AI, Algorithms, and Humanity: Game and Breakthrough in the Second Half of Short Drama

![]() 02/13 2026

02/13 2026

![]() 337

337

In 2026, the short drama industry is standing at a new crossroads: on one side is platform-led efficiency optimization, and on the other is technology-enabled creative liberation.

Author | Zhang Xiansen

Editor | Yang Ming

“It’s mind-blowing. With a good script, just two or three people can create a comic drama.” These days, the multimodal video generation model Seedance 2.0 released by Jìmèng AI has caused a sustained uproar and heated discussion in the tech circle, acting like a blockbuster.

The emergence of Seedance 2.0, dubbed the “strongest video generation model on Earth,” has enabled AI tool platforms to transition from “pixel-level imitation” to “film-and-television-level creation” in live-action drama production. This is not merely a simple technological iteration but a redefinition of the entire short drama ecosystem, poised to rewrite industry rules and reshape the relationship between platforms and content creators.

Three years ago, the rise of Hongguo Short Drama reshaped the commercial model and user habits of short dramas with its free-to-watch model. Today, the AI technology wave represented by Seedance 2.0 seeks to drive deeper transformations from the content side. The core of this transformation is no longer a simple battle for traffic and revenue sharing but how to build a more efficient, fair, and creative industry ecosystem driven by technology.

In 2026, the short drama industry stands at a new crossroads: on one side is platform-led efficiency optimization, and on the other is technology-enabled creative liberation. The intersection and collision of these two forces will determine the future shape of this hundred-billion-yuan market.

01

The Rise of Hongguo: A Victory of ByteDance's Ecosystem

Who could have imagined that Hongguo Short Drama, virtually unknown in 2023, would become the undisputed industry leader in less than three years?

In January 2026, ByteDance's battle report once again reshaped industry perceptions: Hongguo Short Drama surpassed 100 million daily active users (DAUs), becoming the fifth ByteDance app to join the “100-million DAU club.” Its monthly active users (MAUs) approached 300 million, leaving second-place Hippo Theater far behind and even surpassing Bilibili and Youku, ranking fourth only behind Tencent Video, iQIYI, and Mango TV, the three major long-form video giants.

It was Hongguo that truly transformed short dramas from a niche category into a nationwide content sensation.

Hongguo's success fundamentally stems from leveraging ByteDance's ecosystem dividends, using short drama clips as precise “hooks” to reach diverse user groups. As a “sibling product” of Fanqie Novels, Hongguo also enjoys priority access to IP supplies, creating a closed loop of literary-to-drama adaptations. Moreover, its gameplay of earning coins and signing in for rewards precisely targets the needs of users in lower-tier markets (lower-tier markets), making “watching dramas to earn money” a killer feature for boosting user engagement. This approach transformed short dramas from niche entertainment into a pastime for the masses.

Within ByteDance's ecosystem, Hongguo gained the confidence to overturn industry norms, “burying” the pay-per-view era of short dramas and completely rewriting the industry's monetization logic. It also brought crucial structural and standardized improvements to the then-wildly growing short drama industry.

Before 2023, short dramas were dominated by mini-programs. To survive, producers had to invest most of their budgets into user acquisition, yet the pay-per-view conversion rate was less than 1%, leading to countless stories of financial ruin daily. In April 2023, Hongguo emerged with its “free-to-watch + ad-based monetization” model, eliminating the need for users to pay and for producers to gamble heavily on user acquisition. This model led to a major reshuffle in the short drama industry by 2025, with the free model capturing over 80% of the market. Players from the user acquisition era exited en masse, and Hongguo naturally became the industry's “gatekeeper.”

However, Hongguo's ambitions extend far beyond being a mere traffic platform. By merging with Douyin Short Drama to establish a copyright center and integrating with Douyin E-commerce for “search for similar products” live commerce, it opened up greater commercialization possibilities for the industry. Meanwhile, Hongguo is building a complete internal production chain. Data shows that nearly 40% of the short dramas with over 1 billion views on Hongguo in 2025 were platform-produced or deeply involved in incubation.

Evidently, in Hongguo's traffic distribution mechanism, its self-produced dramas often receive superior recommendation weights and exposure resources, attempting to consolidate both the creative control of hits and traffic dominance. From IP incubation to content production and commercialization, Hongguo aims to “have it all.”

Against this backdrop, short drama copyright holders, once ubiquitous, are also undergoing a reshuffle. Veteran players like Jiuzhou and Maiya have either laid off staff and closed down or shifted to overseas markets, with only Hippo Theater, under Dianzhong, hanging on. Hongguo's rise has instead established unified and efficient traffic distribution and commercialization standards for the industry, ushering in unprecedented prosperity and deeply embedding the industry's operational logic into the platform's rule system.

02

Under the Rules: The Survival Game for Producers

For short drama producers, Hongguo's emergence is both a key to unlocking new markets and a requirement to adapt to a new set of industry rules.

Before Hongguo reshaped the rules, user acquisition reigned supreme, and the “all-or-nothing” gamble left countless producers exiting after their initial bets. Hongguo's “minimum guarantee + revenue sharing” model not only provided financial support but also offered a deterministic survival guarantee. Producers no longer had to risk everything on a single gamble, and for the first time, the short drama industry had room for stable operations.

Hongguo's “Guoran Plan,” launched in late 2024, and its three rounds of upgraded review standards in 2025 became the industry's quality benchmark. This not only forced producers to abandon the rough mode of “crudely satisfying” audiences and start refining scripts and production but, more critically, this premiumization (high-quality) transformation directly expanded the audience base for short dramas. No longer just “digital snacks” for lower-tier markets, short dramas gradually became a content category for all. Hongguo deserves much credit for this.

This dividend, however, is not free. The S+, S, and A rating systems set by short drama platforms directly impact content exposure and revenue. The platform decides whether a script is good, the cast is strong, and the production is refined. After a finished product goes live, its final rating is determined by market performance, which directly affects revenue sharing. All revenue sharing data and user acquisition resources are controlled by the platform, leaving producers often in a passive position.

During the 2025 Spring Festival, Yu Jin Wuliang's “What a Good Girl” surpassed 1 billion views on Hongguo, creating a wealth myth with over 10 million yuan in revenue sharing. However, as more players entered and industry competition intensified, top hits rarely achieved such revenue sharing levels today. After deducting production costs, profits often amount to only a fraction.

To secure more stable revenue, producers typically choose to deeply bind with platforms. Some sign copyright agreements, handing over core operational rights to the platform. Others “co-invest” with the platform to gain more user acquisition time, often with only a three-hour trial window after launch—if the data is poor, the content is immediately cut. To chase ratings, producers spare no expense in hiring well-known actors, driving up production costs and making it unbearable for small and medium-sized studios.

Small and medium-sized producers, with weak risk resistance, can only cut corners on costs: using the cheapest boxed meals for extras, and overnight shooting becoming the norm. In September 2025, director Gao Jun died suddenly after four consecutive days of filming, and his company offered only 10,000 yuan in compensation. This tragedy became the cruelest footnote to industry competition.

Today, the most mainstream approach in the short drama industry is to trade quantity for hit probability, with a new drama launching every 10 minutes on average, yet few earn money. Even industry leader China Literature produces 154 short dramas a year, with only one true blockbuster. Behind this lies an extreme Matthew effect: top content monopolizes resources, while small and medium-sized teams struggle to break through, trapped in a cycle of “low exposure - low revenue sharing - low investment.”

03

A Leading Studio Sample: The Delicate Relationship Between Platforms and Content Creators

Within the rule-based game created by Hongguo, Tinghua Island stands as a unique entity—both a traffic leader for the platform and a rule-breaker seeking to break free. This makes the relationship between platforms and content creators even more nuanced.

On Hongguo's 2025 popularity charts, Tinghua Island dominated: nine out of the top 10, five with over 3 billion views, and 70 works totaling over 100 billion views across the web. This studio, built by the Mimeng team, rose from the ashes of its public account decline to achieve a triumphant return in the short drama arena. Its blockbuster formula hides the most humanity-driven traffic logic and the most industrialized content production.

Mimeng perfectly transferred her public account-era expertise in “emotional manipulation and conflict creation” to the short drama arena. Beyond understanding humanity, Tinghua Island's industrialized blockbuster-making model leaves many studios in the dust. Eighty-five percent of homogeneous scripts are discarded, writers are sent to old factory districts for research, required to write 100,000-word scene analysis reports, and reject AI-generated clichés. Its deeply integrated user acquisition loop with Hongguo ensures 80% of user acquisition costs precisely reach target audiences, followed by secondary viral spread through short videos.

Earlier this month, Tinghua Island's collective absence from Hongguo's annual gala cast a suspenseful shadow over the industry event. As the top studio contributing nine top-10 hits and over 100 billion views on Hongguo last year, yet with only two of its actors ranking low on the “Audience Favorites” list, sparked much speculation.

However, even a powerhouse like Tinghua Island cannot escape the platform's constraints. Its rise owes much to Hongguo's traffic support and revenue sharing favoritism, with its 100-billion-view success backed by platform resources. On the other hand, its cold reception at Hongguo's annual gala, the marginalization of its actors in awards, and its eventual collective silence subtly reveal the content creator's sober ( sober ) awareness and reluctance to rely entirely on the platform.

Mimeng understands the ruthlessness of platform ecosystems all too well, much like her helpless (helpless) departure from public accounts. She knows that only by holding her own voice can she avoid being manipulated at will.

Thus, Tinghua Island began a quiet breakthrough: establishing an independent talent agency, building MCN operations, and controlling actor resources; increasing investment in original IP, with “Home and Away 2” shooting for 30 days, customizing 800 costumes, and sparing no expense on real-scene construction to build core competitiveness through extreme high-quality content; and developing full-chain capabilities from scriptwriting to overseas distribution to seek new survival spaces.

Tinghua Island's path is not about severing ties with Hongguo but finding independence while remaining attached. Its existence offers a more insightful model for countless producers seeking ways out under platform rules: the industry's ultimate competition will transcend single-dimensional traffic battles and return to the essence of content value. Traffic can be distributed, and algorithms can be optimized, but good content rooted in profound insights and masterful storytelling remains the content creator's strongest bargaining chip.

The success of Mimeng's team is not a privilege for a few but a verifiable path: building user mindshare and brand equity through vertical deep cultivation (deep cultivation), emotional resonance, and stable output. When this logic becomes an industry consensus, the short drama ecosystem can truly shift from platform dominance to value co-creation.

04

An Arms Race: From Single-Pole Dominance to Diversified Competition and Cooperation

While Hongguo leads, it is not without challengers. Today, tech giants like Tencent, Youku, and Baidu have also entered the short drama arena, triggering unprecedented industry restructuring and adding new variables to the game between platforms and content creators.

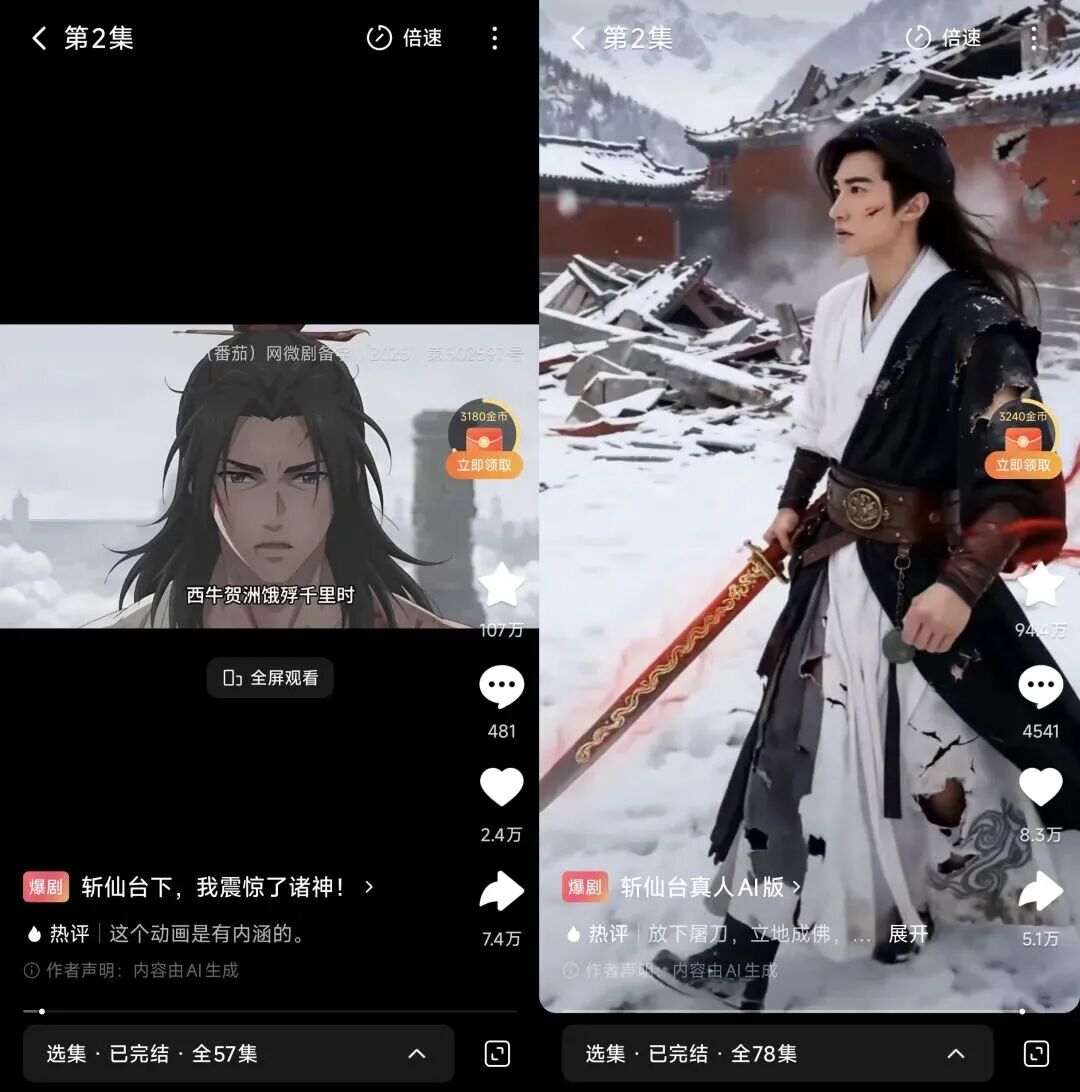

On February 4, Tencent dropped a bombshell: its first independent comic drama app, “Huolong Comic Drama,” officially launched with 133 titles on its first day and 1,701 titles cumulatively, while spending 23.2 million yuan to order comic dramas from ChineseAll, declaring its absolute ambition for the comic drama sector with real money.

Youku quickly followed with a comic drama channel, announcing 24 AI-powered comic drama titles, upgrading revenue sharing rules with member revenue sharing up to 70% and ad CPM sharing up to 80%, and launching the “Kuman Plan” with additional rewards of up to 1 million yuan per program, clearly aiming to poach talent and content. Baidu's Youman Drama and Qimao's Qimao Comic Drama also ramped up efforts, turning the comic drama sector into a battleground for fierce competition overnight.

Hongguo has already extended its reach into the comic drama field, launching a free app and fully applying AI technology, attempting to replicate its success in live-action short dramas. However, Tencent and Youku's aggressive entries have completely altered the competitive landscape. The comic drama battle has thus escalated into a comprehensive contest of ecosystem capabilities.

Meanwhile, the live-action short drama sector is also accelerating its differentiation. While “iQIYI, Youku, and Tencent Video” have not built a full industry chain closed loop (closed loop), they continue to erode market share through a premiumization (high-quality content) strategy and existing membership systems. Kuaishou Xingmang Short Drama, leveraging its community ecosystem and technological accumulation, launched a “family-friendly” content matrix during this year's Spring Festival, reasserting the competitiveness of this short drama veteran.

Behind the entry of multiple players lies a profound transformation in the short drama industry: a shift from single-pole dominance to diversified competition and cooperation, and a return to content value-driven growth from traffic-driven expansion. For producers, this represents a rare opportunity to break free, no longer constrained by Hongguo's single set of rules. Multiple platforms mean more choices, and increased competition compels platforms to offer more favorable terms to attract content, loosening revenue sharing pressures and rating rules quietly (imperceptibly).

However, this does not signify the end of competition. On the contrary, the entry of tech giants has significantly raised industry production thresholds. The application of AI technology, high-quality content demands, and IP-driven development leave fewer opportunities for grassroots teams to stage comebacks. The short drama industry is transforming from a National Carnival (national carnival) into a battleground for professional players.

Hongguo's latest moves also confirm that the industry is entering its next phase: halting minimum guarantees for self-produced dramas indicates the platform is shifting from an expansionary phase of “being both referee and player” to an ecosystem operation phase centered on service and empowerment. Its focus on AI and overseas expansion is also reducing costs and increasing efficiency across the industry chain while unlocking new growth. The trend is clear: the relationship between platforms and content creators is evolving from simple dominance and subordination toward more complex symbiosis and collaboration.",

It is foreseeable that with the popularity of Seedance 2.0, in the past, a high-quality short drama required a crew of dozens of people, with costs running into millions of yuan. However, an AI short drama crew only needs a studio of seven or eight people, with costs around 100,000 yuan to get the job done. This also means that, from a production perspective, all AI short drama companies have the potential to catch up from behind, and the possibility is high.

Standing at such a pivotal moment, we must re-examine what kind of impact this technological revolution will have on our cultural and entertainment industry, content ecosystem, and even our lifestyles.

But no matter how technology disrupts productivity or how the platform landscape changes, for producers, the survival rule remains returning to the value of content itself. Platforms can control traffic and set rules, but they can never replace the value of good content.

In the final analysis, the prosperity of short dramas cannot rely solely on the irrigation of platform traffic; it requires the self-growth of fertile content ground. In the era of AI technology explosion, precise insights into user emotions, delicate capture of social sentiments, and innovative exploration of storytelling—these aspects of 'human creativity' that cannot be fully replaced by algorithms will be the most precious and core competitiveness of the short drama industry in the future.

For creators, the greatest challenge is not adapting to platform rules or technological iterations, but rather safeguarding and honing the narrative ability to engage in dialogue with the real world amidst the tide of efficiency-first. Because ultimately, it is always humans, not algorithms or code, that define the height of the industry and establish emotional connections.

END

Producer: Huang Qiangqiang