Behind Large-Scale Deployment: The 'Light' and 'Heavy' Business Models of Autonomous Mining Trucks

![]() 02/14 2026

02/14 2026

![]() 504

504

Within the commercialization landscape of autonomous driving, a niche sector is quietly approaching its breakout moment: autonomous mining trucks. Unlike Robotaxi services still undergoing iterative validation on urban roads, mining autonomous driving has become the most commercially mature and rapidly scaling niche within the autonomous driving field.

Behind this wave of large-scale deployment, a profound transformation in business models—between 'light' and 'heavy' approaches—is unfolding. This shift not only impacts corporate cash flow security and profitability paths but also reshapes the competitive landscape of the entire mining autonomous driving industry.

01. Mining Scenarios: The 'Promised Land' for Autonomous Driving

Why have autonomous mining trucks led the way in crossing the commercialization divide? The answer lies in the uniqueness of the operating environment.

Open-pit mines feature closed, low-speed, highly regulated, and repetitive characteristics: operational areas are relatively fixed, free from complex social traffic interactions, with clear and stable routes that almost perfectly align with the current capabilities of autonomous driving systems. More critically, mining transportation has long faced three major challenges: high safety risks, recruitment difficulties, and elevated operational costs. According to estimates, a single safety incident leading to production halt can result in losses ranging from millions to tens of millions of yuan for mines.

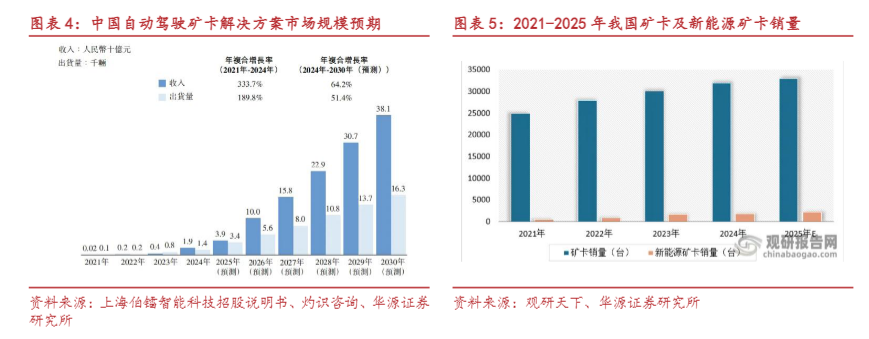

Policy tailwinds cannot be overlooked. In 2024, seven departments including the National Mine Safety Administration jointly issued the 'Guidelines on Deepening Intelligent Mining Construction to Promote Safe Mine Development,' setting targets for intelligent mining capacity to account for no less than 60% of national coal mine output by 2026, with smart equipment replacing at least 30% of dangerous and arduous positions. Frost & Sullivan projects the global market for mining autonomous driving solutions to surge from $700 million in 2024 to $8.1 billion by 2030, representing a 51.0% CAGR. However, behind this large-scale deployment, business model choices have become a critical differentiator for corporate survival.

Currently, mining autonomous driving solutions primarily adopt two business models: TaaS (Transportation as a Service, vehicle-holding model) and ATaaS (Autotech as a Service, vehicle-agnostic model).

TaaS Model (Asset-Heavy): Companies must purchase mining trucks and assume operational responsibilities, covering vehicle configuration, maintenance, fleet management, and even production transportation. While this model facilitates rapid early-stage technical validation and operational data accumulation, it requires substantial capital expenditure, suffers from low asset turnover efficiency, and exhibits weak cycle resistance. Under TaaS, companies function as 'transportation operators' rather than 'technology service providers.'

ATaaS Model (Asset-Light): Downstream clients (mining companies or engineering contractors) purchase or lease mining trucks independently, with companies providing only autonomous driving systems, dispatch platforms, and ongoing operational support on a service-fee basis. This model demands stronger technical and engineering capabilities but offers lower cash flow pressure, higher gross margins, and greater scalability.

Notably, the industry is undergoing a collective shift from 'heavy' to 'light' models. Early on, due to immature technology and risk-averse downstream partners demanding 'zero-risk' proof before adoption, leading players including Ekontrol Intelligence predominantly adopted TaaS models, using self-operated fleets to refine technology and gather data in real-world scenarios.

However, as technology matures and client trust builds, asset-light transformation has become inevitable. Lin Qiao, VP of Ekontrol Intelligence, admits: 'With 70-80% of our workforce in R&D, heavy assets were never our strength.' The company now positions itself as an 'AI driver'—clients purchase vehicles, while Ekontrol provides driving capabilities and enables this 'driver' to progress from novice to expert.

02. Divergent Paths from Light to Heavy

As the world's largest provider of mining autonomous driving solutions, Ekontrol Intelligence's business model transformation is most emblematic.

According to its prospectus, Ekontrol Intelligence generated RMB 986 million in revenue in 2024, with ATaaS contributing RMB 450 million (46%). By Q3 2025, ATaaS revenue share rose to 50% (RMB 461 million), soaring 267% YoY. In contrast, TaaS fleet size increased by only 165 units, while ATaaS vehicles grew by 852 units.

This shift was driven by cash flow constraints. Under the early TaaS model, Ekontrol Intelligence faced massive capital expenditures for vehicle procurement, maintenance, and depreciation. The prospectus reveals negative operating cash flow from 2022-2024 (-RMB 74.51 million, -RMB 251 million, -RMB 713 million). As of April 30, 2025, cash and equivalents stood at just RMB 60.77 million against current liabilities exceeding RMB 1.538 billion, with a current ratio of only 0.62.

After transitioning to ATaaS, Ekontrol Intelligence's financial structure improved markedly. By Q3 2025, gross profit reached RMB 65.328 million, surpassing full-year 2024 levels. More critically, customer retention was validated—a Shougang mine site repurchased services twice from 2024-2025, maintaining 100% retention for three consecutive years.

Unlike Ekontrol Intelligence's 'heavy-to-light' pivot, CiDi (which listed on HKEX in January 2025) opted for an asset-light product strategy from inception.

CiDi positions itself as a 'product company' rather than a transportation operator, generating revenue through sales of autonomous mining trucks (systems) and solutions. Its technology can be replicated across vehicle types, enabling exponential growth. From 2022-2024, revenue skyrocketed from RMB 31.1 million to RMB 410 million (263.1% CAGR), with gross margins turning positive at 24.7% in 2024 from -19.3%, validating business model feasibility.

However, the asset-light model did not immediately deliver profitability. CiDi accumulated RMB 1.099 billion in losses from 2022-2024, primarily due to intense R&D investment (RMB 193 million in 2024, accounting for 47.1% of revenue).

As China's second-largest autonomous transport mining truck solution provider (by 2024 shipments), Boreal Tech submitted its HKEX prospectus in early 2026. By Q3 2025, revenue hit RMB 315 million, surging 819.9% YoY.

Notably, Boreal Tech also faces profitability challenges. Despite rapid revenue growth, autonomous driving firms generally struggle with 'burning cash for market share.' Balancing scale expansion with profitability remains Boreal Tech's critical post-IPO question.

The collective shift to asset-light models by autonomous mining truck companies reflects not just financial pressure but also a rational realignment of industrial division of labor.

In traditional mining transportation, engineering firms procure vehicles, hire drivers, and deliver transport capacity to mines. Inner Mongolia North Hauler, as an OEM, is exploring a unique 'heavy-to-light, hybrid' path.

On the 'heavy' side, Inner Mongolia North Hauler leverages its dominant position in rigid mining trucks (electric wheel dump trucks) to provide hardware for autonomous driving. Its NTE series electric wheel trucks cover 110-400-ton capacities and are among the few manufacturers enabling batch autonomous operations in high-altitude, extreme cold (-30°C) environments. In 2024, its autonomous projects at Baotou Steel and Conch Group achieved batch deployments, with over 200 autonomous trucks implemented or planned globally, ranking third worldwide.

On the 'light' side, Inner Mongolia North Hauler opts for deep technology partnerships rather than building in-house algorithm teams. In 2025, it strategic cooperation ed with Ekontrol Intelligence to advance front- and retrofit autonomous solutions for rigid dump trucks. Through a 'hardware sales + tech service revenue-sharing' model, Inner Mongolia North Hauler successfully transformed from a pure equipment manufacturer to a 'smart mining system solution provider.'

03. Future Outlook: From Technical Validation to Ecosystem Construction

At the 2026 inflection point, the autonomous mining truck industry is transitioning from technical validation to large-scale commercialization. The debate over 'light' versus 'heavy' business models epitomizes the industry's evolution from 'capital-intensive' to 'technology-intensive.'

More profound changes lie in the convergence of electrification and intelligence. CATL's lead investment in Ekontrol Intelligence's Series D round reflects not just confidence in autonomous driving technology but also in the ecological integration of 'new energy mining trucks + battery-swapping networks.' As electric mining truck penetration rises, the synergy between autonomous driving and new energy will amplify.

The clarion call for large-scale deployment has sounded. The commercialization narrative of autonomous mining trucks is shifting from 'burning cash for market share' to 'technology empowerment.' Companies that strike the right balance between 'light' and 'heavy' models—maintaining technical edge while ensuring commercial resilience—will ultimately dominate this hundred-billion-yuan market.

- End -