Xiaopeng and CATL's Ice-Breaking Moment: The Decisive Battle in the Electric Vehicle Industry Chain by 2026

![]() 12/31 2025

12/31 2025

![]() 545

545

As 2025 draws to a close, the new energy vehicle industry chain is stirred by a meeting after years of separation.

Zeng Yuqun, chairman of CATL, personally led a team southward to XPeng Motors' Guangzhou headquarters, engaging in in-depth discussions with Chairman He Xiaopeng. This high-level meeting aimed to bridge the supply relationship that had been interrupted for years and re-explore potential collaborations.

Rewinding to 2021, a different version of the story circulated in the industry. To secure scarce battery production capacity, He Xiaopeng was rumored to have 'waited' outside CATL's factory. Although the involved parties later denied it, the passive relationship where automakers relied on core suppliers during the 'battery shortage' period was a fact.

Since then, the two have had almost no public interactions, with XPeng diverting a large number of orders to second-tier battery manufacturers such as CALB and EVE Energy.

In just a few years, the relationship has evolved from automaker executives allegedly 'waiting' outside factories for batteries to the battery giant's chairman actively 'visiting' to discuss collaboration. This transformation reflects the entire new energy vehicle industry's shift from a wild, high-growth period where 'securing batteries meant winning' to a high-pressure phase of intense competition and elimination. In the market, the surviving players have seen their competitive logic fundamentally change.

What strategic demands does this delayed handshake reveal for both sides? What does it portend for the new energy vehicle industry chain's dynamics entering a new stage?

Behind the Ice-Breaking: Redrawing Safety Boundaries in the New Energy Vehicle Industry

This meeting marks an 'ice-breaking' move after years of separation. Why did XPeng Motors and CATL reunite at the end of 2025?

In the business world, handshakes don't happen without reason. To understand this meeting, one must look beyond the entanglements of the two companies. The shift from 'waiting' to 'visiting' reflects two changes: one is the change in bargaining power between upstream and downstream in the industry chain, and the other is the change in the competitive landscape of the power battery and new energy vehicle sectors.

From the perspective of bargaining power in the industry chain, leading new forces represented by XPeng, NIO, and Li Auto have long completed a diversified supply layout for power batteries. By introducing multiple suppliers such as CALB and EVE Energy, and even building their own production lines, they have largely escaped the anxiety of being 'choked' by a single giant in the early stages.

Figure: CALB's 5C Ultra-Fast Charging Exclusively Supplies XPeng X9 Super Extended Range

Turning to the competitive landscape, the new energy vehicle market is heading towards an elimination stage. Combining the views of BYD Chairman Wang Chuanfu, Huawei Intelligent Automotive Solutions BU Chairman Yu Chengdong, and XPeng Chairman He Xiaopeng, 2025 marks a watershed for intelligent electric connected vehicles, with a window of opportunity lasting only 3-5 years. Ultimately, only a few leading automakers may survive, with the rest being eliminated or integrated.

Meanwhile, the domestic power battery sector is also flourishing. Second-tier manufacturers are eroding market share with flexible pricing and customized services, while automaker self-supply systems, represented by BYD's FinDreams Battery, form a strong competitive closed loop . Currently, this also includes Huawei's Harmony Intelligent Mobility launching the Whale Battery, and Li Auto set to launch the 'Li Auto-branded Battery.'

Against this backdrop, although the market still marvels at 'CATL's profit in the first half of this year exceeding the combined profits of 17 automakers,' CATL has already sensed the impending impact and must proactively break the ice to consolidate its position in the high-end new energy vehicle market and 'make more friends.'

Source: CATL's Official WeChat Account

Thus, this meeting represents a tactical alignment based on reality between two strong players reviewing each other's value under new competitive pressures.

Seeking Mutual Benefits Amidst Competition, Aiming for High-End Intelligence in 2026

The market foundation that drove the two sides apart no longer exists. The current situation is that automakers aim to 'move upmarket,' while the battery leader seeks to defend its high-end market position.

For XPeng Motors, the focus of competition in the entire vehicle market has shifted, with high-endization becoming key to survival. CATL's brand and technological allure hold significant value for XPeng's high-end narrative and consumer perception.

Through supply chain diversification in recent years, XPeng has addressed the 'availability' and basic cost issues of batteries and successfully created hit models like the MONA M03.

However, as the competitive focus shifts from delivery volume to brand premium and gross margin, XPeng Motors faces the most market scrutiny on how to create hit high-end models. The lithium iron phosphate batteries provided by existing suppliers lag significantly behind CATL's Qilin Battery in terms of high-end perception.

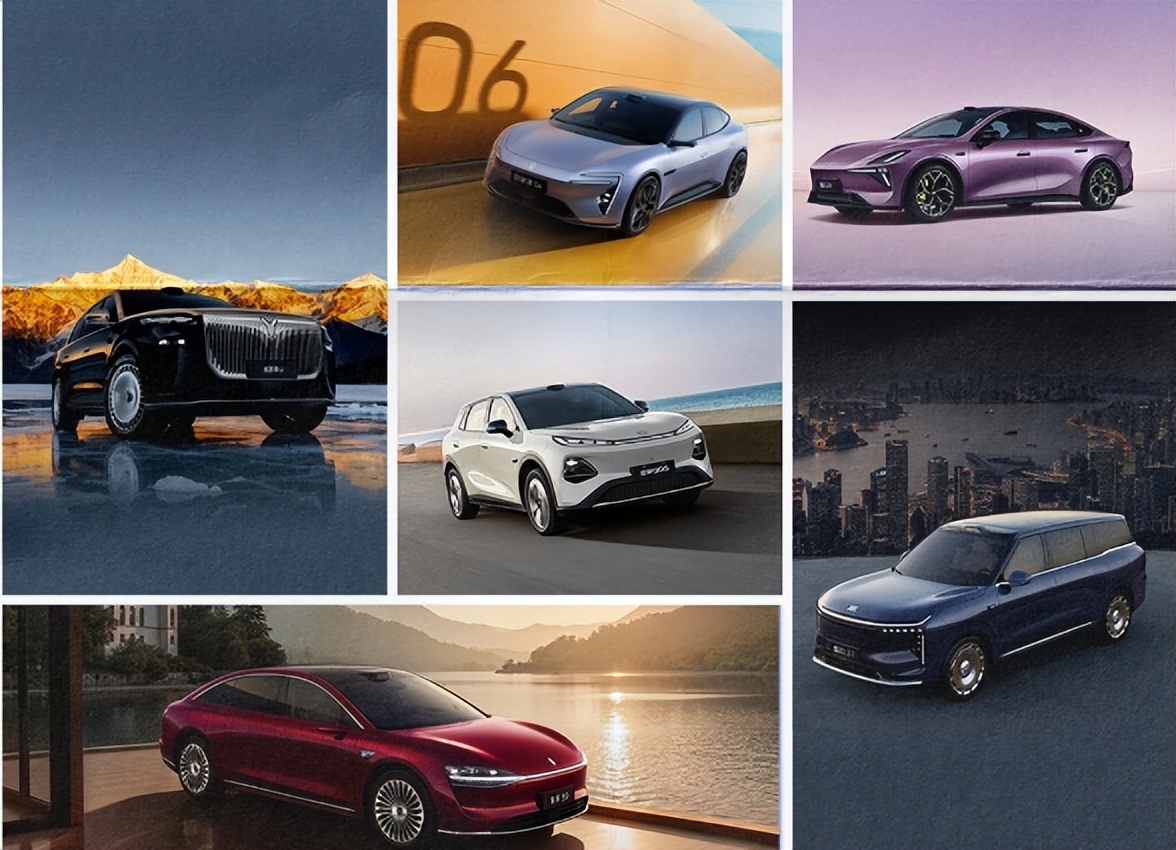

According to He Xiaopeng's revealed 2026 strategy, by launching high-end models, XPeng aims to strengthen its brand image of 'Technology XPeng' and 'Intelligent Mobility,' shed the market perception of being a low-price, high-volume player, penetrate the mid-to-high-end market, and enhance brand premium capabilities.

Meanwhile, at XPeng's 2025 Tech Day, the company also boldly showcased its ambition to transform into a 'Global Embodied Intelligence Company,' covering cutting-edge fields such as advanced humanoid robots and flying cars, which also place extreme demands on battery energy density and safety.

Source: XPeng Motors' Official WeChat Account

Whether driven by the urgency to move upmarket or the grand technological narrative for the future, XPeng Motors has reasons to re-engage with CATL.

Over the past few years, CATL's aggressive toC marketing strategy, including 'CATL Inside' body badges, offline advertising, online social media marketing, and variety show sponsorships, has deeply ingrained its high-end brand image among consumers. This year, LI Auto's first all-electric SUV, the i8, cutting Sunwoda batteries under public pressure and retaining only the CATL Qilin Battery version, is a microcosm of how consumer perception influences automaker choices.

For CATL, seeking to repair relationships proactively also represents a strategic shift towards the future.

CATL aims to find landing outlets for its next-generation cutting-edge technologies to solidify its market perception of technological leadership. The company has released condensed matter batteries with an energy density of up to 500Wh/kg and is collaborating on the development of civil electric manned aircraft projects, with automotive-grade application versions eagerly awaiting launch (world premiere) in high-end mass-produced models.

Loading the most advanced technologies, such as condensed matter batteries and semi-solid batteries, onto models like XPeng's, which have high visibility and intelligent labels, is undoubtedly one of the best ways to validate technologies, define standards, and maintain brand stature. The industry widely speculates that the first landed project (landing project) of the restarted collaboration between the two sides is likely to be XPeng's high-end model planned for launch in 2026. Additionally, from electric vehicles to the 'electric society,' CATL is also ramping up investments in emerging sectors like the low-altitude economy, aligning with XPeng Motors.

'Each side has its intentions.' This high-level meeting between the two sides is a microcosm of the new energy vehicle industry's competition entering the 'deep waters,' marking a fundamental change in the logic of industry chain collaboration. The industry has entered a more complex and refined 'post-vertical integration' stage, aiming for 'limited collaboration and diversified layout (layout).'

Both sides are well aware that a complete return to the past deep binding is neither realistic nor wise. A more likely approach is to engage in 'project-based' deep research and development and supply collaboration on specific high-end models or cutting-edge technology projects, while XPeng will maintain a diversified supply chain system for mainstream high-volume models.

Regardless, in the elimination stage of the industry, industrial giants must construct their cooperation networks in a more flexible, open, and mutually beneficial manner to find the safest and most resilient survival boundaries. For investors, in a gradually maturing sector, a company's ability to 'manage supply chain relationships' is no less attractive than its ability to 'tell compelling stories.'

Re-engaging Hands: The New Energy Vehicle Sector Stands at a New Valuation Starting Point

Looking ahead, the signals released by this meeting are clear enough. The new energy industry is exploring an unprecedented new paradigm of cooperation.

This cooperation is unlikely to be a return to the past deep binding across all model lines but more likely a 'project-based' deep research and development cooperation targeting specific high-end models or cutting-edge technologies. Another potential model is to follow the existing cases of CATL's collaborations with automakers like Changan and Geely, jointly investing in and establishing dedicated production capacity joint ventures to deeply bind interests while locking in supply and costs.

Regardless of the form, the core is to move beyond simple buyer-seller relationships and enter a new 'co-opetition' ecosystem where risks and rewards are shared at core technological nodes.

This ecosystem shift will fundamentally reshape the valuation logic of capital markets towards the two companies and even the entire sector.

First, let's look at automakers. In the past, the market focused more on the climb in delivery volume, market share expansion, and the leading edge in intelligent driving technologies. However, as the industry enters the elimination stage, investors are beginning to place greater importance on a company's ability to convert sales into tangible profits.

Previously, XPeng ensured stable delivery and cost control through a diversified supply chain, delivering nearly 400,000 units from January to November 2025, ahead of schedule for its annual target. However, reflected in its stock price, the company's shares have slightly declined by nearly 5% in the past month, showing no improvement.

It is evident that moving upmarket and securing profits have replaced sales volume as the factors the market focuses on more. A successful collaboration with CATL on high-end projects would help demonstrate to the market XPeng's systemic capability to 'integrate top-tier supply chain resources to achieve high-end breakthroughs.' At that point, capital markets may assign higher valuations.

Now, let's consider battery manufacturers. With intense competition from second-tier manufacturers, automakers' self-research, and strategies to support secondary suppliers, the old narrative that supported CATL's high valuation—near-monopolistic market share and ultra-high gross margins due to technological leadership—has been shaken.

Today, CATL faces the challenge of 'taking the next step.' CATL's shares have slightly increased by 5% in the past month, with its market value nearing HK$2.3 trillion. The market is more concerned with whether CATL can quickly land next-generation battery products and, through more flexible and open cooperation models, build stable and mutually beneficial industrial ecosystems with more leading automakers like XPeng.

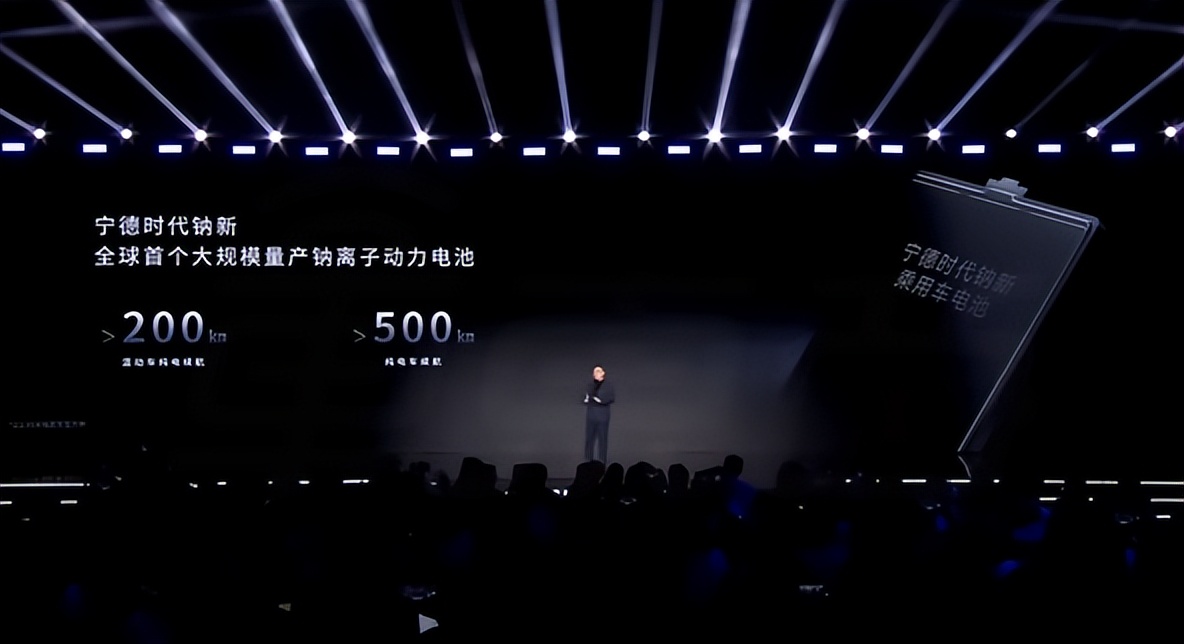

Figure: CATL Supplier Conference Launches the 'World's First Mass-Produced Sodium-Ion Power Battery'

In other words, CATL's value will no longer be solely determined by the production capacity in its factories but will depend more on how the company redefines industry standards and cooperation ecosystems.

In summary, after years of competition, battery giants and automakers are re-evaluating each other's value in the mature phase of the industry and then constructing a new industrial ecosystem.

2026 is widely regarded by the industry as a critical year for the concentrated outbreak and mass production of 'three electrics, three intelligences' technologies in intelligent electric vehicles. Whether it's the large-scale adoption of sodium-ion batteries and solid-state batteries or the popularization of city-level intelligent driving functions, it will drive a comprehensive revaluation of related companies by the market.

XPeng Motors, with its aggressive pursuit of intelligence, and CATL, with its profound heritage in the core 'three electrics,' are once again approaching each other, chasing this historical opportunity driven by technological industry reshuffles and, in turn, driving capital revaluations.

Source: Hong Kong Stock Research Society