Japan's Electric Vehicle Market: Hybrid Dominance, Slow Pure Electric Growth, Local Preferences, and Pricing Challenges

![]() 09/29 2025

09/29 2025

![]() 487

487

As the world's fourth-largest automotive market, Japan's electrification transition follows a unique path: hybrid vehicles dominate with an overwhelming advantage, while pure electric vehicles (EVs) face bottlenecks, with market share lingering at a low level for an extended period.

Recently, a study on Japan's electric vehicle market by automotive industry data and consulting services provider JATO Dynamics revealed that despite Japanese authorities' multi-pronged efforts—including subsidies, tax incentives, and expanded charging infrastructure—to support EV adoption, consumer choices clearly indicate that hybrid technology remains a more pragmatic and nationally suited solution for Japanese consumers at this stage. Meanwhile, while the selection of pure EV models has grown increasingly diverse, their market performance remains constrained by real-world challenges such as price polarization, range anxiety, and inadequate infrastructure. Particularly in mainstream price ranges, pure EV options are scarce, struggling to compete with the abundant hybrid lineup.

This pattern of 'hybrid dominance and slow pure EV adoption' not only reflects Japan's unique automotive market preferences but also highlights the complex realities faced by the global EV wave as it adapts locally across different markets.

▍Hybrids Replace Fuel Vehicles as Dominant Force, with Significant Cost Advantages

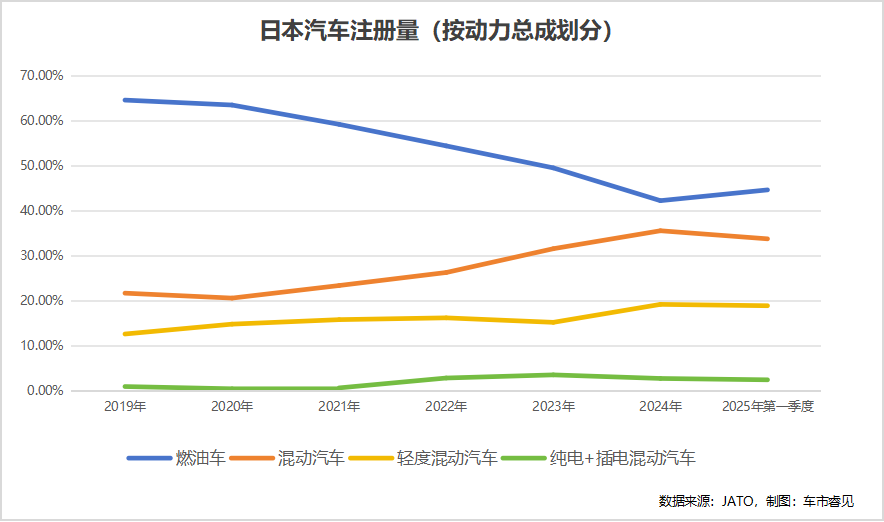

Japan's passenger vehicle market is undergoing profound transformation, with internal combustion engine (ICE) models' share steadily declining. In 2023, ICE vehicles accounted for less than 50% of total passenger car registrations for the first time, further dropping to 42.3% in 2024. Despite a slight rebound to 44.7% in the first half of 2025, electrified powertrains now dominate the market.

Japan's electrified powertrain options include hybrid electric vehicles (HEVs), mild hybrid electric vehicles (MHEVs), plug-in hybrid electric vehicles (PHEVs), and battery electric vehicles (BEVs). Data shows hybrid models' market share rose from 21.7% in 2019 to 35.6% in 2024, stabilizing at 33.8% in the first half of 2025, indicating steady growth. Japanese manufacturers, leveraging their technological edge and competitive pricing strategies, have driven sustained hybrid growth. In the first half of 2025, hybrids accounted for 21% of total market sales, with Toyota contributing 6% and Nissan 4.5%.

For most Japanese consumers, hybrids currently represent the most practical choice. In the first half of 2025, the weighted average price of new passenger cars in Japan was approximately ¥3.29 million (about RMB 157,000), with roughly 80% of models priced below ¥4.09 million (about RMB 196,000) and 90% below ¥5.8 million (about RMB 281,000).

However, within this mainstream price range, pure EV options are extremely limited, with only six models priced below ¥4.09 million—two being kei cars (light vehicles) and three imported models (Hyundai Kona/Inster, BYD Dolphin). In contrast, 34 hybrid models are available, primarily from domestic brands like Toyota, Honda, and Nissan.

Although hybrid models typically carry higher sticker prices than equivalent ICE vehicles, their cost-effectiveness is deemed outstanding when considering fuel efficiency, upgraded configurations, and tax incentives. Backed by a broad product lineup and long-standing consumer trust in local brands, hybrids remain Japan's most familiar and accessible electrification option.

▍Slow Growth of Pure EV Models, with Light Vehicles Emerging as Breakthrough

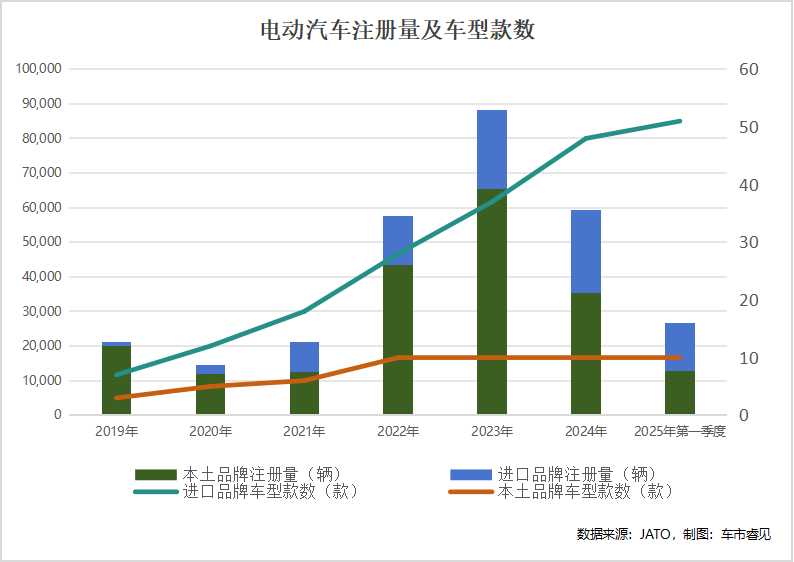

Japan's pure electric vehicle (EV) market has seen sluggish progress, with market share at just 0.5% in 2019, rising to 2.2% in 2023 before dropping back to 1.3% in the first half of 2025. Penetration remains limited despite available models surging from 10 in 2019 to 61 in 2025. However, only 10 of these models are from Japanese brands, with the remaining 51 being foreign imports, underscoring the strong influence of imported vehicles in Japan's pure EV market. At the sales level, lightweight pure EV models launched by Nissan and Mitsubishi in 2022 have gradually boosted the market share of Japanese-brand pure EVs. Affordable and compact, these lightweight pure EVs align well with local preferences, attracting consumers and serving as a practical entry point for EV adoption in recent years.

A price comparison between domestic and imported pure EV models in Japan reveals significant disparities. In the first half of 2025, the average price of domestic pure EVs was ¥3.53 million (about RMB 171,000), emphasizing practicality and economy, with affordable kei cars dominating. Imported pure EVs averaged ¥7.37 million (about RMB 357,000), targeting high performance, advanced features, and luxury positioning.

The Japanese government offers subsidies for clean energy vehicles (pure EVs and plug-in hybrids), with the maximum subsidy gradually increasing from ¥400,000 (about RMB 18,000) in 2020 to ¥900,000 (about RMB 42,000) in 2025. For lightweight pure EVs, the maximum subsidy reaches ¥574,000 (about RMB 27,000).

Take Nissan's Sakura (base model priced at ¥2.54 million) as an example: it qualifies for approximately ¥574,000 in subsidies, accounting for about 22% of the vehicle's price. Combined with local subsidies and tax incentives, this effectively narrows the price gap between EVs and internal combustion engine vehicles. Additionally, Japan's 'Eco-Car Tax Reduction' policy reduces environmental and tonnage taxes based on a vehicle's environmental performance, lowering purchase and ownership costs. Nevertheless, the direct impact of subsidies on overall pure EV adoption remains limited. Fundamental challenges, such as consumer preferences and lagging infrastructure development, continue to hinder widespread EV acceptance.

Currently, hybrid electric vehicles remain Japan's most stable and widely accepted electrification solution. Emerging market segments like lightweight pure EVs are expected to become crucial breakthroughs for future pure EV expansion.

Looking ahead, Japan's pure EV growth hinges not only on continuous improvements in external conditions like incentive policies and infrastructure but also, more critically, on offering diversified products spanning different price ranges that align with Japanese consumers' practical lifestyles. Only by addressing these core issues can Japan's pure EV transition truly accelerate.

Layout 丨 Zheng Li

Source 丨 JATO Dynamics

Image Source 丨 Qianku Network