Horizon Welcomes New President: How Will Zhu Wei Propel the Team Towards Accelerated Commercialization?

![]() 02/14 2026

02/14 2026

![]() 502

502

By Du Xiaoxun

Edited by Ziye

On February 9th, Horizon's official WeChat account made a formal announcement regarding its strategic partnership with Contemporary Intelligent Technology, a subsidiary of CATL.

While strategic collaborations are not uncommon for Horizon, the spotlight in this announcement was the accompanying photograph.

The image featured Zhu Wei, President of Horizon, and Yang Hanbing, Managing Director of Contemporary Intelligent Technology, seated at the negotiation tables representing their respective companies. Witnessing the signing were Yu Kai, Founder and CEO of Horizon, and Li Ping, Co-Founder and Vice Chairman of CATL, standing on either side.

The individuals in the image, from left to right, are Yu Kai, Founder and CEO of Horizon; Zhu Wei, President of Horizon; Yang Hanbing, Managing Director of Contemporary Intelligent Technology; and Li Ping, Co-Founder and Vice Chairman of CATL. Image source: Horizon's official WeChat account.

The presence of Horizon's top leader and CATL's second-in-command at the signing ceremony underscores the significance both parties attach to this partnership.

Zhu Wei, who sat at Horizon's table, was previously the Executive President of CATL, overseeing the company's passenger vehicle and overseas energy storage businesses. Prior to this cooperation announcement, news had emerged about his appointment as President of Horizon.

With Zhu Wei's ascension to the presidency, Chen Liming, the former President of Horizon, transitioned to the role of Vice Chairman. Chen Liming, who previously served as President of Bosch China, joined Horizon in 2021 and played a pivotal role alongside Yu Kai in areas such as management system development, supply chain stability, and customer delivery.

According to Lei Feng Network, in his new capacity as Vice Chairman, Chen Liming will focus on major strategic decisions, further refining the company's governance system and implementing significant strategies.

Over the past decade, Yu Kai has steered Horizon from its inception, and the addition of Zhu Wei, an executive with extensive sales experience, signals Horizon's ambition to accelerate large-scale commercialization.

1. Horizon Appoints New President

Zhu Wei's name last made headlines in media reports at the end of 2024.

At that time, industry rumors swirled about significant changes at CATL. According to a report by 36Kr, the Executive President of CATL's Passenger Vehicle Business Unit had their rank upgraded from Level 16 to Level 17 but was relieved of specific operational responsibilities.

Meanwhile, CATL's power battery passenger vehicle business adopted a team leader responsibility system. The business previously overseen by this executive was divided into 12 teams reporting to Han Wei, CATL's Co-President responsible for market operations. These teams would continue their past business scopes, segmented according to corresponding customer groups.

Zhu Wei was rumored to be the CATL Executive President who experienced a "promotion in rank but demotion in power," with his authority being divided. At that time, he had been with CATL for nearly eight years.

During his tenure at CATL, Zhu Wei witnessed almost the entire evolution of domestic new energy vehicle (NEV) startups, many of which became CATL's major clients.

He also cultivated close relationships with several NEV startups. According to previous media reports, Zhu Wei was primarily responsible for CATL's cooperation with NEV makers such as Xiaomi, Li Auto, NIO, and Seres.

Image source: CATL's official website

However, as NEV manufacturers sought supply chain diversification, CATL's sales anxieties became apparent.

Take Xiaomi as an example: for its first model, the SU7, CATL supplied 90% of the batteries. However, for the second model, the YU7, BYD's FinDreams Battery became the primary supplier for the Standard and Pro versions, with CATL only supplying the top-tier Max version. According to 36Kr, CATL's share dropped to half, which was undoubtedly unacceptable to the company.

CATL Chairman Zeng Yuqun attempted to renegotiate with Xiaomi Group Founder Lei Jun, hoping to secure a larger supply share. However, Xiaomi had already designed its supply chain framework to maintain a balanced battery supply situation.

Xiaomi was not alone in taking such actions; many in the industry followed suit. Consequently, CATL's domestic market share and gross margin were affected. According to data reported by 36Kr, its market share declined from 53% in 2021 to 43% by the end of 2025, with the gross margin approaching 23%.

A defensive strategy became almost inevitable. CATL set more aggressive goals for itself. According to a report by 36Kr at the time, various internal divisions at CATL had projected their battery installation targets for the following year (2025) from different perspectives, aiming for "at least a 30% increase, with plans to challenge a 50% increase."

Fierce competition, automakers' attitudes, and CATL's anxieties inevitably led to internal adjustments. A notable trend was the departure of CATL veterans and the implementation of a new horse-racing mechanism to motivate young talents.

Image source: CATL's official website

All these factors set the stage for Zhu Wei's departure.

Meanwhile, on the other side of the power battery industry, downstream companies in the intelligent driving chip sector were engaged in fierce competition to popularize intelligent driving technologies. Horizon, as a major player in the industry, needed a senior executive with extensive sales experience to join its ranks.

According to a report by Xinliu Auto, Horizon's former Vice President and General Manager of the Intelligent Driving Product Line, Zhang Yufeng, had just left the company in 2025. Zhang Yufeng had been comprehensively responsible for research and development, products, marketing, and sales since 2019 and had led the construction of Horizon's two major product systems: Horizon Matrix Autonomous Driving and Horizon Halo In-Vehicle Interaction.

Despite filling the vacancy left by Zhang Yufeng, Horizon still needed a president with more experience in research and development, products, marketing, and sales.

Therefore, this personnel change came at an opportune time for both Horizon and Zhu Wei.

2. What Will Zhu Wei Bring to Horizon?

Almost simultaneously with Zhu Wei's official announcement to join Horizon, the company announced another piece of news—it had signed a strategic cooperation agreement with Contemporary Intelligent Technology, a subsidiary of CATL.

In the photo of the signing ceremony, the person seated at Horizon's table was none other than Zhu Wei, the newly appointed President of Horizon.

According to the agreement, both Horizon and Contemporary Intelligent Technology will leverage their respective strengths.

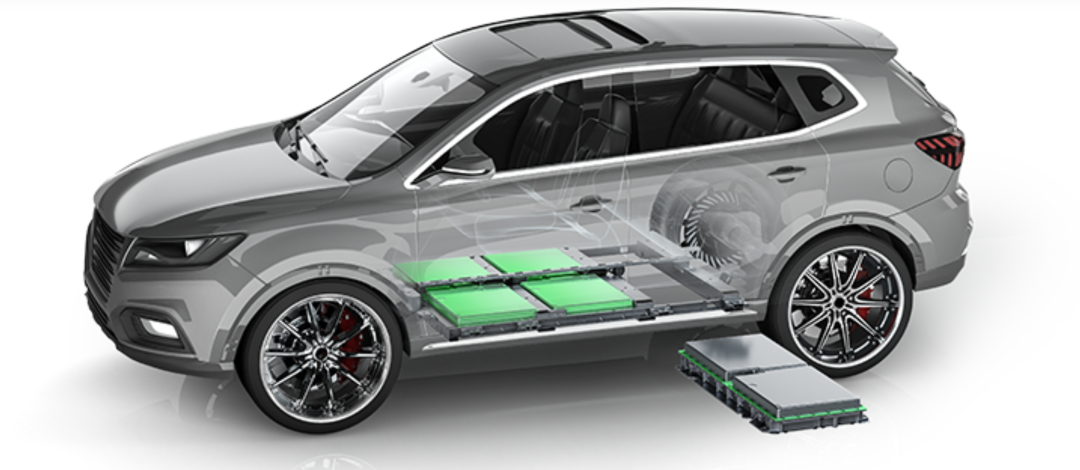

Contemporary Intelligent Technology will provide its Panstone chassis series products and technologies. The Panstone chassis can significantly enhance the battery-to-chassis packaging efficiency and the battery-electric drive system conversion efficiency. Additionally, by decoupling from the upper body, it enables simultaneous development and parallel iteration with upper body space and intelligent driving modules.

Horizon will contribute its core capabilities in vehicle intelligence, including its full-scenario assisted driving products and solutions. Previously, it had just launched the industry's first mass-produced one-stage end-to-end full-scenario assisted driving system—Horizon HSD.

From the perspectives of both companies' strengths, the significance of this cooperation lies in the potential for soft-hard synergy in product development and service support in the future.

In the future, Contemporary Intelligent Technology may serve as the "intelligent carrier," providing battery technology, Panstone chassis technology, and more. Horizon, as the "intelligent brain," will provide clients with intelligent driving chips and assisted driving solutions.

Market voices suggest that the Panstone chassis may come pre-installed with Horizon's HSD system in the future. This cooperation will also help automakers reduce costs and improve efficiency, thereby enhancing the competitiveness of both parties in the industry.

Zhu Wei, who had just joined his new employer, was seated at the signing table with a subsidiary of his former employer, CATL. This suggests that Zhu Wei may have played a key role in the negotiations between the two parties.

Therefore, this signing has been interpreted by the industry as Zhu Wei's "pledge of allegiance" to Horizon. The successful cooperation between the two parties also demonstrates his advantages in customer resources and negotiation capabilities.

Judging from Zhu Wei's resume, his career spans intelligent driving, new energy, and domestic and international businesses.

During his eight years at CATL, he was primarily responsible for the company's passenger vehicle and overseas energy storage businesses, making him one of the core forces driving CATL's leapfrog development.

Familiar with the needs, pain points, and cooperation models of CATL's former major clients—NEV manufacturers—Zhu Wei can quickly promote cooperation between Horizon's intelligent driving chips and assisted driving solutions with these key clients, shortening the commercial negotiation cycle.

On the other hand, having worked in CATL's high-intensity sales system for many years, he understands the market competition logic of the NEV industry. Therefore, he can leverage his past experience to help Horizon optimize its sales team structure, improve market expansion strategies, and enhance commercial delivery capabilities.

Additionally, Zhu Wei was once responsible for CATL's overseas energy storage business. Horizon, having already established a certain scale domestically, is now seeking opportunities in overseas markets.

For example, Yu Kai previously revealed in an interview that Horizon had recently secured overseas automaker orders totaling approximately 7.5 million vehicles over their entire lifecycle, covering global market demands from German and Japanese automakers.

In the future, as Horizon expands into international markets, it will directly face international chip companies such as Qualcomm and NVIDIA. Zhu Wei's overseas market experience will be crucial.

Overall, Zhu Wei will bring more benefits to Horizon in intelligent driving, new energy, and domestic and international businesses.

3. Horizon, in Urgent Need of Scaling Up Commercialization, Requires New Driving Forces

Over the past decade of development, Horizon has been a typical scientist-led startup.

When Yu Kai worked at Baidu, he was introduced by Baidu Founder Robin Li as "an expert we recently recruited from overseas in the AI field." Before founding Horizon, he had driven the construction of Baidu's entire AI system infrastructure.

After founding Horizon, perhaps because its technological route gained recognition in the capital market, the company hardly experienced a life-or-death struggle. The most challenging period was a strategic shift in 2019—abandoning the AIoT (Artificial Intelligence of Things) business, which already had clear revenue, to focus on the implementation of intelligent driving technologies.

Yu Kai, Founder and CEO of Horizon. Image source: Horizon's official WeChat account.

Today, Horizon has successfully gone public and secured nearly 46% of the Chinese ADAS market share in the first half of 2025. According to its previous announcements, the company has become the first domestic tech brand to surpass 10 million intelligent driving chip shipments, with cooperation covering 27 automakers and 42 automotive brands worldwide.

However, while Horizon appears to have achieved success in both capital and commercialization on one side of the coin, it faces challenges from various quarters on the other.

In 2025, automakers led by BYD initiated a movement for "intelligent driving democratization," making more automakers realize that only by achieving NOA (Navigate on Autopilot) capabilities for complex urban roads can intelligent driving become a genuine selling point for their products.

Consequently, automakers have increasingly high demands for intelligent driving capabilities in models priced between RMB 100,000 and RMB 150,000. Providing products with low prices and high capabilities has become a mandatory course for every intelligent driving supplier.

Industry anxieties have spread from downstream to upstream, leading to price wars and making cost reduction an inevitable measure.

As early as 2024, NavInfo disclosed that its cabin-integration solution based on the self-developed "AC8025 chip + Horizon Journey 3" could control costs below RMB 2,000.

Horizon also lowered its prices. In 2024, the average price of its mid-level Pilot solution dropped from RMB 754 to RMB 636, while the average price of its low-level Mono solution fell from RMB 185 to RMB 142.

By 2025, international manufacturers had joined this price competition, also attempting to meet automakers' demands for intelligent driving democratization.

According to a report by Xinliu Think Tank, industry insiders revealed that domestic automakers such as Chery had secured PCB board costs based on Qualcomm's 8650 chip at around RMB 3,000, while PCB board costs for Qualcomm's 8620 chip were around RMB 2,000.

The Qualcomm 8650 chip offers impressive performance. For example, the Leapmotor B10, priced around RMB 130,000, is equipped with a Qualcomm 8650 + 8295 chip combination, enabling high-speed and urban NOA functions, comparable to configurations in models priced between RMB 300,000 and RMB 400,000.

Today, Horizon is also attempting to capture the home automobile market priced between RMB 100,000 and RMB 150,000.

In April 2025, Horizon Robotics unveiled its most powerful chip to date, the Journey 6P, along with the HSD (High-Level Driving Assistance Solution). Subsequently, in November 2025, the HSD was commercially integrated into the Changan Avatr L06 and Chery Exeed ET5 models, resulting in 12,000 HSD activations within just two weeks.

Whether engaged in price wars with competitors or promoting new products, Horizon Robotics faces significant cost pressures and remains in a loss-making phase.

Financial reports reveal that in the first half of 2025, Horizon Robotics achieved revenue of approximately RMB 1.567 billion, marking a 67.6% year-over-year increase. However, it incurred a loss of RMB 5.233 billion during the same period, with adjusted operating losses rising by 34.9% year-over-year to RMB 1.111 billion.

Furthermore, Horizon Robotics grapples with the challenge of customer concentration.

In 2024, revenue from Horizon's top five customers accounted for 71.8% of its total revenue, with the largest customer contributing 31.5%. In the first half of 2025, although the revenue share from the top five customers declined slightly, it remained substantial at 52.48%, with the largest customer accounting for 19.7% of the total.

Customer instability has also become apparent at Horizon Robotics. For instance, two major customers that contributed 60.47% of its revenue in 2024 saw their revenue share plummet to 12.19% in the first half of 2025.

Moreover, securing orders from downstream automakers may pose an increasing challenge.

Firstly, compared to international chip giants, domestic intelligent driving chip companies still have room for improvement. At this year's Consumer Electronics Show (CES), chip behemoths such as Intel, Qualcomm, and NVIDIA actively positioned themselves in the automotive sector. Over the next 1-2 years, chips from NVIDIA and Qualcomm scheduled for mass production will generally adopt 4nm/5nm processes.

However, as of the end of August 2025, domestic manufacturers like Horizon, Black Sesame, and Semidrive were still at the 7nm stage.

This indicates that Horizon Robotics is under substantial competitive pressure.

Not long ago, Yu Kai set forth multiple objectives during a media exchange event: Over the next 3-5 years, the production goal for HSD is to reach tens of millions of units. By 2026, he aims to foster a tenfold growth in China's intelligent driving capabilities, meaning a tenfold increase in urban MPI (Miles Per Intervention, the average annual distance driven between manual takeovers), and strive for urban MPI to exceed 10,000 miles by 2028. Additionally, Journey 7 will be launched concurrently with Tesla's next-generation AI5. By 2026, Horizon Robotics' joint venture with Volkswagen, CoreDrive, will have at least eight new models equipped with Horizon's solutions.

Image source: Horizon Robotics' official WeChat public account.

Achieving these ambitious goals necessitates that Horizon Robotics continues to ramp up R&D efforts, reduce costs, and accelerate large-scale promotion by 2026.

With Zhu Wei joining Horizon Robotics at this pivotal moment, he will need to leverage his extensive experience to assist Horizon Robotics in proving its worth to the market.

Just as at the critical turning point in 2019, Horizon Robotics finds itself at a new crossroads in its development. However, this time, Horizon Robotics doesn't need to change its course—it needs to muster its strength and sprint ahead.

(The header image of this article is sourced from Horizon Robotics' official WeChat public account.)