DJI Zhuoyu Finds a New Home with FAW, Marking a Pivotal Moment in the Assisted Driving Sector

![]() 09/29 2025

09/29 2025

![]() 663

663

After achieving independence, DJI Zhuoyu has finally secured a new haven under the expansive umbrella of a major player.

Since the start of the year, the competition in automotive intelligence has broadened its scope from cockpit innovations to encompass the realm of assisted driving. This shift has been particularly pronounced during the regulatory lull preceding enhanced oversight by the Ministry of Industry and Information Technology and other regulatory bodies. "Equal access to intelligent driving technologies" has emerged as the central theme in automaker rivalries during the first half of the year.

In contrast to intelligent cockpit features, the performance of assisted driving systems directly influences vehicle safety. Consequently, automakers tend to approach this area with caution, especially within the traditional automotive sector where suppliers typically offer comprehensive solutions.

However, as assisted driving functionalities continue to diversify, so too has the involvement of suppliers. This evolution has transitioned from previous black-box solutions to a landscape where multiple collaboration models coexist. The domestic market has witnessed the emergence of a leading group of suppliers, including Horizon Robotics, DJI Zhuoyu, Huawei ADS, and Momenta.

Under the influence of the 'Big Four' - Horizon, DJI, Huawei, and Momenta - these companies have secured a substantial portion of the market share, with only a few brands opting to develop their own solutions.

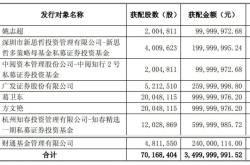

Recently, it was confirmed that China FAW Corporation Limited will inject additional capital and acquire a 35.8% stake in Zhuoyu, making it the largest shareholder. Alongside existing shareholder New Territory (now holding 34.85%), they will jointly steer Zhuoyu Technology.

Subsequently, the State Administration for Market Regulation posted an antitrust notification on its official website, confirming the acquisition.

Seeking Shelter Under a Larger Canopy

Regarding Zhuoyu, the outside world often perceives it as DJI's in-house assisted driving division. From the inception of an in-vehicle project team within DJI in 2016 to Zhuoyu Technology's independent operation in 2023, Zhuoyu has flourished under DJI's aegis for six years.

This has led to the perception that DJI and Zhuoyu are essentially the same entity. Founded under DJI's illustrious banner, Zhuoyu Technology can be said to have been born with a silver spoon. DJI's technology, honed over years in the drone industry, has finally borne fruit in the automotive sector.

In the drone industry, DJI stands as a veritable unicorn, commanding over 90% of the market share. However, its foray into the assisted driving industry, from DJI In-Vehicle to the current Zhuoyu Technology, has left the most prominent impression as the realization of high-level assisted driving at a cost of 7,000 yuan, as highlighted by Shen Shaojie in 2024.

Subsequently, this low-cost solution became DJI Zhuoyu's hallmark. Starting from that year, Zhuoyu's collaborating automakers saw a steady increase. By the Shanghai Auto Show this year, Zhuoyu announced nine major collaborating clients: Volkswagen, SAIC-GM-Wuling, BYD, Chery Automobile, Great Wall Motors, China FAW Group, Dongfeng Motor Corporation, Audi, and BAIC Group.

Leveraging low costs and a prestigious background, Zhuoyu successfully established itself in the automotive assisted driving industry, achieving mass production for over 20 models and fixed-point (designated production) for over 30 models, leading to a market valuation that once reached billions of yuan.

Beyond the low-cost solution, Zhuoyu's collaboration with Volkswagen Group on fuel vehicles garnered significant attention. As early as 2018, Zhuoyu's predecessor, DJI In-Vehicle, was selected by Volkswagen from numerous suppliers, initiating their collaboration. This partnership remained under wraps until the 2021 Shanghai Auto Show.

However, the Germans' approach differs from the domestic market, with time seemingly moving at a slower pace for Volkswagen Group. It wasn't until May 2024 that the first model under their collaboration, the Tiguan L, was officially launched, three years after the partnership was announced.

As a result, Zhuoyu gained market recognition through the Tiguan L. Prior to its launch, no mainstream fuel vehicle in China had achieved high-level assisted driving capabilities. Most automakers were focusing on new energy vehicles, seemingly overlooking the needs of fuel vehicles.

Behind this lies the fact that automakers have chosen to abandon difficult and low-return solutions. Unlike electric drives, achieving high-level assisted driving in fuel vehicles requires overcoming multiple challenges. Firstly, there is the demand for electrical energy. Perception, computation, and execution all consume significant amounts of power, which traditional batteries in fuel vehicles cannot adequately support.

On the other hand, due to the inherent drawbacks of internal combustion engines, their response speed cannot match that of electric motors. Response speed is a critical factor for the safety of assisted driving features; a one-second difference can result in a 33-meter error at high speeds.

It can be said that the realization of high-level assisted driving solutions on fuel vehicles in collaboration with Volkswagen Group provided Zhuoyu with the foundation to become a leading player in the industry. This collaboration also laid the groundwork for Zhuoyu's subsequent partnership with FAW on the Hongqi brand.

The successful collaboration between the two parties on the Hongqi Tiangong series models laid the foundation for this acquisition. FAW trusts Zhuoyu's technology, while Zhuoyu also needs stronger external support to sustain its future development.

Individual Tree vs. Entire Forest

For assisted driving solution providers, securing capital investment from automakers is quite common. For instance, Huawei, currently the most prominent in China, has not only deeply bound itself with five major automakers through HarmonyOS Intelligent Connectivity but has also expanded its circle of friends by establishing Deepal to collaborate with more automakers.

Before this collaboration, Zhuoyu Technology was also held by multiple parties. For example, BYD, through Shenzhen BYD Chuangxin Material Co., Ltd., held a 5.1845% stake in Zhuoyu at the beginning of this year. However, BYD's collaboration with Zhuoyu primarily focused on in-vehicle drone projects, with multiple public statements clarifying that their collaboration did not involve assisted driving.

Meanwhile, during Zhuoyu's Series B funding round, BAIC Capital and GAC Capital also invested, albeit with smaller stakes, aligning with the general collaboration model between automakers and suppliers. For instance, Changan Automobile indirectly holds a 10% stake in Deepal through Avatr Technology while retaining a 10% reserved stake, totaling only 20%.

However, Zhuoyu's introduction of FAW as an investor this time involved directly selling a 35.80% stake, elevating FAW to become Zhuoyu Technology's largest single shareholder. FAW will jointly manage the company with DJI-affiliated New Territory, essentially equating to Zhuoyu 'selling itself' to FAW to a certain extent.

Of course, this also reflects the emerging trend of factionalization among assisted driving suppliers in the market competition. The market is evolving from a simple 'supplier vs. automaker' relationship to a complex 'alliance vs. alliance' competition.

Similar to the 'Android Alliance' versus 'Apple' rivalry in the smartphone industry, the intelligent driving sector has also witnessed the emergence of the Huawei ecosystem and a new alliance formed by FAW + Zhuoyu. Horizon Robotics, Momenta, and others are also constructing their respective ecosystems. Automakers' choice of suppliers is increasingly akin to selecting future technological allies and ecological factions.

Besides the well-known Huawei ecosystem, Horizon Robotics participated as a cornerstone investor in Chery's IPO, investing alongside leading institutions like Hillhouse Capital.

Momenta, on the other hand, has received investments from SAIC, General Motors, Mercedes-Benz, and Toyota. However, these automakers do not participate in daily operations and management, representing more of a technological investment.

The most direct benefit of FAW's holding (holding a controlling stake) is the financial support it brings to Zhuoyu. Meanwhile, as the birthplace of China's automotive industry, FAW enjoys various preferential treatments that other enterprises cannot easily attain. Its central enterprise background ensures that Zhuoyu can go further under FAW's protection.

However, FAW's holding will also bring new challenges, particularly in advancing collaboration projects with other automakers. Previously, Zhuoyu collaborated with automakers as a third-party supplier. However, with FAW's background, it may raise different concerns among other automakers.

For Zhuoyu, there is a risk of choosing to stand under one big tree and potentially losing the entire forest after this equity change.

Zhuoyu needs to maintain a more delicate balance in its future development. Previously, Zhuoyu has been striving to shape an independent brand image. Now, it must avoid being completely 'FAW-ized' and preserve its openness and service capabilities to clients across the entire industry.

Of course, collaborations like Zhuoyu's with FAW may represent a future trend in automaker-supplier partnerships. As intelligence becomes the key to competition, automakers may choose to deepen their collaboration with suppliers based on mutual trust for stronger binding.

In the future, alliances and mergers within the assisted driving industry will become more frequent. Suppliers not only need to accelerate technological iteration but also find suitable allies for deep binding to maintain a competitive edge in the industry.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for deletion.

-END-