Joint Venture Auto Market Collapses: SAIC-GM's Sales Plunge Far Beyond Halving

![]() 01/06 2025

01/06 2025

![]() 452

452

Source | Shenlan Finance | Written by | Yang Bo

If there's one joint venture automaker that has suffered immensely in recent years, it is undoubtedly SAIC-GM. Recently, SAIC Motor Corporation Limited released its December 2024 production and sales report, revealing that SAIC-GM experienced the most significant decline in cumulative sales for the entire year.

SAIC-GM encompasses three world-renowned brands: Chevrolet, Buick, and Cadillac. However, in China, these three brands are declining, with their market share being severely compressed. Does SAIC-GM still have a chance to mount a comeback?

1. SAIC-GM's Sales Plunge from 2 Million to 435,000 Units

According to SAIC Motor's sales data from January to December, the total sales volume was 4.013 million units, a year-on-year decrease of 20.07% compared to the cumulative total sales volume of 5.02 million units in the same period last year. Among them, SAIC-GM suffered the largest sales decline. SAIC-GM's total sales volume from January to December was 435,000 units, a year-on-year drop of 56.54%, compared to last year's cumulative sales barely exceeding 1 million units.

Additionally, SAIC Volkswagen's total sales volume from January to December was 1.148 million units, a year-on-year decrease of 5.51%. IM Motors recorded the largest sales growth, with a total annual sales volume of 65,500 units, a year-on-year increase of 71.24%. IM Motors' total sales volume in December was 8,003 units, showcasing decent performance. However, IM Motors' annual total sales volume did not match Tesla China's monthly sales. SAIC Motor's overall new energy vehicle sales in 2024 were 1.234 million units, a year-on-year increase of only 9.9%. The majority of SAIC Motor's new energy vehicles were contributed by Wuling Automobile, which had a total annual sales volume of 1.34 million units, a year-on-year decrease of 4.49%. Wuling Automobile's best-selling model is the Wuling Hongguang MINIEV.

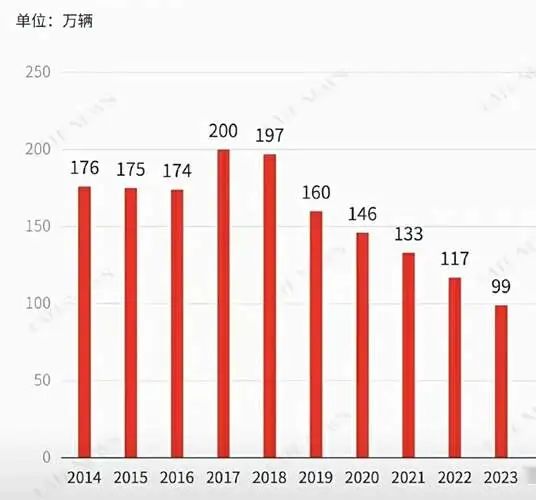

From a longitudinal perspective, SAIC-GM peaked in 2017 and 2018 with annual sales of approximately 2 million units. Since then, sales have been declining, falling by 50% from the 2023 peak. In 2024, compared to the previous year, sales plunged by another 56%, essentially halving again after already being halved.

(SAIC-GM Annual Sales Volume Source: Internet)

Behind the plummeting sales, SAIC-GM's vehicle prices have also seen a significant drop.

2. Price Reduction Strategy: A Double-Edged Sword

General Motors is one of the oldest foreign automotive brands produced locally in China, becoming the second foreign brand approved for auto production in China after Volkswagen in 1997. GM's joint venture automakers in China primarily include SAIC-GM and Wuling Automobile. According to Tianyancha data, GM's joint venture share in SAIC-GM is 50%, and in Wuling Automobile, it is 44%. Industry insiders attribute SAIC-GM's decline partly to its adoption of three-cylinder engines. Starting from 2019, SAIC-GM significantly promoted three-cylinder engines, installing them in multiple models of Chevrolet and Buick. The Buick Excelle, once a best-seller with annual sales exceeding 40,000 units and a competitor to the Lavida and Xianyi, saw a sharp decline in sales and reputation after adopting three-cylinder engines across its lineup.

By the fourth quarter of 2023, the once-popular Buick Excelle model was forced to cease production. SAIC-GM owns three global brands: Chevrolet, Buick, and Cadillac. Referencing prices on the "Autohome" platform, SAIC-GM's pricing structure for its three brands has completely collapsed:

- The starting price for the Chevrolet Cruze's entry-level 1.5L DCT Enjoy version is 94,900 yuan, with dealers offering it from 59,900 yuan, representing a 36% discount.

- The Chevrolet Malibu 1.5T RS version has a guide price of 175,900 yuan, with dealers offering it from 117,900 yuan, a 32% discount.

- The Buick Verano Pro Le Yi version has a guide price of 128,900 yuan, with dealers offering it from 68,900 yuan, a 56% discount, essentially sold at half price.

- The Buick Envision Plus 28T has a guide price of 229,900 yuan, with dealers offering it from 169,900 yuan, a 25% discount.

- The Cadillac CT5 28T Luxury has a guide price of 289,700 yuan, with dealers offering it from 209,700 yuan, a 27% discount. As a luxury brand, Cadillac is now priced similarly to past B-segment cars like the Passat and Camry...

(Chart compiled by Shenlan Finance) As SAIC-GM's last remaining "face," the domestic MPV giant Buick GL8's starting price has fallen below 200,000 yuan (guide price: 232,900 yuan)... It was unimaginable in the past to buy a GL8 for just over 100,000 yuan.

To boost sales, SAIC-GM introduced a "fixed-price" sales policy for multiple models this year, which to some extent drove a recovery in sales. For example, the Buick LaCrosse 2025 Platinum Edition has a guide price of 209,900 yuan, but the official fixed price is 159,900 yuan. Its terminal sales in December were 5,940 units, a year-on-year increase of 105%. Another example is the Cadillac XT5, which cut its price by a direct 130,000 yuan through a fixed-price promotion in September. It is reported that over 5,000 pre-orders were received within half a month of the pre-sale. In December, 6,163 units were delivered, a year-on-year increase of 114%. SAIC-GM is really cutting prices harder than market hagglers! The models that SAIC-GM can still barely maintain its face with include the Buick GL8, which surpassed 100,000 units in cumulative terminal sales in 2024, continuing to lead the large MPV sales chart. This achievement was also achieved through significant terminal discounts.

With prices slashed to the bone, SAIC-GM finally saw a rebound in sales. According to disclosures, as of December, SAIC-GM's terminal sales achieved a six-month consecutive monthly increase.

3. GM Records Over $5 Billion in Impairment in China

Data shows that for the first nine months of this year, GM has suffered losses in the Chinese market for three consecutive quarters, totaling approximately $347 million in losses, compared to a profit of $353 million in the same period in 2023.

According to media reports, in December, GM stated in a filing submitted to the U.S. Securities and Exchange Commission (SEC) that it expects to reduce the equity value of its joint ventures in China by $2.6 billion to $2.9 billion. Additionally, GM has accrued approximately $2.7 billion in additional equity losses due to the implementation of its restructuring plan, totaling over $5 billion. It appears that the continuous sales plunge in the Chinese market has caused anxiety for GM in the United States. The impairment provision and restructuring support amounting to $5 billion have also severely impacted GM. GM stated that it does not expect a quick rebound in its China business and that the restructuring plan to be finalized with its partners will enable gradual annual improvements in GM's performance in China starting next year.

It is reported that to achieve long-term development goals in China, GM is taking measures to reduce inventory, produce on demand, protect the price system, and reduce fixed costs.

With the rapid rise of Chinese new energy vehicle brands, traditional French, German, Japanese, and American joint venture automakers in China have all felt the crisis. GM was one of the quicker joint venture automakers to follow up on the new energy transformation in China. According to SAIC-GM, its new energy vehicle sales totaled 104,905 units in 2024, a year-on-year increase of 56%, ranking first in new energy penetration among mainstream joint venture automakers.

The data is impressive, but let's break it down: Autohome shows that currently, Chevrolet has 3 new energy vehicles on sale, including the Menlo EV, Equinox EV, and Equinox Plus PHEV. Buick has 4 models: the Buick Electra E5, Electra E4, Velite 6, and GL8 Electra. Cadillac has 2 models: the Lyriq and Lyriq IQS. With a total of 9 models, the annual sales volume was 104,900 units, which also includes export data, and the export ratio is not insignificant. In fact, the only models that sold relatively well were the Buick GL8 Electra and the Buick Electra E5. The high-end brand Cadillac's new energy vehicles are almost unsellable. The transformation of traditional joint venture automakers into new energy is still very challenging.

Under such circumstances, in December, SAIC-GM once again stated that it would accelerate its transformation in 2025 by introducing "new and competitive products and innovative technologies" covering mainstream types such as pure electric, plug-in hybrid, extended-range, and L2++ intelligent driving, sounding the "counterattack horn" for joint venture automakers.

Joint venture, counterattack? Is it still possible now?