Qianwen's DAU Nears Doubao's: Is Alibaba Riding a Wave of Success?

![]() 02/14 2026

02/14 2026

![]() 398

398

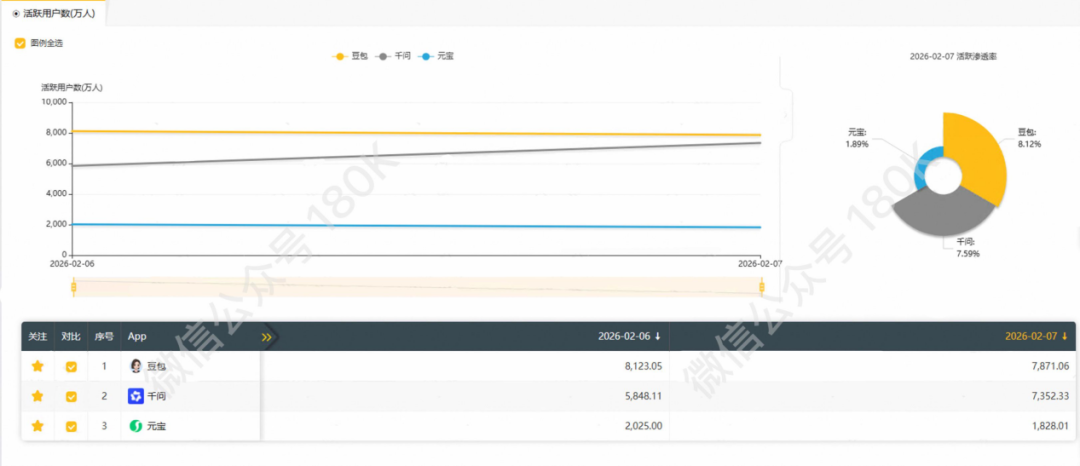

A campaign offering free milk tea, which enticed users to indulge in a complimentary beverage, catapulted Qianwen's DAU to a peak of 73.52 million.

On the same day (February 7), Doubao's DAU reached 78.71 million. Doubao made its debut in June 2023, whereas Qianwen commenced its beta testing in November 2025. According to numerous media reports, Qianwen has attained a DAU nearly on par with Doubao's three-year achievement in a mere three months.

Initially striving to catch up and subsequently focusing on user retention is a prevalent strategy adopted by major corporations.

However, unlike previous internet products, Alibaba's current competition is centered around AI, often hailed as the "gateway to the future."

Therefore, rather than debating the extent to which Qianwen will retain users after the subsidy frenzy subsides, Alibaba's underlying strategy is more captivating. After all, this time, Alibaba is not merely contending with a localized rival like Pinduoduo but is engaged in a comprehensive battle for its future survival.

Concurrently with the news of Qianwen's DAU surpassing 73 million, Alibaba's core management team made a statement during an internal meeting in early 2026.

The management urged the team to persist in aggressively pursuing flash sales, unburdened by concerns over losses (for the next three years). They also anticipated that Taobao's investment in flash sales in 2026 would be at least on par with that in 2025, with instant retail as a focal point.

This represents a new mission for Taobao flash sales within Alibaba's AI gateway battle.

Under the strategic framework of "AI + E-commerce," Alibaba is mobilizing all core resources across the group to converge on this pivotal battlefield.

Alibaba is adopting a resolute stance, "fighting a very novel kind of war." However, unlike before, Alibaba does not face a tangible adversary like JD.com, Meituan, or Pinduoduo this time—it's another moment to test its "entrepreneurial spirit."

No 'Opponent' Amidst Technological Revolution

Almost all of Alibaba's pivotal battles in history have been initiated by provocations (crossed out) from competitors.

In 2013, it vied with Tencent for mobile payments; in 2014, it competed with JD.com for e-commerce supremacy; later, it clashed with Meituan for local services; and in 2019, its market share in lower-tier markets was eroded by Pinduoduo. Alibaba has never been lacking in adversaries during the mobile internet era.

However, in the current AI battle, everyone is starting from scratch.

Alibaba's launch of Qianwen is less about chasing Doubao and more about seizing the right opportunity. In other words, Doubao poses less of a crisis to Alibaba than the aforementioned competitors.

This is underpinned by a significant industry consensus: AI products have yet to discover a clear business model.

The online advertising model of the Web 1.0 era gave rise to giants like Google, Amazon, and Baidu, while the mobile internet era spawned super apps such as Meituan, Uber, and Didi.

Yet, in the face of the AI technological revolution, similar super apps have not emerged, and their potential forms remain unknown.

Possessing technical capabilities and being able to monetize them are two distinct matters—this is a pressing issue.

Especially since the current market environment is vastly different from a decade ago. In the past, capital allowed for results to materialize within three to five years of substantial investment; now, capital is less patient and demands corresponding new growth post-investment.

Therefore, for Alibaba, as long as Doubao cannot form a closed loop with its traffic, it does not pose a genuine threat.

In this context, Alibaba has no adversary in this war; its "opponent" is its past self. The challenge lies in whether it can cultivate a new AI-driven ecosystem where its existing businesses can thrive.

The launch of Qianwen indicates that Alibaba has at least discerned the path forward.

This path has gradually become evident with the recent 3 billion yuan milk tea campaign preceding the Chinese New Year.

Most general-purpose conversational models on the market, including Doubao, essentially serve a single function—chatting. Their applications are confined to information retrieval, decision-making aid, creative assistance, etc., with scenarios existing solely online.

Qianwen, however, is currently the only AI product enabling milk tea ordering through AI commands.

This represents an entirely unprecedented human experience—Alibaba aims to demonstrate to users that AI is not just for photo editing, fortune-telling, or report modifying; it can also handle "tedious tasks" like ordering milk tea, effectively enhancing its presence among users.

Being perceivable by C-end users is something Alibaba has long aspired to but rarely achieved.

The latent power of AI has been unleashed.

Looking ahead, once users develop the mindset of "being able to order takeout on Qianwen," and the system can manage surges without crashing, coupled with efficient fulfillment services, Alibaba can activate its existing full-chain consumption ecosystem through Qianwen.

By investing in Qianwen and then relying on user orders to subsidize operations, a large closed loop is established.

In this light, Alibaba's move to integrate its takeout and travel businesses over half a year in 2025, further complementing the group's offline ecosystem, appears to be paving the way for Qianwen's future expansion.

There are already reports that Qianwen has completed integration with Damai and Fliggy, enabling users to not only purchase movie tickets but also buy air tickets at more competitive prices than airlines, all potentially launching during the Chinese New Year.

Alibaba's ambitious blueprint for "AI + E-commerce" is taking shape, accompanied by its long-lost superior organizational capabilities and combat system.

Alibaba's Total War

Alibaba has demonstrated remarkable agility and unity in this AI battle.

From the summer of 2025, when management decided to create an AI-native C-end super gateway, they brought in hundreds of engineers from Beijing and Guangdong in September for closed development at Alibaba's Xixi Park C4 building.

Almost simultaneously, business teams from Alibaba Cloud, Tongyi Lab, Taotian, and Gaode were also mobilized for development.

On November 17, Qianwen, benchmarked against ChatGPT's latest 5.1 version, went live for public testing.

This scene had not been witnessed for a considerable time before 2025.

According to the Qianwen team, this battle, akin to flash sales, is not solely fought by Qianwen or Alibaba's Intelligent Information but concentrates all of Alibaba's advantageous resources under unified command—a total war for Alibaba.

This contrasts sharply with Alibaba's state when competing with Pinduoduo around 2020.

When Pinduoduo rose, Alibaba was plagued by "big company syndrome," characterized by a bloated organization, low decision-making efficiency, and a lack of grounding. Consequently, it ceded traffic in lower-tier markets to Pinduoduo, and its market value was once surpassed by Pinduoduo.

In retrospect, Alibaba had missed the optimal window to counter Pinduoduo.

Alibaba seemed to have been "out of luck" for an extended period before, unable to tell new stories in the era of short videos and live streaming, being suppressed (suppressed) by Meituan in the local services sector, its once-proud corporate culture constantly being demonized (demonized), and its stock price plummeting... Pinduoduo seemed to be the final straw.

The turning point arrived in September 2023.

Following Daniel Zhang's resignation as Alibaba Group's Chairman and CEO in June, Alibaba announced in September the return of its founding team, with Joe Tsai and Eddie Wu assuming the roles of Chairman and CEO of Alibaba Group, respectively.

Alibaba then commenced readjusting its strategy and streamlining its businesses; founder Jack Ma also began making frequent appearances, reiterating the "entrepreneurial spirit" and showing his presence across various businesses.

The most direct change brought about by this adjustment was that the group now had a commander-in-chief to guide unified operations.

At a time when employee morale was low and the AI trend was upon us, the emergence of a clear-headed, capable, and visionary leader was particularly crucial.

Eddie Wu

The newly appointed CEO, Eddie Wu, has proven to be such a figure. Alibaba's significant strategies and implementations in the past two years have all been driven by Wu. For instance, he successfully convinced Jack Ma that "AI has the opportunity to transform Alibaba into a world-class company."

This enabled Alibaba to fully advance towards AI, making AI-driven operations its paramount strategy.

According to the Qianwen team, the decision to develop Qianwen was also made by Wu, who believed that Alibaba must possess an AI-native C-end super gateway.

Wu's "investor style," distinct from Daniel Zhang's "financial style," has also rendered Alibaba a bolder team—encouraging the team to persist in pursuing flash sales aggressively and not worrying about losses for three years is a testament to this.

It can be said that almost all of Alibaba's current achievements stem from Wu's judgments two years ago.

2025 serves as a concentrated test of the effectiveness of Alibaba's organizational adjustments two years ago—with Taobao flash sales surpassing 100 million in peak value and Qianwen's DAU catching up, it has commenced to "achieve small successes," proving that it can still compete.

Even Pony Ma lauded Alibaba's ability to mobilize its entire ecosystem to serve Qianwen, noting its impressive organizational efficiency.

In his "2026 New Year's Letter to All Employees," Wu could not conceal his joy, stating, "We have fought several 'big battles' beautifully this year."

Full text of Alibaba's "2026 New Year's Letter to All Employees"

Alibaba is starting to play a favorable game; after sweeping away its slump, fortune may forge a new Alibaba.