen Dengxin

Typeset by / Annalee

Recently, at Wang Leehom's Chengdu concert, Unitree Technology's G1 humanoid robot stole the show with a mesmerizing dance performance, collaborating seamlessly for the song 'Full Firepower.' The video quickly went viral on social media, even catching the attention of Elon Musk across the ocean, who praised the innovation.

From the 'Yang BOT' performance at the Spring Festival Gala earlier this year to the dynamic dance routines at year-end concerts, humanoid robots have been a hot topic throughout the year. This trend has spurred more companies, including automakers like GAC Group, SAIC Motor, BYD, Changan Automobile, Chery, and XPENG Motors, to venture into this field.

XPENG Motors has even set an ambitious goal: to mass-produce high-end humanoid robots by the end of next year, with a sales target of one million units by 2030.

Beyond humanoid robots, emerging automakers are also setting their sights on AI glasses. Li Auto has introduced Livis, a smart glasses product that seamlessly integrates photography, video recording, open-ear headphones, and car control functions, positioning it as Li Auto's most powerful smart accessory.

As emerging automakers leverage their automotive technology to explore new growth opportunities in the broader smart terminal market, a crossover competition in smart terminals, led by automakers, has quietly commenced.

Diverse Paths to AI Integration

'I tried Li Auto's AI glasses but returned them.' This sentiment echoes among the first batch of users who purchased Livis, Li Auto's AI glasses.

After extensive use, a clear user profile for Livis has emerged: recommended for Li Auto vehicle owners, glasses wearers, or those with vision correction needs; also suggested for writers, music enthusiasts, and Douyin browsers. However, it may not be the best choice for non-Li Auto vehicle owners, casual photographers, or those who don't frequently wear glasses.

Based on user feedback, Livis's strengths and weaknesses are evident. Its photography capabilities, both for videos and photos, fall short of meeting basic editing and sharing needs. Therefore, in most cases, a smartphone or camera is a better recording option. Additionally, the photochromic lenses transition quickly from clear to dark but slowly from dark to clear, requiring users to remove the glasses for facial recognition when entering buildings from outdoors.

However, Livis excels in battery life, sound quality, and call quality, making it a viable replacement for ordinary headphones, glasses, and voice recorders. More importantly, it seamlessly connects with Li Auto's vehicle infotainment system, allowing users to open the trunk with Livis outside the car and seamlessly connect to 'Xiaoli' (Li Auto's virtual assistant) to control the vehicle upon entering, enhancing the experience for Li Auto owners.

One user commented, 'Livis is priced between 1,700 and 2,500 yuan, demonstrating precise market positioning.'

Livis starts at 1,999 yuan

The inception of Livis can be traced back to October last year when Li Auto held its autumn strategy meeting at Yanqi Lake. Li Xiang proposed the AI glasses project, but a major shareholder argued against diversifying into new areas and explicitly rejected the project.

However, Li Xiang was determined to pursue the AI glasses project. In January 2025, he formally established a secondary department and entrusted the project to the Wearable Robot Department, headed by Zhang Wenbo, who previously led the development of 'Xiaoli' (Li Auto's virtual assistant). Thus, the seamless interaction between Livis and the vehicle infotainment system is understandable.

Regarding why AI glasses are a must-pursue project for Li Auto, Fan Haoyu, Senior Vice President of Product at Li Auto, explained, 'Glasses, being close to the eyes, ears, and mouth, and requiring no change in user habits, are currently the most natural human-machine interaction interface. Livis will become Li Auto's best carrier for bringing smart experiences outside the vehicle.'

Similarly, XPENG Motors is actively pursuing AI terminal layouts.

At the Geek Park Innovation Conference 2026, He Xiaopeng, Chairman and CEO of XPENG Motors, shared three main reasons for XPENG's development of humanoid robots.

First, society is designed for humans, making humanoid forms the most universally adaptable. Second, humanoid robots can be trained using vast amounts of human behavioral data. Third, humanoid robots can become more versatile rather than being specialized for specific scenarios.

IRON has made significant efforts in humanoid design

From a practical standpoint, He Xiaopeng also mentioned in a media dialogue that 'the continuous improvement in business conditions has made the company more determined to invest in the research and development of 'physical AI.'' He views the deep integration of AI vehicles, global expansion, and embodied robots with the automotive industry as three growth curves driving XPENG's future development.

In fact, robots have been dubbed 'intelligent vehicles that stand up.' The technological architectures of both are nearly identical, and the crossover is essentially technological reuse. Therefore, XPENG's development of robots aims to achieve an intelligent technology ecosystem closed loop from vehicles to robots. The technology and data from vehicles can enable robots to land faster and more stably, while the interaction data accumulated by robots in diverse scenarios can feed back to vehicles, optimizing intelligent driving data.

In other words, whether it's Li Auto, XPENG Motors, Tesla, NIO, or Xiaomi, new energy vehicle companies are crossing over into AI to fully leverage their AI capabilities and mutually promote their automotive businesses, seizing opportunities in the era of artificial intelligence.

Positioning Competition and Breaking Through Homogenization

Currently, competition in the new energy vehicle market has entered a fierce phase, with homogenized competition becoming a core bottleneck restricting industry development.

From a product design perspective, whether it's exterior styling, interior layout, power parameters, or intelligent configurations, most models exhibit a significant 'convergence effect.' From a user experience perspective, the differences in intelligent cockpits and assisted driving functions among different brands are gradually narrowing, and traditional configuration stacking is no longer sufficient to form sustained core appeal.

Therefore, finding new breakthroughs in differentiated competition is a current priority for every emerging automaker. Crossover layouts in smart terminals represent a key choice for addressing homogenization dilemmas and opening up a second growth curve.

As for why Li Auto chose AI glasses and XPENG chose robots, it's based on judgments about market gaps and user needs, aiming to avoid fiercely competitive red ocean markets and achieve differentiated competition as much as possible.

In fact, as early as 2022, NIO introduced NIO Air AR Glasses, pioneering the integration of 'in-car entertainment + AR' scenarios. However, it remained more as a supplementary in-car accessory and did not make a significant impact. Meanwhile, the smartphone market has long been dominated by leading brands, and the market performance of NIO Phone and Geely's collaboration with Meizu also confirms the high difficulty of automakers crossing over into smartphones.

In contrast, the smart glasses sector is experiencing rapid growth and possesses vast market potential.

IDC data shows that global smart glasses shipments reached 4.065 million units in the first half of 2025, a year-on-year increase of 64.2%. IDC predicts that by 2029, global smart glasses market shipments will exceed 40 million units, with China's market share expected to achieve a five-year compound annual growth rate of 55.6%, ranking first globally in terms of growth rate.

Livis is regarded as Li Auto's strongest accessory

More importantly, the current smart glasses market exhibits a clear pattern of 'high-end monopoly and mid-to-low-end absence' – the high-end market is dominated by a few tech giants with overly priced products, while the mid-to-low-end market, though populated by numerous brands, generally lacks core AI capabilities and cross-scenario linkage experience, failing to meet users' deep-seated needs. This presents Li Auto with a precise positioning opportunity.

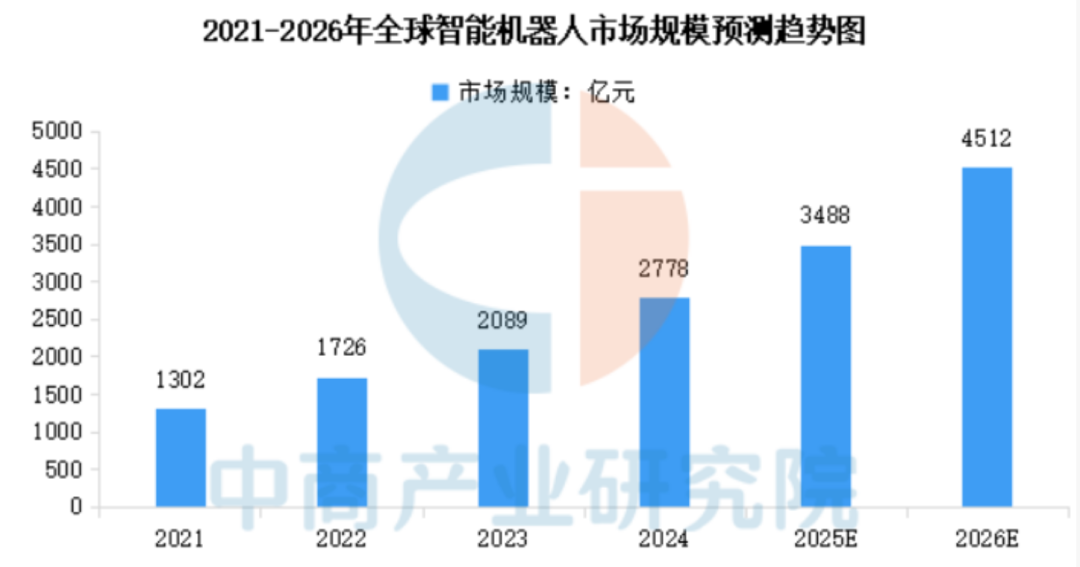

The intelligent robot sector follows a similar pattern. The '2025-2030 China Intelligent Robot Industry Analysis and Development Prospect Research Forecast Report' released by ASKCI Consulting shows that the global intelligent robot market size increased from 130.2 billion yuan in 2021 to 277.8 billion yuan in 2024, with a compound annual growth rate of 28.7% from 2021 to 2024. ASKCI Consulting analysts predict that the global intelligent robot market size will reach 348.8 billion yuan in 2025 and 451.2 billion yuan in 2026.

XPENG Motors has initially targeted industrial manufacturing as the core application scenario for its AI humanoid robot, IRON, claiming it can screw 5,000 screws per day, directly addressing the automotive industry's core demand for cost reduction and efficiency improvement. Therefore, in the long run, the production efficiency improvements and process optimizations brought by IRON will become an important part of the company's core competitiveness.

Source: ASKCI Consulting

If technological foundation-building is the prerequisite for crossover, and competitive breakthrough is the driving force, then ecological upgrading represents the ultimate goal of emerging automakers' crossover layouts.

From an industry development trend perspective, the 'vehicle + N terminals' intelligent ecosystem has become an inevitable direction for automotive companies' transformation. Tesla's scaled layout of 'vehicles + robots' has enabled Optimus to possess practical functions after its second-generation iteration. As it expands into home scenarios in the future, economies of scale will give it an inherent advantage in cost control. Although domestic emerging automakers started slightly later, they can also embark on a differentiated ecological transformation path through precise sector selection and technological reuse.

In this transformational change, the traditional criterion of 'whether to focus solely on vehicle manufacturing' is no longer applicable. As the automotive industry evolves, the nature of vehicles is shifting from a single mode of transportation to an intelligent lifestyle hub, and the competitive boundaries of companies are expanding accordingly, no longer limited to automotive products themselves but extending to users' intelligent needs across all scenarios.

This strategy, which may seem like a crossover but is actually a deep dive, is precisely the key for emerging automakers to stand out in fierce competition.